Are you biased?

Every year, we return to the same condo at Sandbridge Beach—we enjoy the same activities as the year before, and we eat at the same favorite restaurants. It may sound boring, but our familiarity with the accommodations and the area relieves the stressful unknown of going somewhere new.

The comfort of the known is the same reason we shop at Wegmans—we know where everything is, and there is great comfort in that. Familiarity feels safe and comfortable. In the investment arena, this feeling is known as “home bias”—home bias describes investors willingness to buy investments that are in their home country because they feel more familiar (and therefore safer).

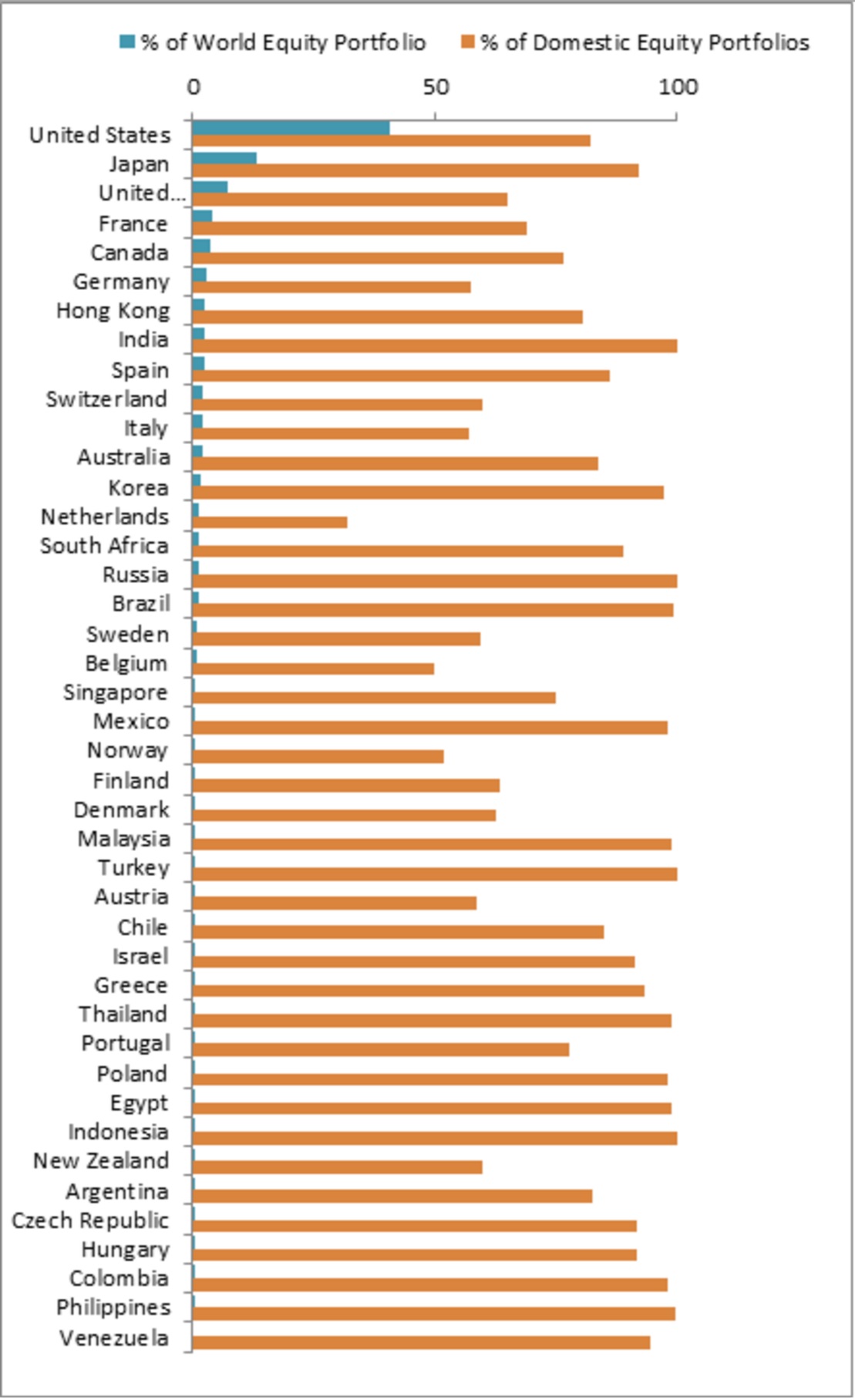

According to Betterment, on average US investors have about 82% of their portfolios in stocks that are headquartered in the US, despite the fact that the US stock market only makes up about 40% of the total global stock market. The bias works across all countries—for example, Sweden’s stock market makes up 1% of the total global market, but Swedish investors have about 55% of their portfolios in Swedish companies.

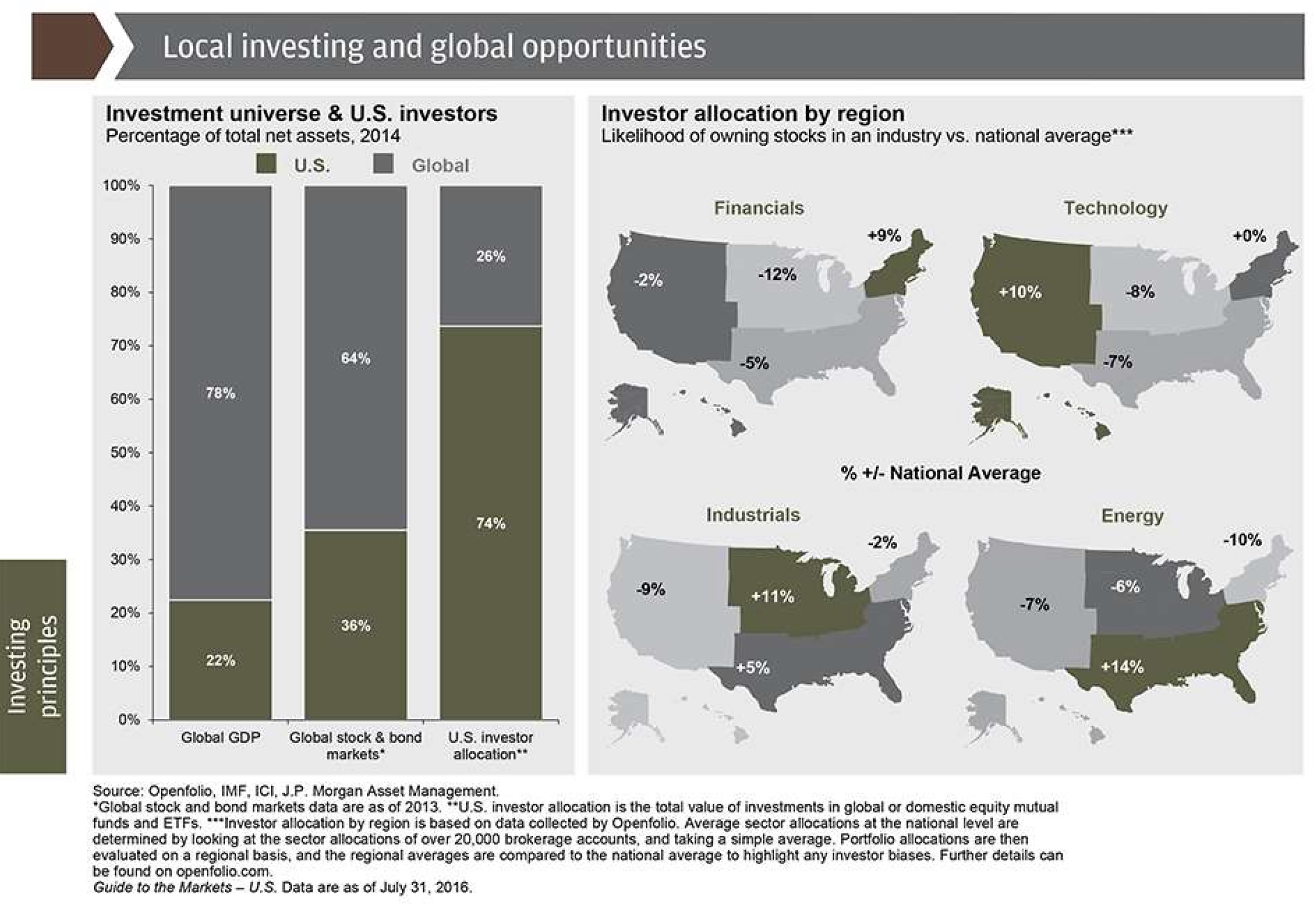

Interestingly, the bias works on a regional level as well. In this fascinating chart form JP Morgan, you will see investors favoring certain stocks based on their familiarity with the local industry. In the northeast with financial companies concentrated in New York, Boston, and Philadelphia, local investors tend to overweight financial companies. Likewise, with companies like Google and Apple centered in California, investors on the west coast have a tendency to overweight technology companies in their portfolios!

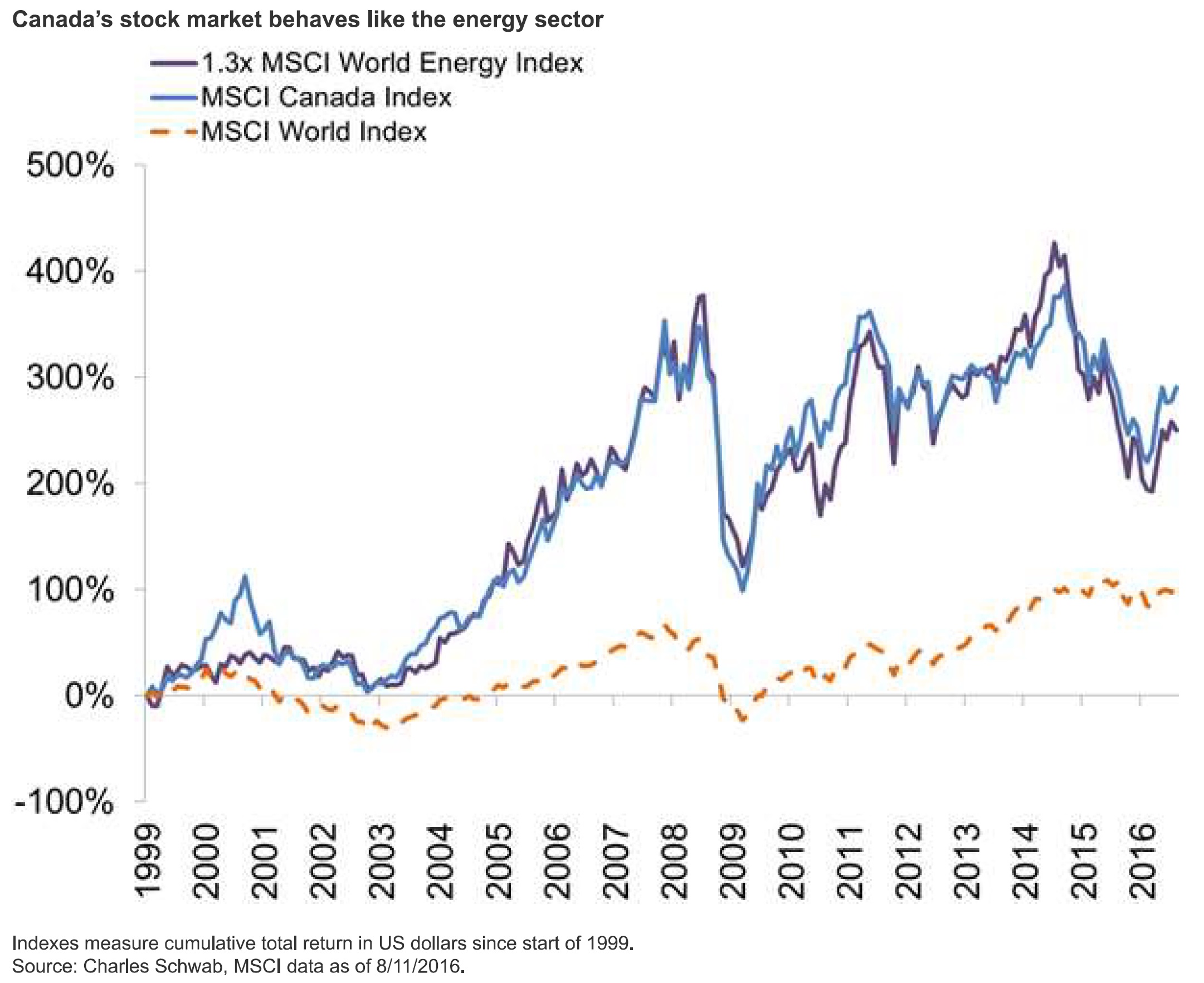

However, even though the local and familiar feel safer, sticking with investments close to home may expose your portfolio to unnecessary risk. An interesting Charles Schwab article highlights the dangers of home bias. As they note, no one country or region provides complete stock market exposure. In fact, many countries are linked very closely with certain industries—like Canada. The Canadian stock market is tightly linked with energy prices:

And the US stock market is very closely linked with the information technology sector:

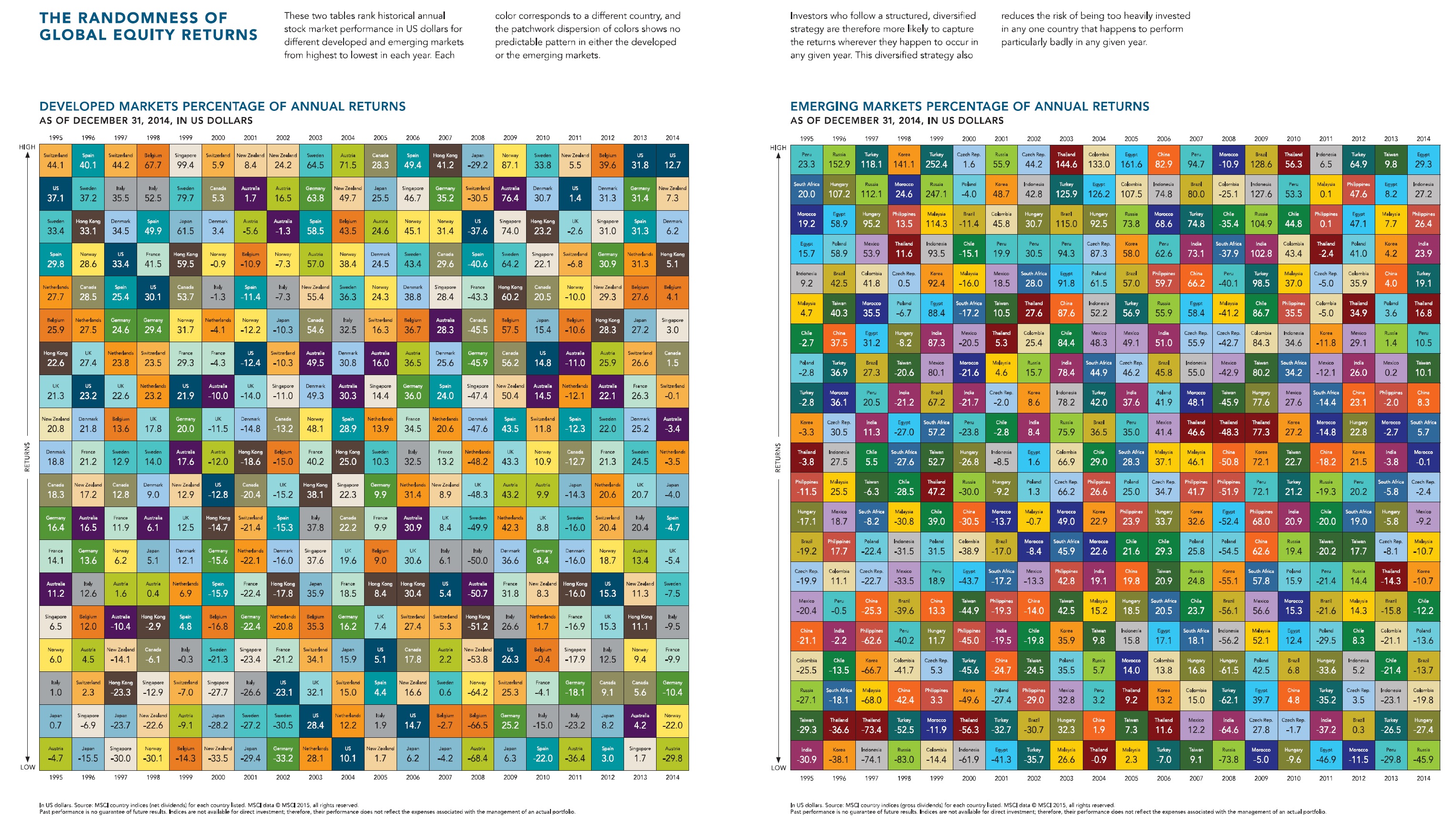

And these narrow, most often unintentional concentrations impact portfolios significantly over long time horizons, as no one country is the consistent high performer as this chart from Dimensional shoes:

So, when it comes to your portfolio, it is wise to think beyond our comfort zone and diversify out of our borders. Stretching past what makes us feel comfortable and safe is truly prudent!