There’s Still Time

For everyone eagerly awaiting to file their taxes, Meridian sent an email last week letting our clients know that 1099s have been physically mailed /emailed from Charles Schwab. However, before you submit all of your tax filing documents, there are still things you can before the April 18th deadline.

- Contribute to your IRA or Roth or SEP if you have one. The maximum contribution is $6,000 for those under the age of 50 and $7,000 for those 50 and older. Just remember that you and / or your spouse must have earned income to make these contributions.

- For a deductible IRA contribution you must meet these following requirements:

- Not be eligible to participate in a company retirement plan

- For a deductible IRA contribution you must meet these following requirements:

or

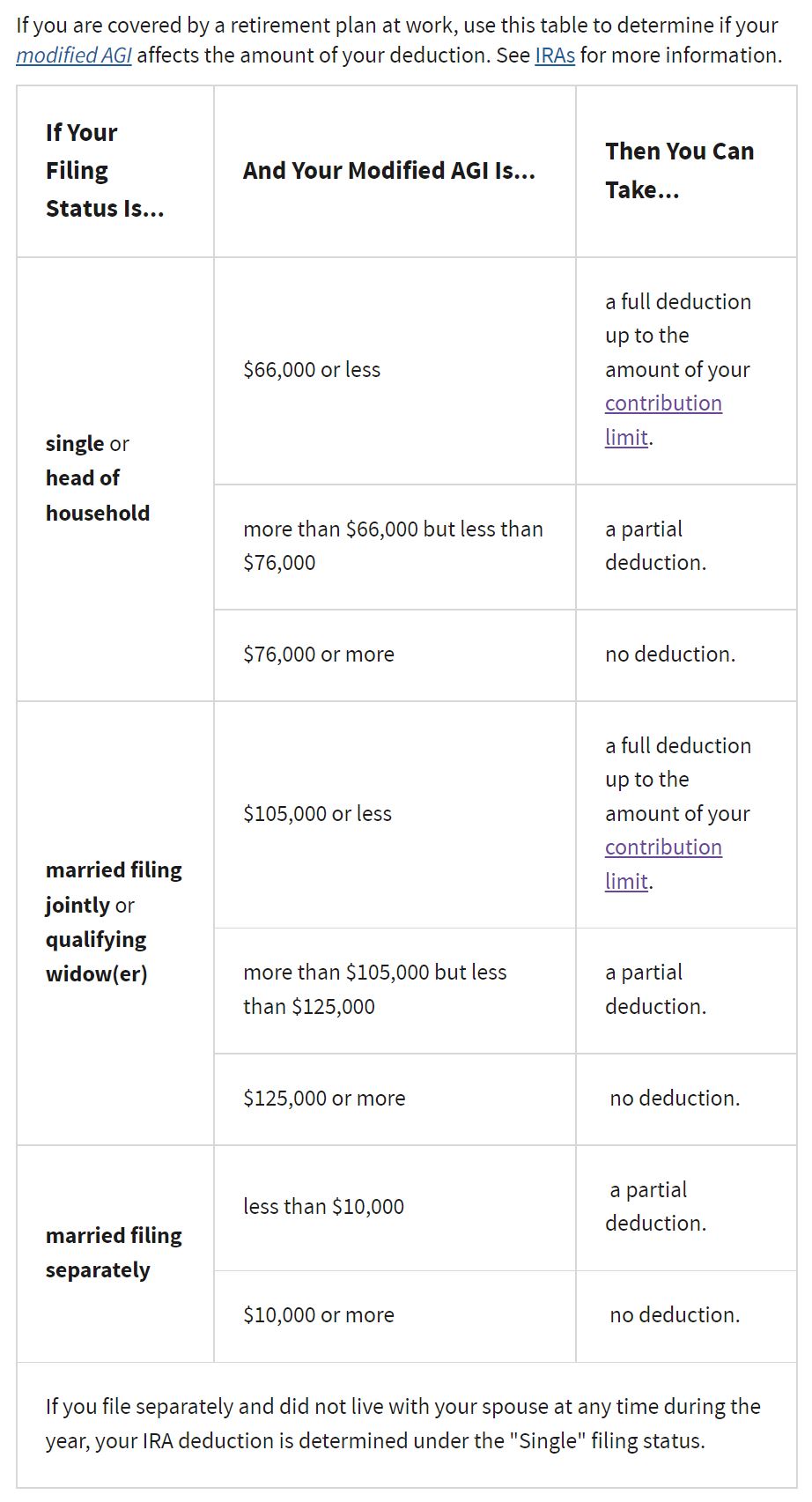

- If you are employed and covered by company retirement plan you must not make more than the below amounts

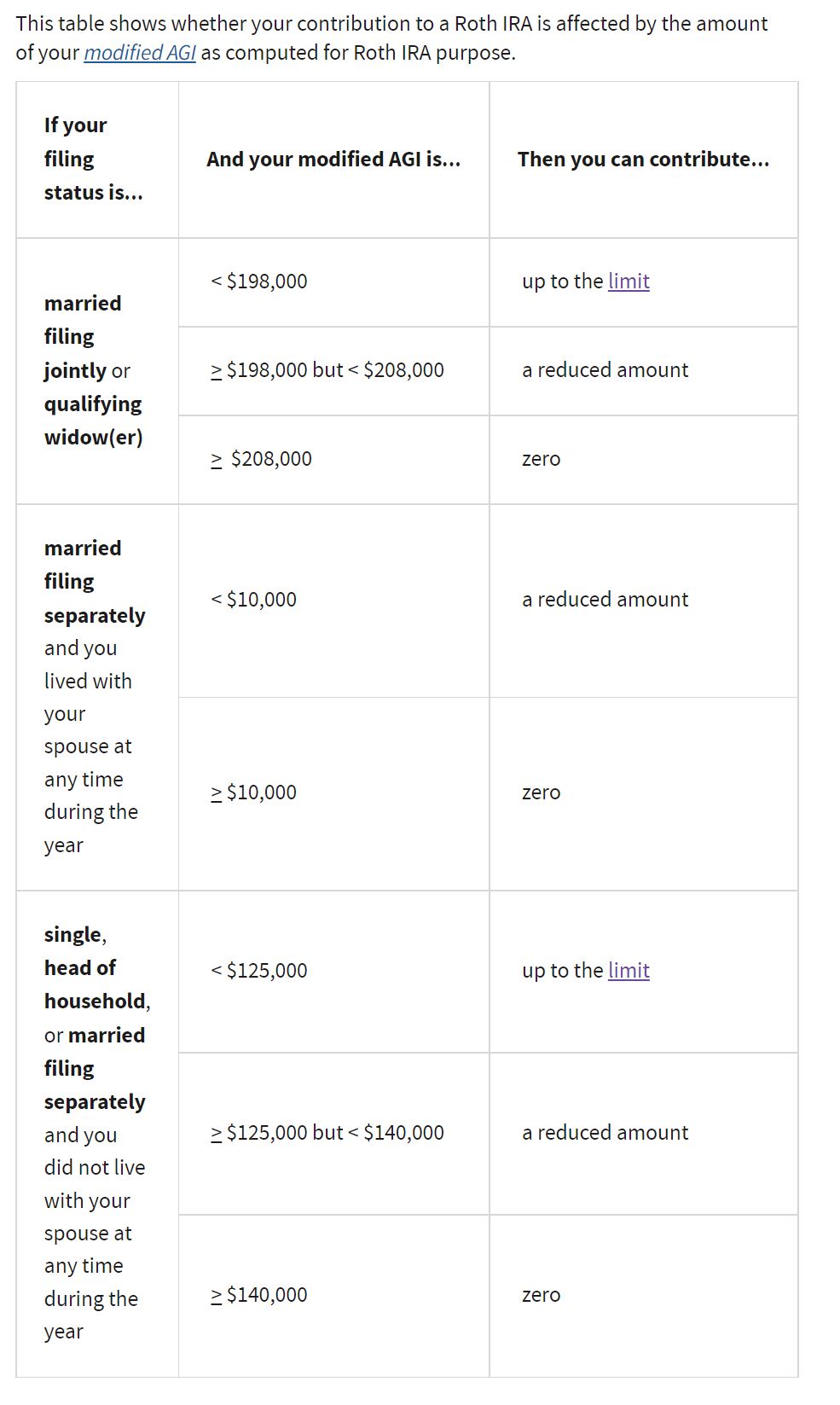

- If you are married and are not eligible for a company plan, but your spouse is, you can make a fully deductible IRA contribution if your income does not exceed $198,000.

- To contribute to a Roth you must meet these following requirements:

- If you are contributing to a SEP and file extensions you have until October to make your contribution. ** Did you contribute too much to your SEP? In order to avoid a possible penalty and / or excise tax, you will want to correct this before filing!

- Max out your HSA if you have one or are eligible for one. Deadlines are April 15th for a 2021 contribution

- Maximum contribution is $3,600 for self-only insurance plan and $7,200 for family plan, plus an additional $1,000 catch-up contribution for those 55 and older.

- Make sure you gather everything you may need:

- If you are working with a CPA they will more than likely provide you with a comprehensive list of items that are required and needed for filing. If you file your own taxes, having a checklist ready will save you time. Most tax software’s have these readily available but here is a good place to start:

- Previous year tax return (not required to file, but good to have as comparison)

- Social Security numbers for all family members (don’t forget the new baby if you had one!)

- W-2s

- 1099s

- 1098

- 1098-E (if you paid more than $600 in student loan interest)

- 1098-T (if you paid tuition costs and related education expenses)

- Records of IRA contributions (if you contribute to an employer sponsored plan your W-2 will show this information). ** Form 5498 which shows IRA contributions is not required for tax filing and is not available until after May 31st.

- Documentation if you did a Qualified Charitable Distribution from your retirement account.

- Records of 529 contributions if you contributed to one and your 529 plan offers a state tax benefit. ** You will not receive a tax document for contributions, only withdrawals.

- Documentation / receipts for child care

- Receipts for charitable contributions if you think you will be itemizing. ** For 2021, taxpayers can take an above the line deduction for $300 of a cash donation ($600 if Married Filing Jointly).

- Medical bills if you think you will be itemizing or feel they will total more than 7.5% of your adjusted gross income.

- Property tax documents

- Estimated tax payment amounts (if applicable)

- For 2021 taxes, you may have received Letter 6419 from the IRS if you received advance child tax credit payments and Letter 6475 which lists the amount of the third economic impact payment.

- Supporting information for any other deductions or credits you feel you may qualify for.

- If you are working with a CPA they will more than likely provide you with a comprehensive list of items that are required and needed for filing. If you file your own taxes, having a checklist ready will save you time. Most tax software’s have these readily available but here is a good place to start:

- Understand what deductions and credits are available…. And what aren’t

- For a comprehensive list I always feel it is best to go straight to the source — https://www.irs.gov/credits-deductions-for-individuals.

- Just a friendly reminder that advisor fees are no longer tax deductible for the years 2018-2025.

- For a comprehensive list I always feel it is best to go straight to the source — https://www.irs.gov/credits-deductions-for-individuals.

I know many individuals have submitted their documents to their accountants already, and if you have, you are on the ball! But if you haven’t, rest assured there’s still time.