The Mom Trifecta

As you all know (or better know!), this past Sunday was Mother’s Day. As always, it served as a reminder how important moms are in all of our lives. As a parent myself, there is an extra level of appreciation for what our parents do for us as children. One of the first things I did when my first was born was apologize to my parents!

This year, my own mom pulled the very rare Mom Trifecta – birthday, retirement, AND Mother’s Day all on the same weekend! Needless to say, there was a lot of celebrating, and she had a very nice sendoff from family, friends, and coworkers alike. It was a lot of fun to hear stories from her co-workers and friends about events and experiences that I had never heard before.

The transition from working and saving to retiring and spending can be difficult for some. Many of us have been taught to work and save for most of our lives, but sometimes there is not a whole lot of guidance for how to retire and spend wisely.

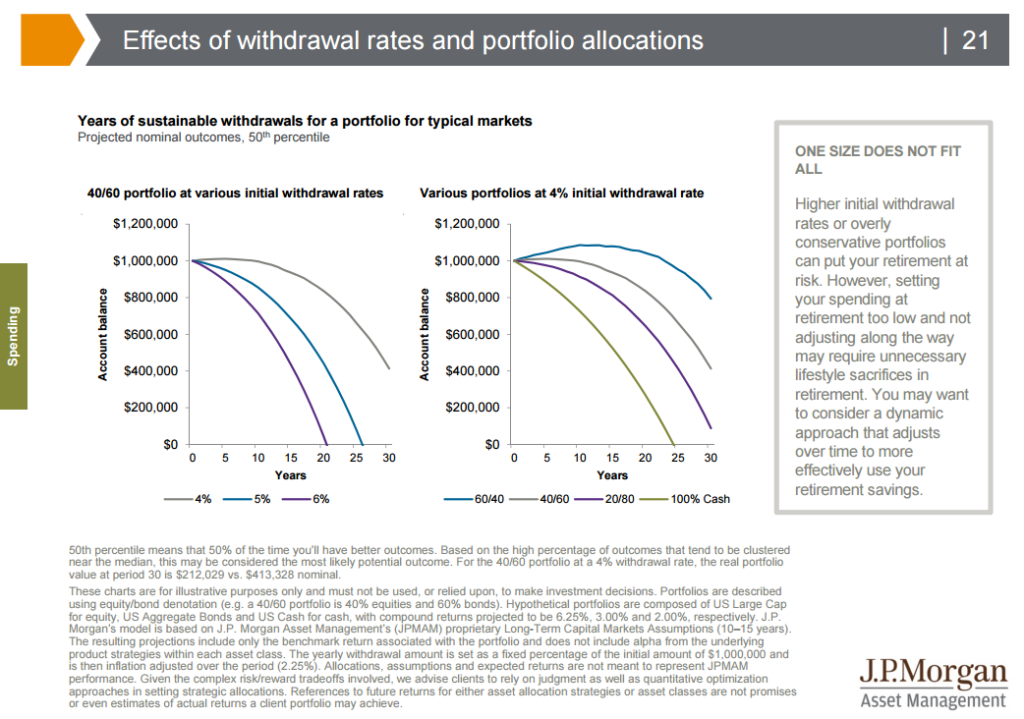

Understandably, for most people the natural tendency is to invest too conservatively as it “feels” like the right thing to do. However, as you can see from the chart above, and overly conservative portfolio can draw down the value of an account too quickly. A well-diversified portfolio that is built appropriately for your situation will have a much higher likelihood of keeping up with withdrawal rates and lasting throughout retirement.

We have often heard the reasoning of, “at my age, I can’t afford to take any risk.” We would argue that you can’t afford to NOT take any risk (please forgive the double negative!). After all, some of the money for retirement still has a time frame of 20 or more years if you assume an average life expectancy of a 60-year-old.

So, find the right mix for you, so you can sit back and enjoy some bacon and beer like my mom!