Volatility is Not Enjoyable

Volatility continues for the markets, and although there is a very slight recovery as I write this (has that changed again already??), there doesn’t seem to be any consistency in sight. The majority of the prognosticators in the press and market commentaries are not predicting a recession, but most expect these types of ups and downs to continue.

The reason for the recent market declines can be attributed to several factors, but the focus seems to be narrowing on the increase in interest rates, both via the Fed raising interest rates and market factors also causing them to rise. It will be interesting to see if the Fed continues down their stated path of increasing again in December. As always, they are trying to walk the very fine line between making money “too cheap” through too-low interest rates and “too expensive” through high rates. A long period of rates being too low can cause stocks to grow too much too quickly, and a period of rates being too high can cause markets to fall and inflation can take hold.

Volatility is not enjoyable, but it is normal.

Source: Vanguard analysis based on the MSCI World Index from January 1, 1980, through December 31, 1987, and the MSCI All Country World Index thereafter. Both indexes are denominated in U.S. dollars. Our count of corrections excludes those that turned into a bear market. We counted corrections that occurred after a bear market had recovered from its trough even if stock prices hadn’t yet reached their previous peak.

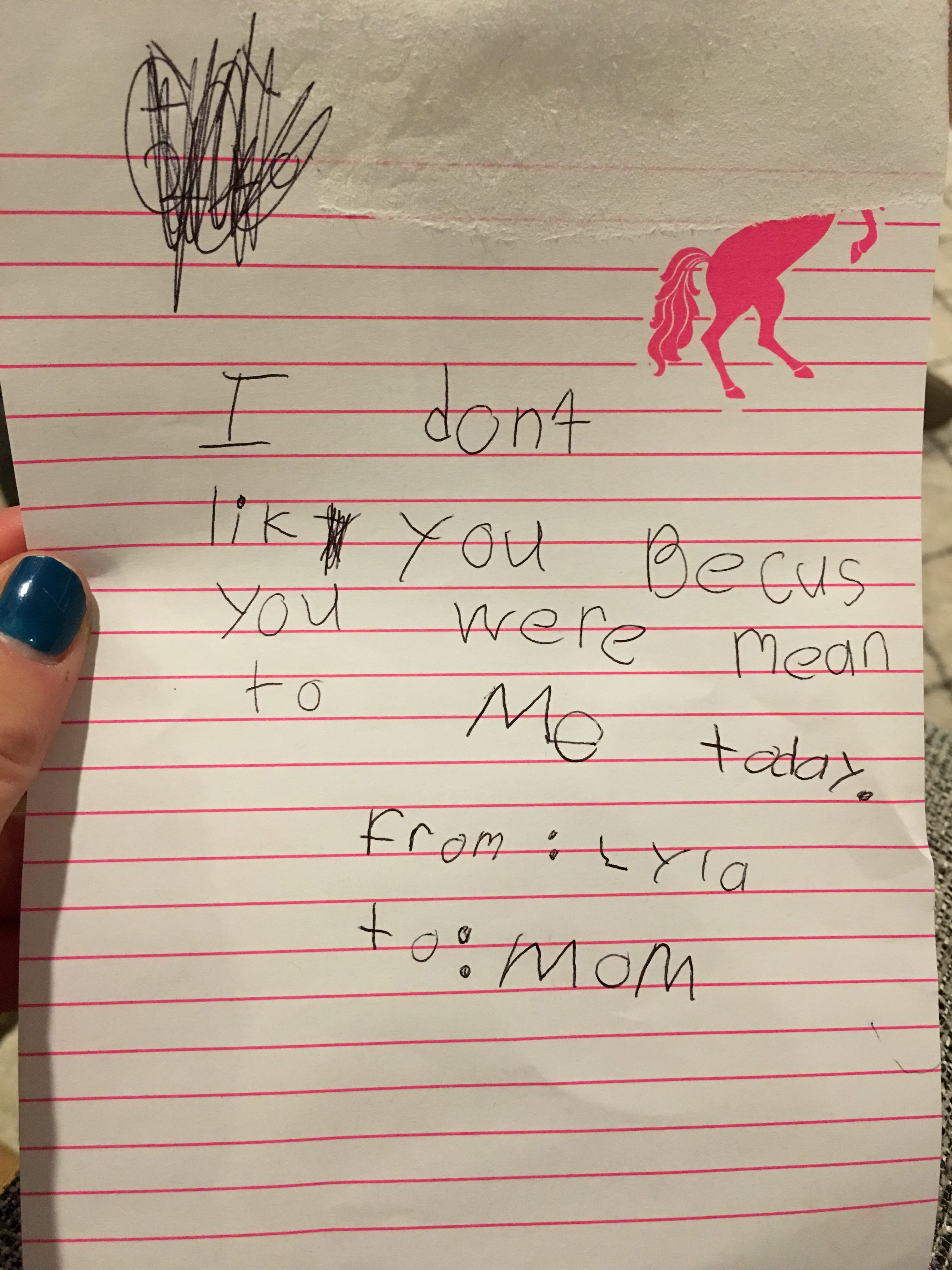

Speaking of volatility, there’s nothing much more volatile than the emotions of a 7 year-old girl. See the note below that my middle daughter left for my wife after a recent “conversation.”

I suppose that is pretty normal too. When dealing with a 7 year-old or the markets, patience is the key!