BREAKING: SHOCKING HEADLINE MAKES PEOPLE CLICK ON ARTICLE!

PARENTS FORCE 4-YEAR-OLD TO WEAR GAS MASK

Actually, little Molly is wearing a nebulizer to ease some stubborn congestion. But, you have to admit the initial headline is a little more intriguing (and misleading). It’s no secret that news outlets (no matter their left or right lean) generate headlines to garner clicks and attract advertisers. It’s certainly no different in the financial world. And, since it has been several years since we’ve seen this type of market volatility, the shocking (and mostly negative) attention-grabbing news bites are being laid on thick.

Our excellent marketing consultant, Frannie Barnes (https://www.forwordcommunication.com/) pointed this out to me just yesterday. To borrow a quote from her recent e-mail to me, “So, everything I’m seeing this weekend about stocks and investing is a tad on the alarming side…” A quick Google search of recent market headlines echoes her point:

- From The Boston Globe: “Bernie Madoff and the coming stock market apocalypse.” Huh? Isn’t he in jail for massive fraud?

- From Bloomberg: “Where’s the Bottom? Valuation Cases for an Unstable Stock Market.”

- From CNBC: “Investors should be furious: 3 blue-chip stock buybacks that went horribly wrong.”

- From Yahoo Finance: “Trump’s trade war with China is causing CEOs to make one risky change.”

In defense of the above headlines, the actual articles do go on to make decent points. Unfortunately, there are lots of studies out there (like this) that indicate most of us don’t even go on to read the content beyond the headline. Before I wade too far into the dangerous waters of “fake news,” just know that for most outlets, maximizing clicks is the end goal.

Further, day-to-day headlines should not drive your investment philosophy or allocation. Unfortunately, headlines such as, ‘Long Term Investor Enjoys Solid Returns’ really don’t exist nor would they generate the attention desired. So, we as prudent investors are forced to ignore the noise and stick to the tried and true methods of investing. You know, boring stuff like: stay diversified, invest for your time horizon, or rebalance regularly. Yawn!

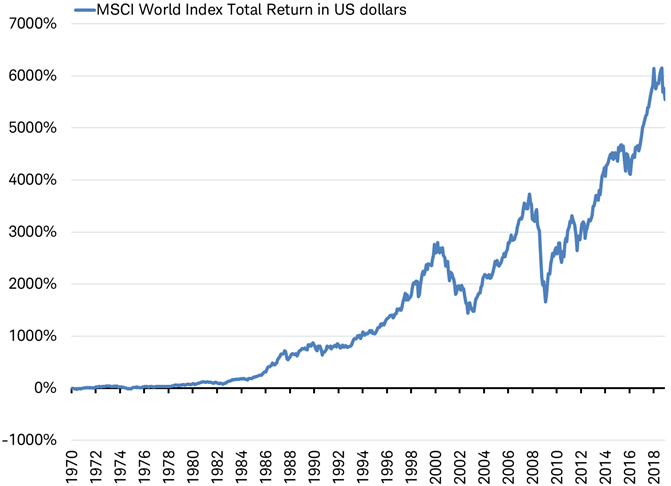

Here are two friendly reminders in chart form:

1 – Long term returns of the global stock market since 1970 (yes, it’s over 5000%)

Source: Charles Schwab, Bloomberg data as of 12/8/2018. Past performance is no guarantee of future results.

2- Don’t try to time the market

Source: The Vanguard Group

If you’ve read this far down, congratulations! You are one of the few! Stay tuned for my next post titled, “To Hell and Back: Why I Will Never Invest in Stocks Again!” 😊

Nathan