FLORIDA! (And Master Planning)

As I write this blog, the Yakel family is working our way down the Florida coast. We started in Hollywood, and now we are working our way towards Key West. From there, we plan to head up to Marco Island and then end our trip in Orlando. Sort of a little sampling of Florida’s attractions… 🙂

While it seems like half of America is in Florida this month due to relaxed COVID rules, our trip has actually been in the works for a while. This trip was born out of a scheduled vacation master planning session with our whole family a few years ago. In 2016, we sat down together as a family, and looked at a map of the United States and a world atlas, and everybody picked places that they would like to visit. Apparently, I am the only one with the desire to go beyond the continental US borders (Italy! England! Hawaii!). The rest of my family was focused on the continental states.

From this master list, we’ve just been working our way through the top choices. We visited Montana last year (Jonathan’s pick), and this trip in Florida was one of Melanie‘s top choices. Ethan is a California fan, and Ben really wants to see Texas (🤷🏻♀️). So, we are slowly working off that master bucket list of sights to see with our kids before they grow up!

It’s probably not surprising that a planner by profession enjoys long-range planning, but academic studies have actually shown that goal based planning leads to increased wealth for investors. The problem is that many people have a hard time identifying the goals that are important to them. Sometimes it is easy (i.e. paying for college, retiring, etc.)…most some of the other goals may not be super clear (like to go on a dream vacation or to not be a burden to your family as you get older). Even the goals that are pretty glaring—like retirement—may not be as clear on the specifics.

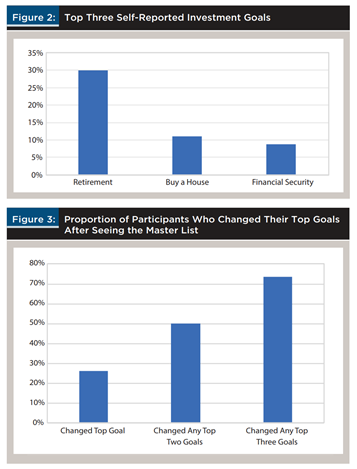

In an interesting study published in the Journal of Financial Planning in July 2019, financial planning clients were asked to self report their top financial goals. Then, they were presented with a master list of financial goals that spanned retirement goals, professional development goals, tax planning objectives, lifestyle thoughts, estate planning, etc. When the participants had a list of goals to review, 27% of the participants actually changed their top planning goal. And, more impressively, over 73% of all participants changed one of their top three goals when they had a list to pick from.

The study concluded that our own cognitive biases can actually make it difficult to identify goals that are important to us—whether it may be a recency effect (where a recent event makes a goal more important…i.e. insurance review after a car accident and repair claim drama) or projection bias (where we project our current tastes and preferences into the future). The study recommended offering a master ‘menu’ of goals to financial planning clients to allow them to review and select all the goals that are important to them. From there, advisors and clients can work together to prioritize and plan how to accomplish the most important goals first.

So, to help our clients identify possible goals to think about, we’ve created this Master-List-Of-Goals-2021 (1)

These foundational questions can help you expand your understanding and awareness of possible goals to consider, including:

- Retirement and lifestyle goals

- Tax planning & healthcare goals

- Self-development and professional goals

- Estate planning and wealth transfer goals

So, if you review this list and need any help in thinking through and planning for any of the goals important to you and your family, please let us know—we’d love to help you get a plan in place!