The Conversation Hasn’t Changed

We have been very fortunate to add some wonderful people to our team since starting Meridian in 2015 (!), and as they advance their careers and knowledge base, they have started to enter the regular blog rotation (shout out to Kira Topeka for next week!). It is nice to not only add their expertise and smiling faces, but also to extend the gaps in time of when it becomes my turn to write the weekly blog!

That is not to say that I don’t enjoy writing them, but I find the hardest part is coming up with a topic that is both timely and informative. One of the first things I do is look at our own blog page to make sure I am not repeating anything that others (or I) have said recently. Second, I reflect on recent conversations that I have had with clients and with my colleagues in an attempt to address what is currently on people’s minds. Last, I sift through commentary from investment managers and analysts that we follow regularly to grab charts and/or quotes that speak to the latest market trends (aka the latest thing we should worry about).

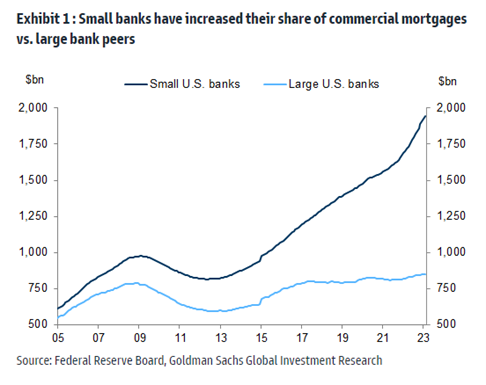

Here’s one. A lot of Commercial Real Estate debt is coming due soon, and small/mid-size banks hold a lot of that debt. Be afraid?

As I take those 3 steps today, very little has changed with regard to what we are all talking about. Our latest posts, beginning with mine exactly one month ago (again, yay other blog writers!):

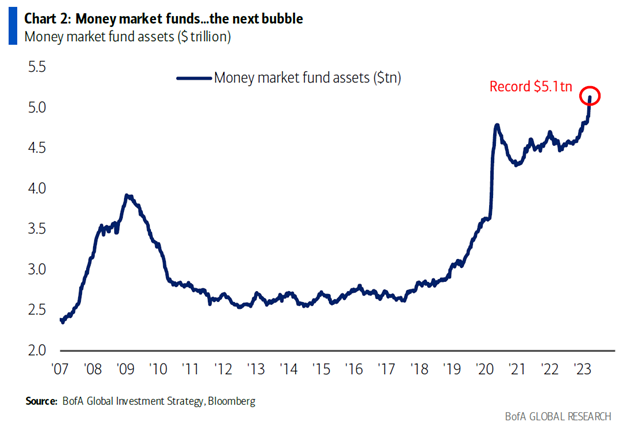

- Cash is Rarely King – don’t leave all of your cash in the bank at temporarily high interest rates because it ‘feels good’

- The “R” Word by Sarah Irving – will there or won’t there be a recession – by the time there is one/we are in one, the market has usually already recovered.

- Everything, Everywhere Not All At Once by Lucy Valandra – a great title with a nod to the academy-award winning movie and with an amazing manatee picture at the end – do I have to worry about the money in my bank now that these other banks I’ve never heard of had to get bailed out? Answer, no.

- So Tired… by Sarah Yakel – we too are tired of all the anxiety, volatility, and low returns that markets have brought us in the short-term. Keeping a lot of money in cash/banks is still a bad idea.

The bottom line is that I am left repeating myself/ourselves.

The ‘I’ll just leave my money in cash…’ conversation seems to be the winning the day.

“The Biggest Picture: the next bubble…money market fund AUM surges above $5.1tn (Chart 2), up >$300bn past 4 weeks; prior 2 surges ‘08/’20 coincided with big Fed cuts.” BofA Global

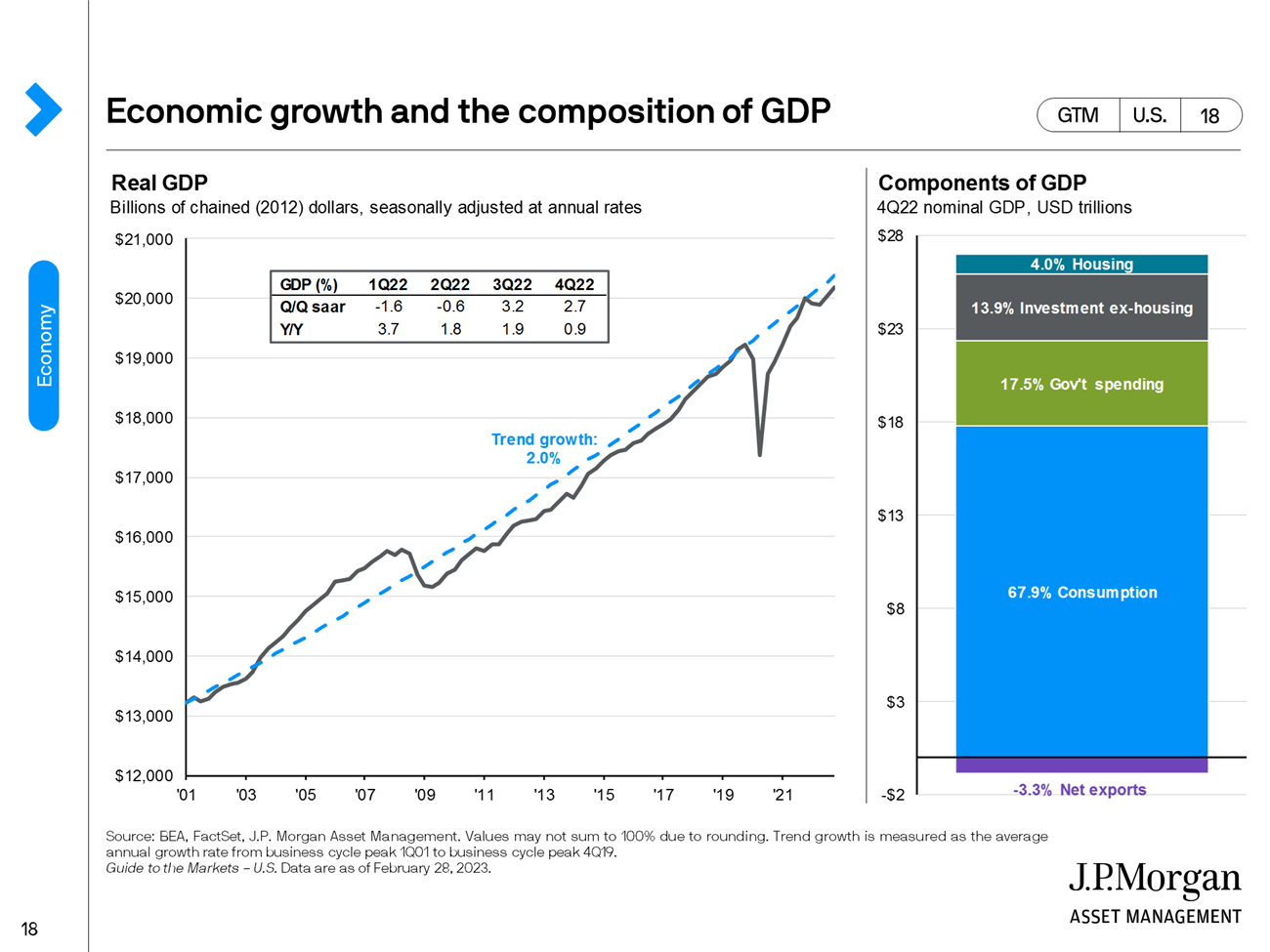

The Recession conversation – Will there be one? Are we in one? Is one coming? – rages on. From JP Morgan – “Entering the first quarter of 2023, there is a growing danger that the U.S. economy could slip into recession. While the U.S. consumer has been largely resilient so far, higher interest rates have weighed on home-building, trade and business investment.”

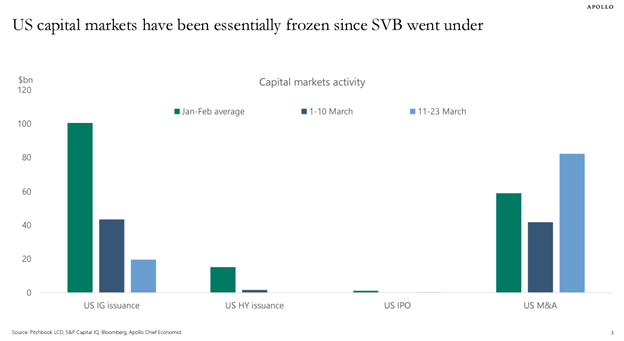

The “Banks” conversation continues as well – what’s ironic to note here is that we are fielding calls ranging from ‘is my money safe in the bank?’ to ‘should I just take my money out of the market and leave it in the bank?’

Banks have been scared into doing nothing.

And yes, we are all still So Tired of the volatility and anxiety brought on by the markets and headlines! The best way to combat all of this is to stay invested when others are fearful and keep your and your money’s timeframe in mind.

It’s a Matter of Time: Some Asset Classes Have Taken Longer to Double an Investment Than Others

Stocks vs. bonds vs. money-market funds vs. certificates of deposit (based on average rates over the past 25 years)

| US Equities1 | US Fixed Income2 | CDs3 | Money Markets4 |

| 7.64% | 3.97% | 2.16% | 1.61% |

| 9 years to double | 18 years to double | 33 years to double | 45 years to double |

Past performance does not guarantee future results. Indices are unmanaged and not available for investment. For illustrative purposes only.

1 US equities are represented by the S&P 500 Index, a market capitalization-weighted price index composed of 500 widely held common stocks.

2 US fixed income is represented by the Bloomberg US Aggregate Bond Index, which is composed of securities from the Bloomberg Government/Credit Bond Index, Mortgage-Backed Securities Index, Asset-Backed Securities Index, and Commercial Mortgage-Backed Securities Index. Source: Hartford Funds.

3 Source: Bloomberg. CD rates are proxied by Bankrate.com’s 12-month CD national average. CDs, like all deposit accounts, have FDIC insurance up to the $250,000 legal limit.

4 Money markets are mutual-fund money markets using the US Fund Money Market–Taxable Morningstar category.

Finally, when I wrote my last post 1 month ago, I mentioned my son breaking his arm and having to wear a cast for 6 weeks. It has been a frustrating time for him, as he has had to remain on the sidelines (or ice rink bench, in his case) while his bone healed. I am happy to report that the cast came off today, and he will soon be back in action.

Ready to get back on the ice!

Is it time for you to get back in action with your money? Yes, the ice is still slippery, but you can’t win if you don’t play the game!