Spinoffs, Splitoffs, and Stocks

In light of the communication many of our clients received on regarding the exchange offer of Johnson & Johnson shares for Kenvue, I figured this would be a timely topic! While we hope our email provided enough background information on the spinoff and instructions to take advantage of the exchange, we know this won’t be the last time a situation like this arises.

Understanding Corporate Spinoffs

In fact in 2022, Goldman Sachs produced analysis that corporate spinoffs increased by 33%, the second highest level on record and 2023 seems to be on track to be another popular year for spinoffs.

The Logistics

A spinoff is a type of corporate restructuring in which a parent company splits off a portion of its business to create a new separate entity. Spinoffs are part of a strategy which can help the business achieve several things such as:

- Allow the parent company to focus on core business strategies

- Sharpen focus on a separate sector/priorities from the core business

- Boost profits

- Streamline operations

- Create focused management teams

- Reduce litigation risks (either for the parent company or the spinoff company)

The spinoff company will have a separate management structure and have a new name, but the parent company will in most cases provide financial and technological support.

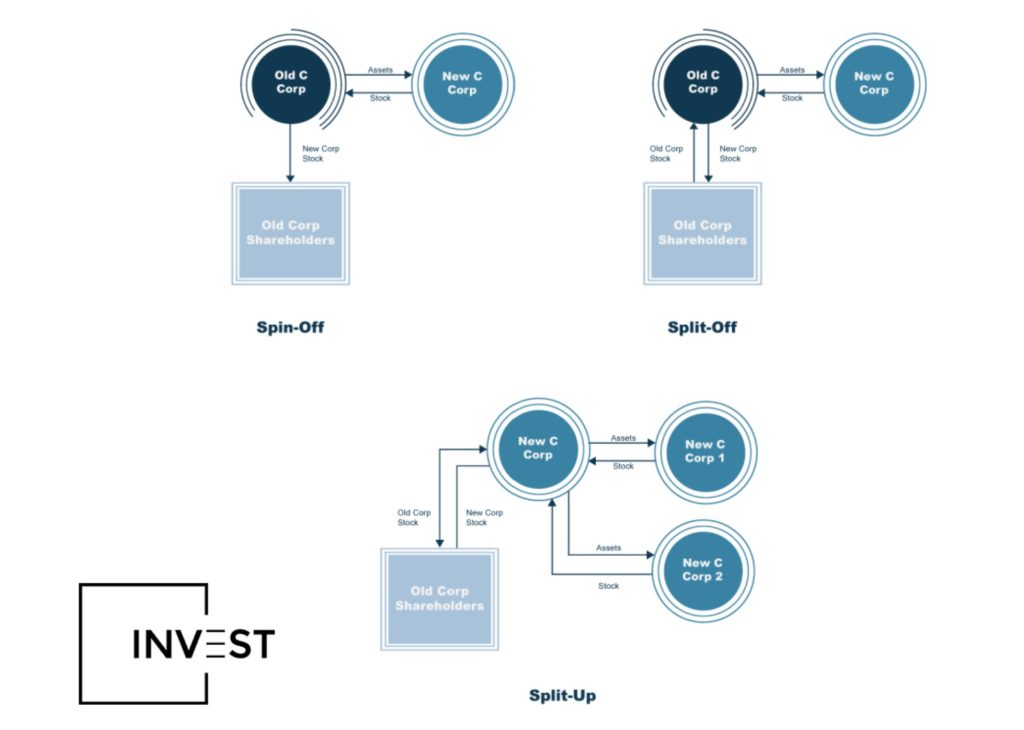

When the spinoff occurs, investors owning shares of the parent company will either automatically receive shares of the spinoff company or they will be presented with an exchange offer in which they can exchange shares of the parent company for those of the spinoff company at a discount. Technically the latter is referred to as a splitoff, as investors must elect whether they want to own shares of the new company or if they do nothing, they continue holding onto their shares of the parent company.

Tax Implications of Spinoffs

How is this Taxed

In the case of the J&J/Kenvue splitoff as well as the majority of spinoffs, the transaction is tax free, which means no capital gains are owed by the investor exchanging their shares of the parent company for shares of the new company. However, it is always recommended to double check as few can be taxable transactions.

When is it Appropriate

The decision to own shares of the new spinoff/splitoff company should be a thoughtful one that aligns with the allocation of your portfolio, the goal for holding the parent company and/or the new company, and financials and business strategies for the parent and new company. And as we always recommend, walk through these decisions to exchange, hold, or sell with your trusted advisor.

I can tell you two things I won’t be exchanging any time soon though….