Go Global, Young Grasshopper

Yes, I have bastardized a quote from Mr. Miyagi (from The Karate Kid movie) as the title for this post. For some reason, the idea of staying disciplined with your investment strategy reminded me of the discipline Mr. Miyagi preaches to “Daniel-san” in the movie. Many of his quotes relate to staying the course in the face of adversity.

Within the investment world, the current “adversity” is the elongated outperformance of US stocks over the rest of the world. Historically, we know that other markets will catch up and the trend will reverse, but it is very tempting to put more eggs in the basket that’s doing the best. And, it’s especially tempting when the sector that’s outperforming is in the investor’s home country. Charles Schwab’s Anthony Davidow summed the phenomenon up nicely in a recent article:

“Moreover, in investing—as in sports and other areas of life—people often exhibit familiarity bias (“home-country bias” in this case). We’re inclined to believe in and root for the things that we know best. While this may be human nature, home-country bias limits an investor’s universe of available opportunities. Worse, it may not be prudent given the nature of today’s global markets: According to MSCI data, roughly half of all global companies are based outside the United States, which corresponds to global gross domestic product ratios. Do you really want to limit your investment opportunities by half? How can you overcome home-country bias?”

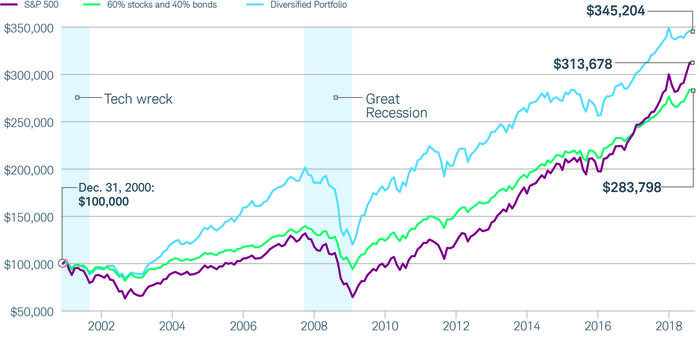

The answer is to go global and remain diversified across many types of assets classes. Doing so will not only reduce your risk, but it will also improve performance. Take a look at the chart below that invests $100,000 on December 31, 200 in three different hypothetical portfolios. You can see that the globally diversified mix fared much better.

The 60/40 portfolio is a hypothetical portfolio consisting of 60% S&P 500® Index Stocks and 40% Bloomberg Barclays U.S. Aggregate Bond Index bonds. The diversified portfolio is a hypothetical portfolio consisting of 18% S&P 500, 10% Russell 2000, 3% S&P U.S. REIT, 12% MSCI EAFE, 8%, MSCI EAFE Small Cap, 8% MSCI EM, 2% S&P Global Ex-U.S. REIT, 1% Bloomberg Barclays U.S. Treasury, 1% Bloomberg Barclays Agency, 6% Bloomberg Barclays Securitized, 2% Bloomberg Barclays U.S. Credit, 4% Bloomberg Barclays Global Agg Ex-USD, 9% Bloomberg Barclays VLI High Yield, 6% Bloomberg Barclays EM, 2% S&P GCSI Precious Metals, 1% S&P GSCI Energy, 1% S&P GSCI Industrial Metals, 1% S&P GSCI Agricultural, 5% Barclays U.S. Treasury 3–7 Yr. Including fees and expenses in the diversified portfolio would lower returns. The portfolio is rebalanced annually. Returns include reinvestment of dividends, interest and capital gains. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Past performance is no indication of future results. Diversification strategies do not ensure a profit and do not protect against losses in declining markets.

It can be hard to maintain your investment discipline and avoid “home-country” bias, but as Mr. Miyagi would likely tell you, go global young grasshopper.

On an unrelated note, my oldest young grasshopper got his first official hockey jersey the other day. He’s really been enjoying the sport, and although I don’t even know how to ice skate, I will still use some Mr. Miyagi quotes on him to help motivate him throughout the season! “Man who catch fly with chopstick, accomplish anything.” – Mr. Miyagi