Time for a Hike

It is the season of anticipation—children are eyeing the presents under the tree, families are preparing for holiday guests…and investors are looking to December 16th to see if the Federal Reserve will finally raise interest rates for the first time since 2006.

Given the recent good employment report, it seems all but inevitable that the Fed will finally raise interest rates. But, we’ve been at this point before—all but absolutely certain of rate hikes—only to have the Fed delay action.

At this point, it is likely that the stock market will view a rate hike as a vote of confidence in the economy. It is as if the Fed deems the economy strong and mature enough to take of the training wheels of artificially low interest rates.

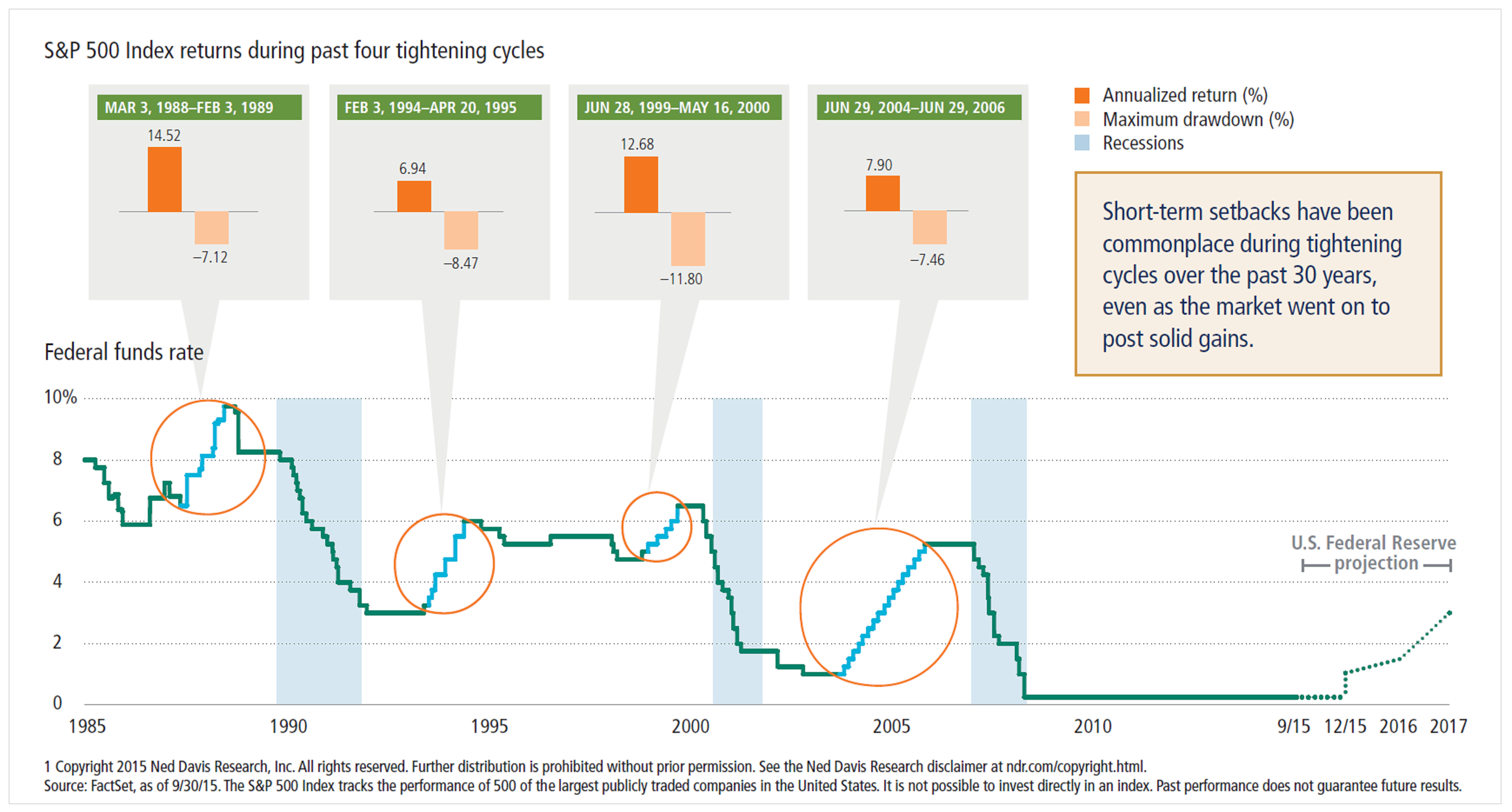

And while rising rates will be different than what we’ve seen for most of the decade, they have often been a good thing for the stock market. Below is a chart form John Hancock that shows the annual stock market return during rising rates:

One thing to note about the above chart is the Maximum Drawdown figure—this is a measure of volatility which shows that while the overall return of the stock market was healthy, the market was rather volatile, dropping between 7%-11% over the generally positive time period.

So, while investors should be welcoming a rate increase, they should also be anticipating the accompanying volatility. Investors should brace for this volatility as rates lift off by building and maintaining a prudent balanced, well diversified portfolio.