Contribute to Your Company Plan or IRA?

Short answer: Likely your company plan. Feel free to stop reading now! 😊

If you are employed and covered by a 401k, 403b, 457b, TSP, or some other unnecessarily complicated number/letter combination (qualified plans), then you should maximize contributions to that plan prior to adding to your own IRA.

Reasons:

- Ease of contributions – you can set a percentage or dollar amount to come out of your paycheck automatically each pay period

- Ease of tax reporting – the deductible amount of your contributions will be reported on your W-2 tax form vs. self-reporting IRA contributions

- Much higher limits – You can contribute up to $19,500 (plus an additional $6,500 for those over age 50) to a work plan vs. $6,000 ($7,000 for over age 50) to an IRA

- No question on tax-deduction – there are income limits on making deductible IRA contributions. There are none on company plans

- You might be able to make work plan ROTH contributions – many plans now have a ROTH option, which doesn’t have an income limit either

- You probably get an employer match on a portion of your contributions. The average match percentage is about 4.3% according to Investopedia

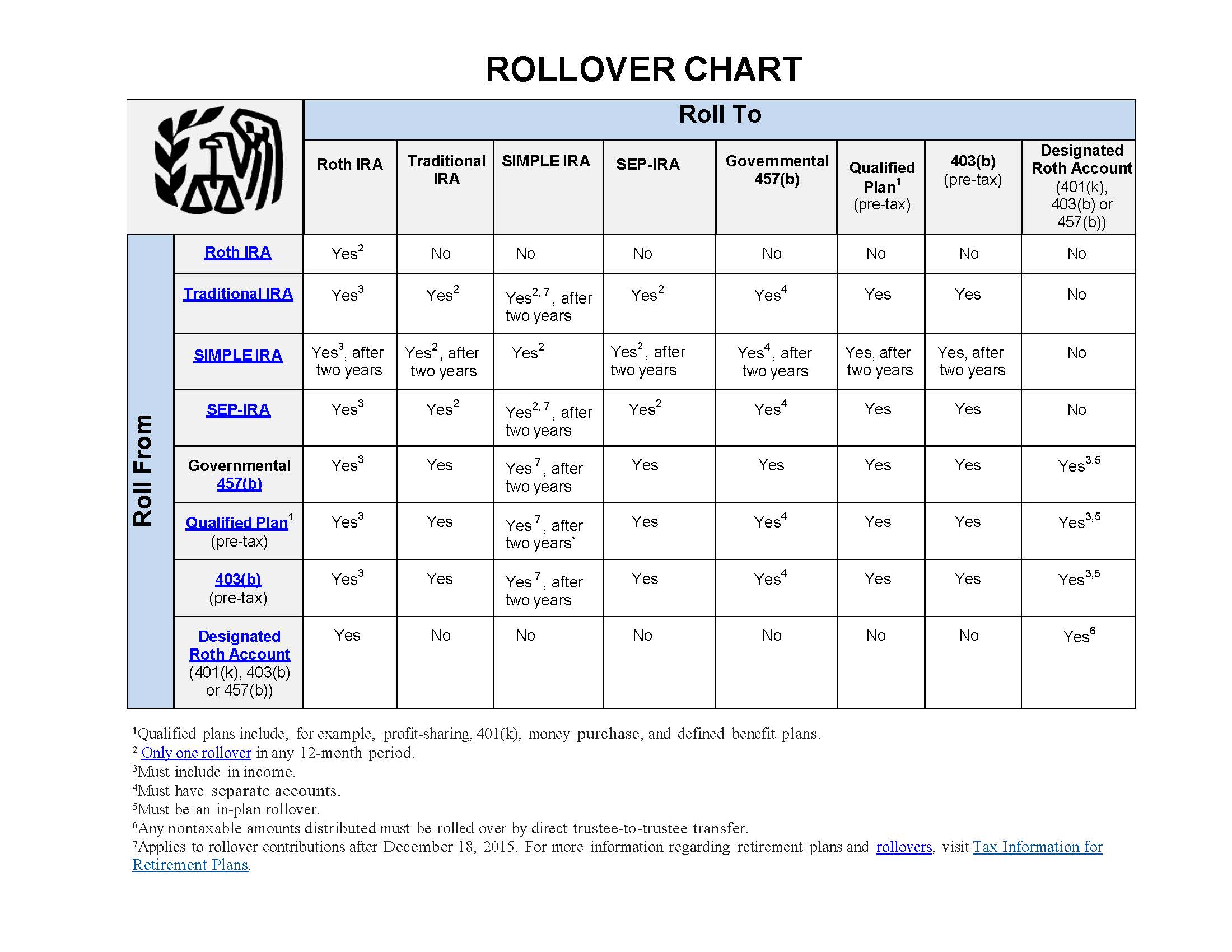

If you are working and have a company plan, there are still valid reasons to have an IRA. These days, workers change jobs frequently and often leave a “bread crumb trail” of plans in their wake. It might be a good idea to open an IRA and rollover the old plans to the IRA. Or, you can roll the old plans into your current plan if it’s allowed. However, I would argue that the IRA would offer many more (and more attractive) investment options than the standard work plan, which is often a generic mix of mutual funds.

The IRS website isn’t great at charts, but they actually have a pretty good one regarding what type of plan can go where.

As a worker gets closer to retirement, it becomes more important to have a customized mix of investments and strategies that often aren’t fully covered by an employer-sponsored plan. Again, an IRA offers a far broader range of investment options and more flexibility. As always, consulting a qualified advisor or planner (Meridian maybe? 😊) is a great option.

With no real clever tie-in this week, I leave you with a picture of our dog Daisy in what my wife and I call the “rotisserie chicken” sleeping position.

Enjoy the rest of your Summer!

Nathan