Status Check

*Note: Click on graphics to expand

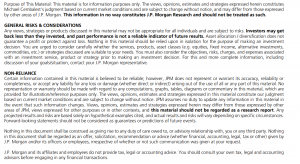

It has certainly been a challenging month for all of us. “Normal life” has screeched to an abrupt halt as we all attempt to navigate the current health crisis. These are historic times as schools, restaurants, bars, and shops close to contain the spread of Coronavirus. And, the stock market has reflected the sudden halt to economic activity, reaching bear market levels in record time. The average from market peak to recession has been about 210 days from peak to bear market—our current market went from peak to bear territory in about a month—over 16 trading sessions.

At Meridian, we are working diligently to help our clients navigate the challenges of financial markets facing a health pandemic. We receive research and updates from many sources across the world, and are working to review, distill, and create strategic plans forward from them. A recent report from JP Morgan was particularly interesting, and we wanted to share a few images with you.

JP Morgan, as one of the largest research teams in the US, has developed an entire team to follow Coronavirus research and statistics from sources around the world. Their team held a call last Friday and went through a very comprehensive slide deck of research summaries. Here are some of the points that we found interesting:

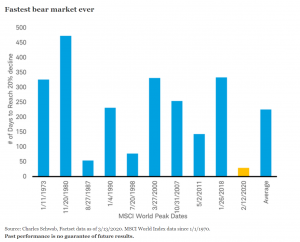

- Here is the summary of the research on contagion—the main problem being the final bullet—that people are contagious about a day before they show symptoms:

Hence the rationale for social distancing—as shown in this animation:

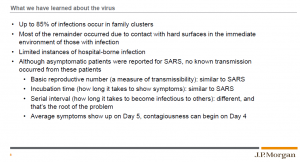

- COVID-19 does linger on different sufaces for days, but its potency rapidly decreases over shorter time frames:

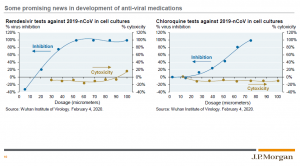

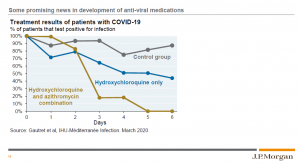

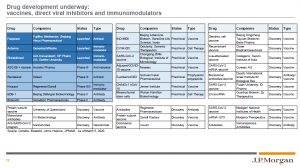

- Health care companies are working around the clock to find antidotes, managed care medications (to slow/manage the illness), and vaccines—there were three promising lab studies and the last chart is just the sheer number of companies working on drug development:

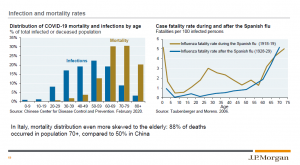

- Much has been made about COVID-19 being particularly unkind to the older generations, but infection rates actually peak in the 40-70 range.

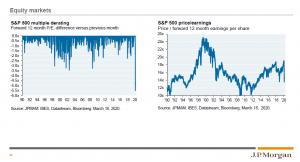

- As to impact on the financial markets, the US stock market quickly repriced, lowering valuations dramatically…

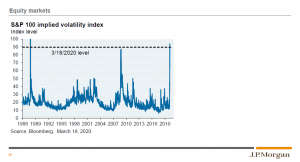

- …and volatility spiked past 2008 levels:

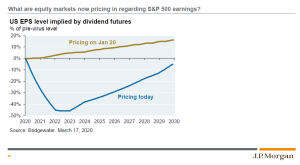

- The current valuations imply that US company earnings will not recover fully until 2030.

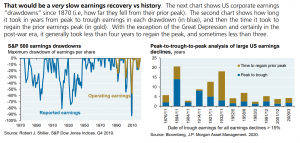

- And history shows us that a recovery time of 10 years is very long compared to historical averages of about 3-4 years (the chart on the bottom right):

So, while we are waiting and praying for good news on the virus front, we are weighing how much the market has priced in the bad economic news to come. Markets tend to overshoot the bottom and the top, so it can be difficult to see either until the perfect vision of hindsight.

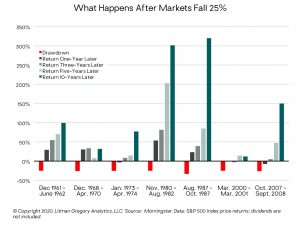

What we do know is that a 25% or greater drawdown in U.S. stocks is quite infrequent. It’s happened only eight times in the past 70 years. But such painful periods do happen. Investors in equities need to be emotionally and financially prepared for them. And the longer-term returns are worth the short-term discomfort.

Since 1950, buying U.S. stocks after the initial 25% decline of a bear market delivered strong returns over the next five or 10 years most of the time.

Given that the main catalyst for this downturn is the coronavirus (alongside an unexpected oil price war) and that there is an end game for the virus at some point, it seems reasonable that markets will rally when virus news turns incrementally positive (the spread slows, new cases stabilize or drop, treatments or vaccines are developed, etc.). But even if this bear market lasts longer than the historical average of 18 months, potential forward-looking U.S. stock returns have already improved. And they will get even better the lower stocks go.

So while it may be hard to imagine now, there will be an end point to this crisis from a medical perspective and thus from an economic and financial markets perspective. Of that, we think we can be confident. The key to overcoming panic in financial markets is to focus on the future. Remember, severe losses only become permanent losses if you sell, go to cash, and lock them in. Volatility is uncomfortable when you’re living through it, but it sows the seed of the future’s strong returns.

With all this said, we recognize it is natural to be concerned when volatile markets impact your portfolio holdings. For that reason, we encourage you to connect advisor to discuss any questions you have about your situation and portfolio.

On a small personal note—here are three things that we are deeply grateful for in this crisis:

- Disaster preparedness is now top of mind. It has been a while since we have faced large scale disaster on a national or local level. At Meridian, we’ve had plans in place, hoping that they would never be needed, but we are needing to use them now. At our family level, we are learning how to do distance learning and be wise stewards of resources as things are scarce at grocery stores. While we are not thankful for the virus, we are thankful for the opportunity to see what being prepared for the unknown should look like.

- We have a new definition of essential employees and so thankful for those on the front lines. We tend to automatically be grateful to the doctors, nurses, health care professionals, but we had not really been truly thankful for the grocery store employees, truckers, gas station attendants…all the people that show up every day in the midst of this, so that we can have access to food and critical services. To everyone fighting to keep us safe and healthy—we are deeply thankful for you.

- The sacrifice we have to make is relatively benign compared to sacrifices of generations before us in times of crises. We are being asked to slow down, make meals at home, enjoy time with our families, get outside and take walks. Again, while no means are we thankful for the virus, we are aware of how blessed we are be asked to take these steps to protect each other as opposed to rations, drafts, and other sacrifices that Americans have made.

Our thoughts are with you, and hope you are staying safe as this storm rages past.

Disclaimers: