Musings

What a difference a few months can make…with time, perspectives can change!

From last quarter to this quarter, this happened:

Bailey doubled in size.

Here are a few other charts or images that caught our attention this past month and shifted or confirmed our perspectives:

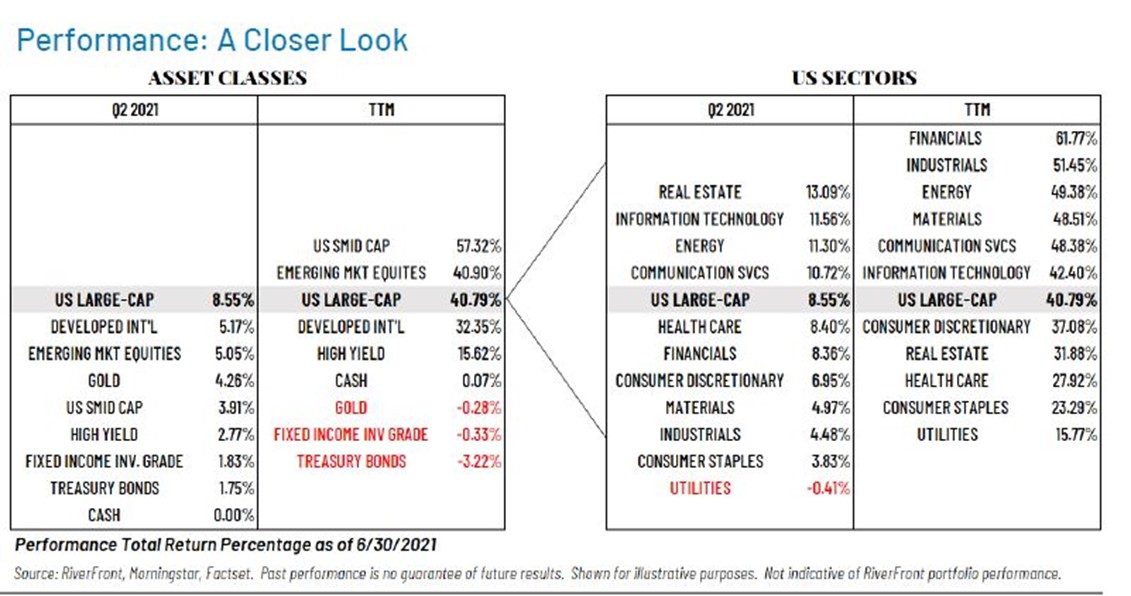

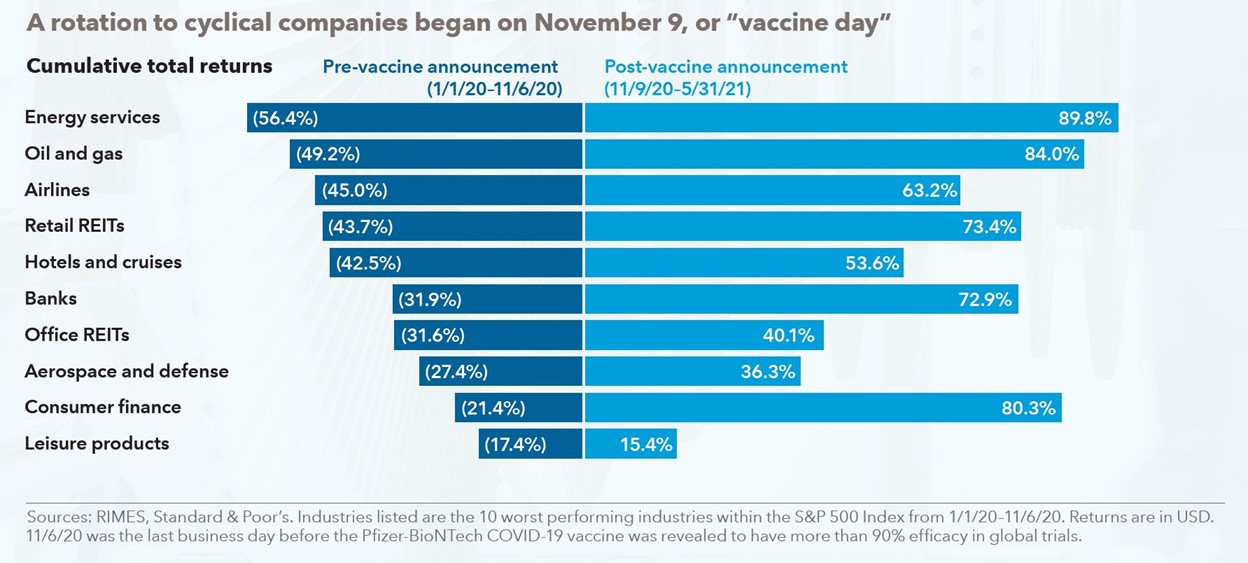

- Large cap stocks returned to the top of the best performing assets list for the second quarter, although they came in third for the trailing twelve months (TTM) that ended 6/30/2021. The rotation of winning sectors also rotated in the second quarter, ending the outperformance run that cyclical companies had been on since November 9th—“Vaccine Day”.

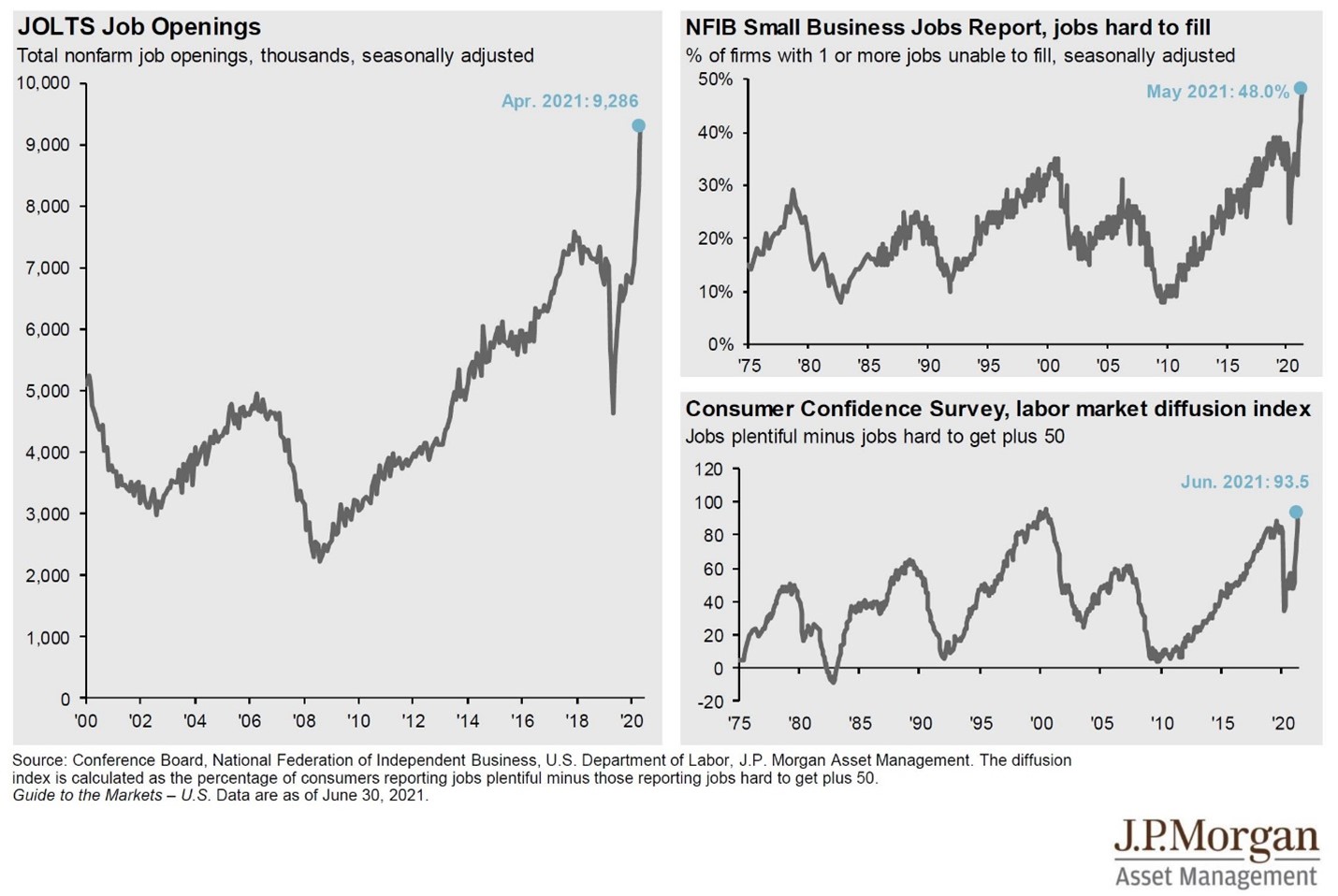

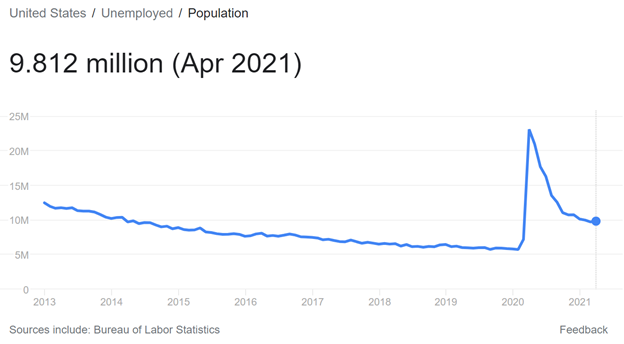

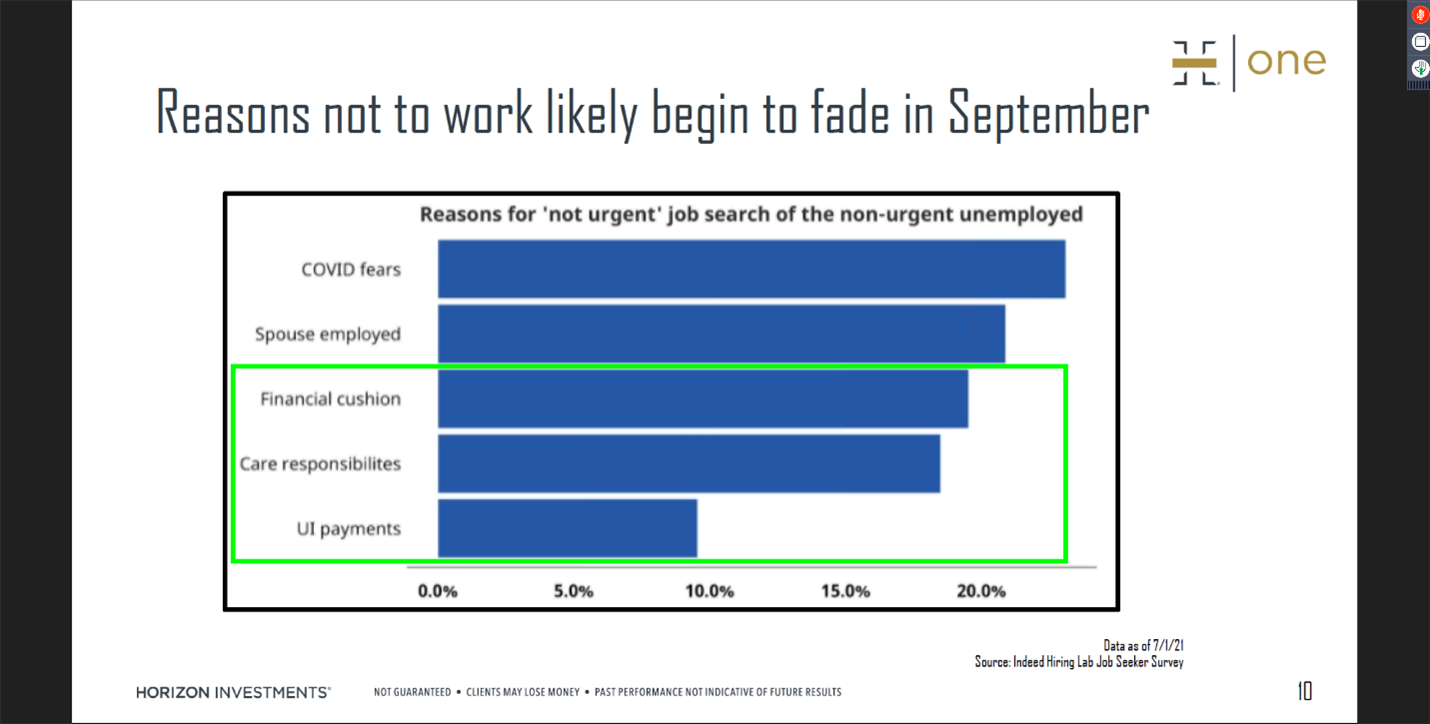

- There were 9,286,000 job openings in April 2021. Ironically, there were 9,812,000 unemployed people in America in April 2021. And yet, 48% of small businesses report that they have 1 or more jobs that they have been unable to fill. But it appears many of the reasons for not searching for a job may fade by September.

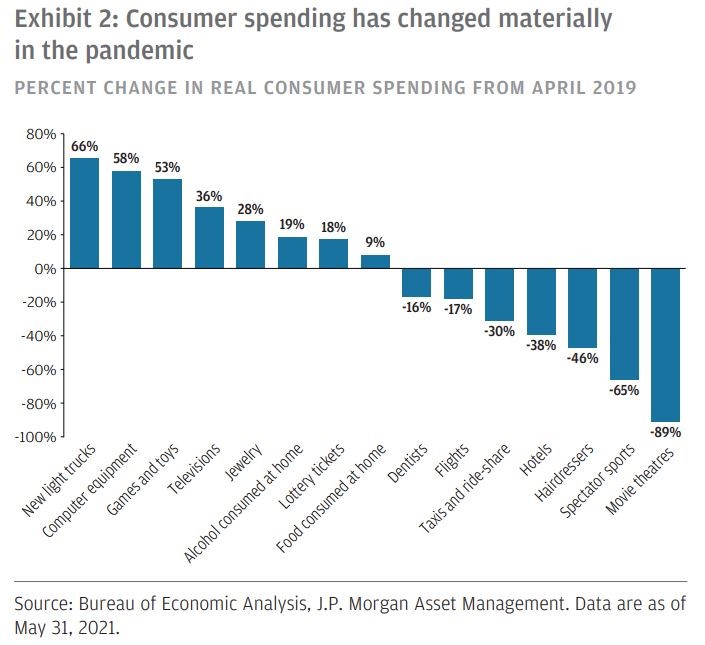

- COVID has changed US consumer spending rather dramatically.

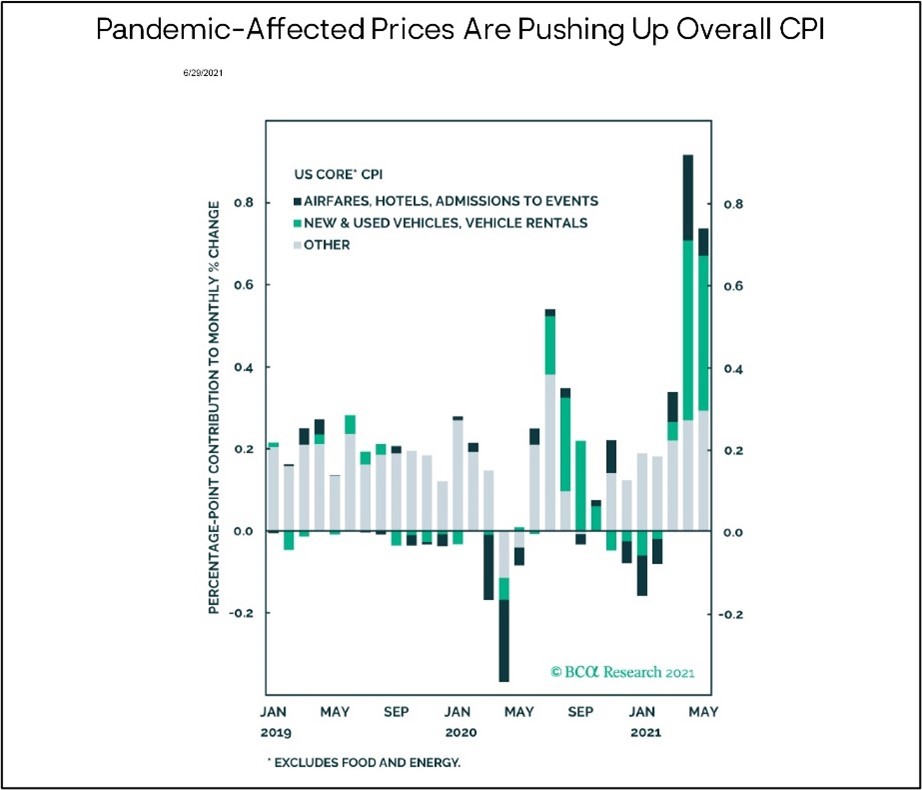

- And while much has been made about the high headline inflation number, not as much press has been given to the fact that almost half of the high inflation numbers in April and May were caused by a spike in used vehicle prices.

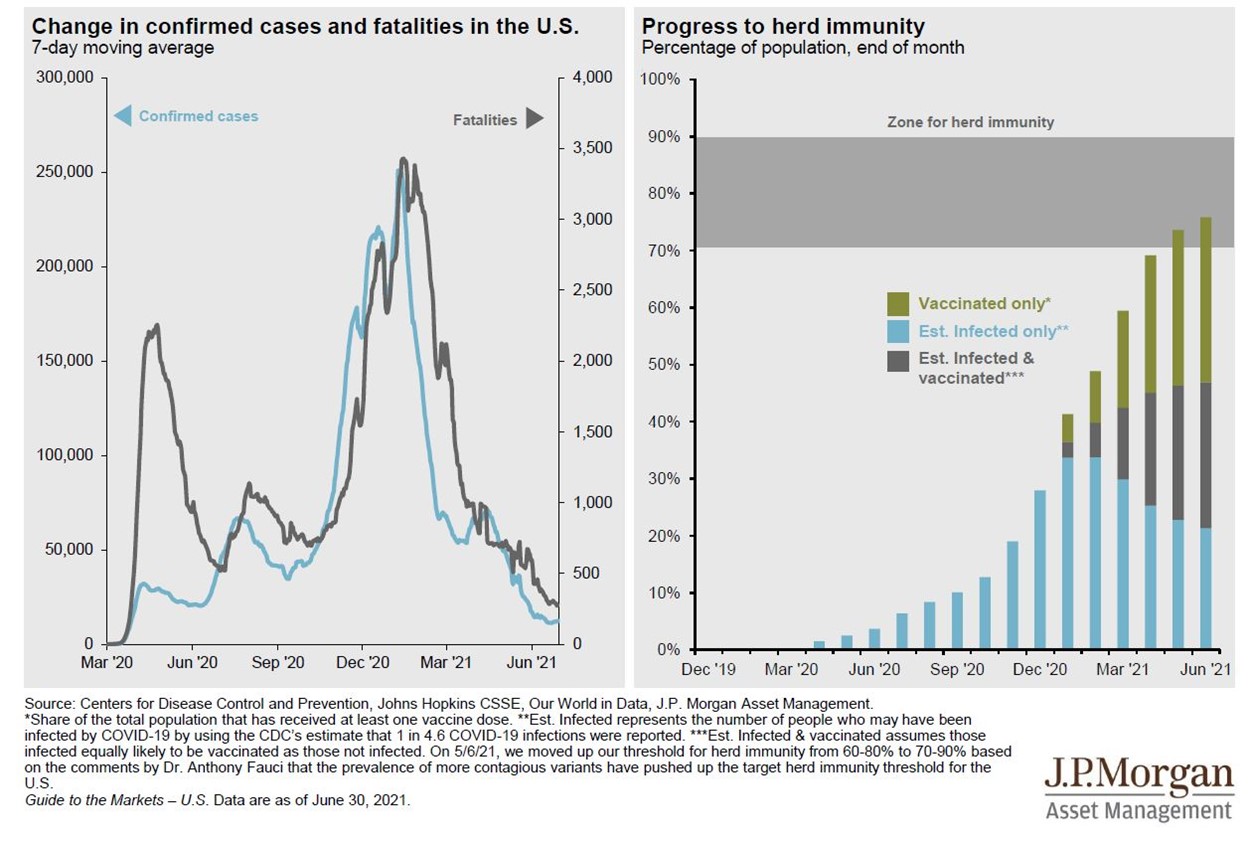

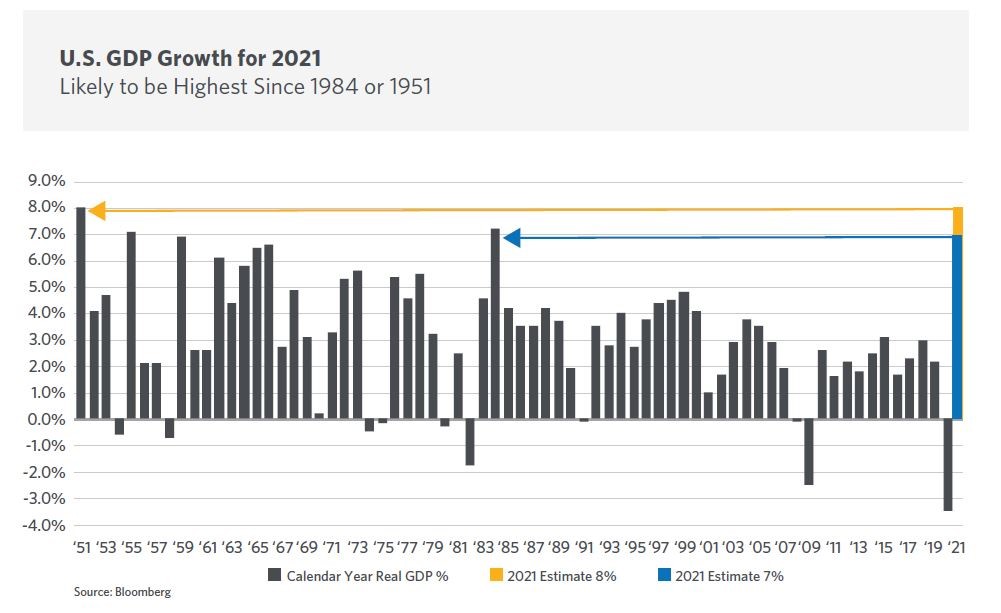

- With consumer spending back, and COVID metrics moving towards potential herd immunity, the United States is on pace for the highest GDP growth since 1951.

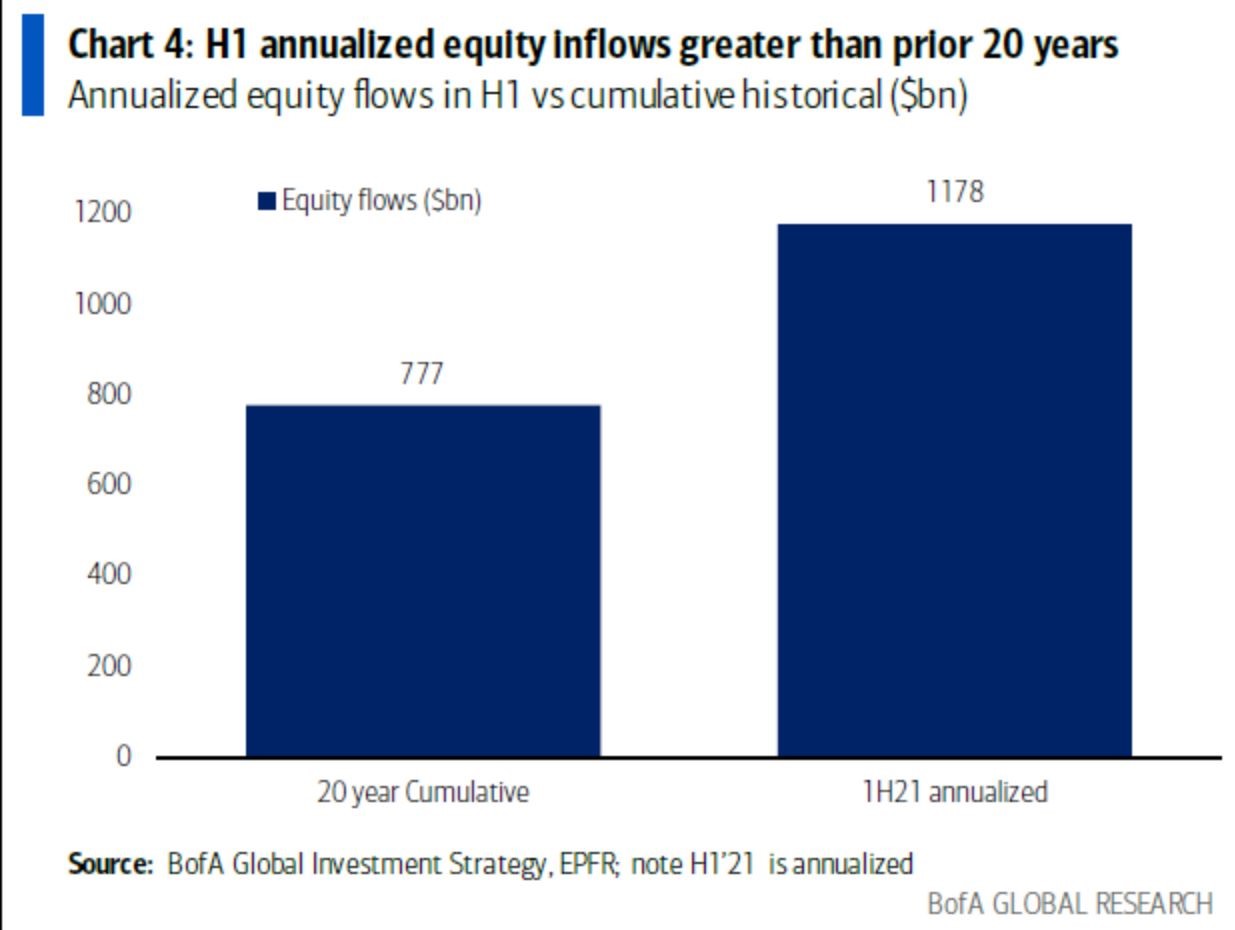

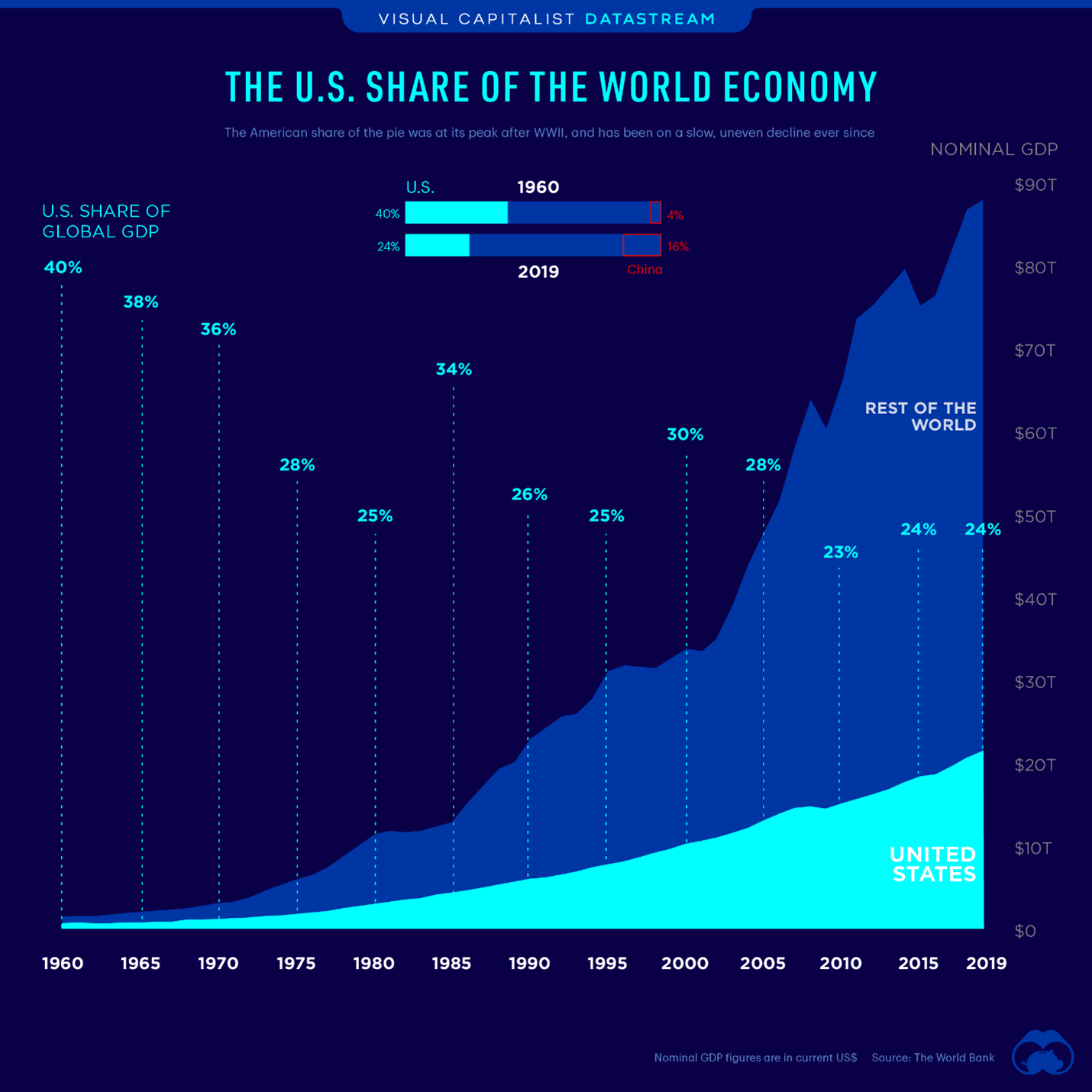

- Investor flows into equity mutual funds this year are on track to equal the total inflows into equity mutual funds over the past 20 year. With this record cash infusion, the stock market has reached new historical highs, despite the fact that the US market only accounts for 24% of the total world economy.

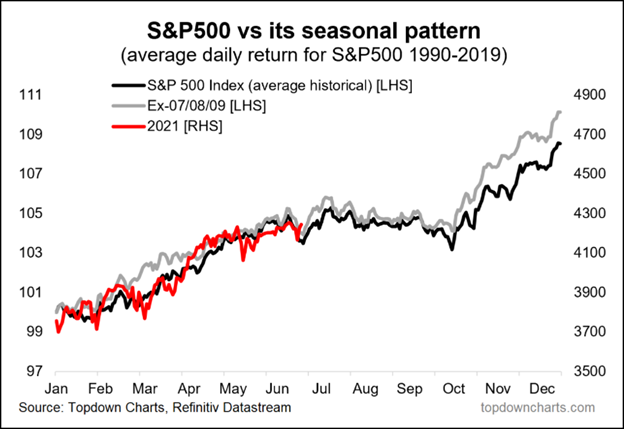

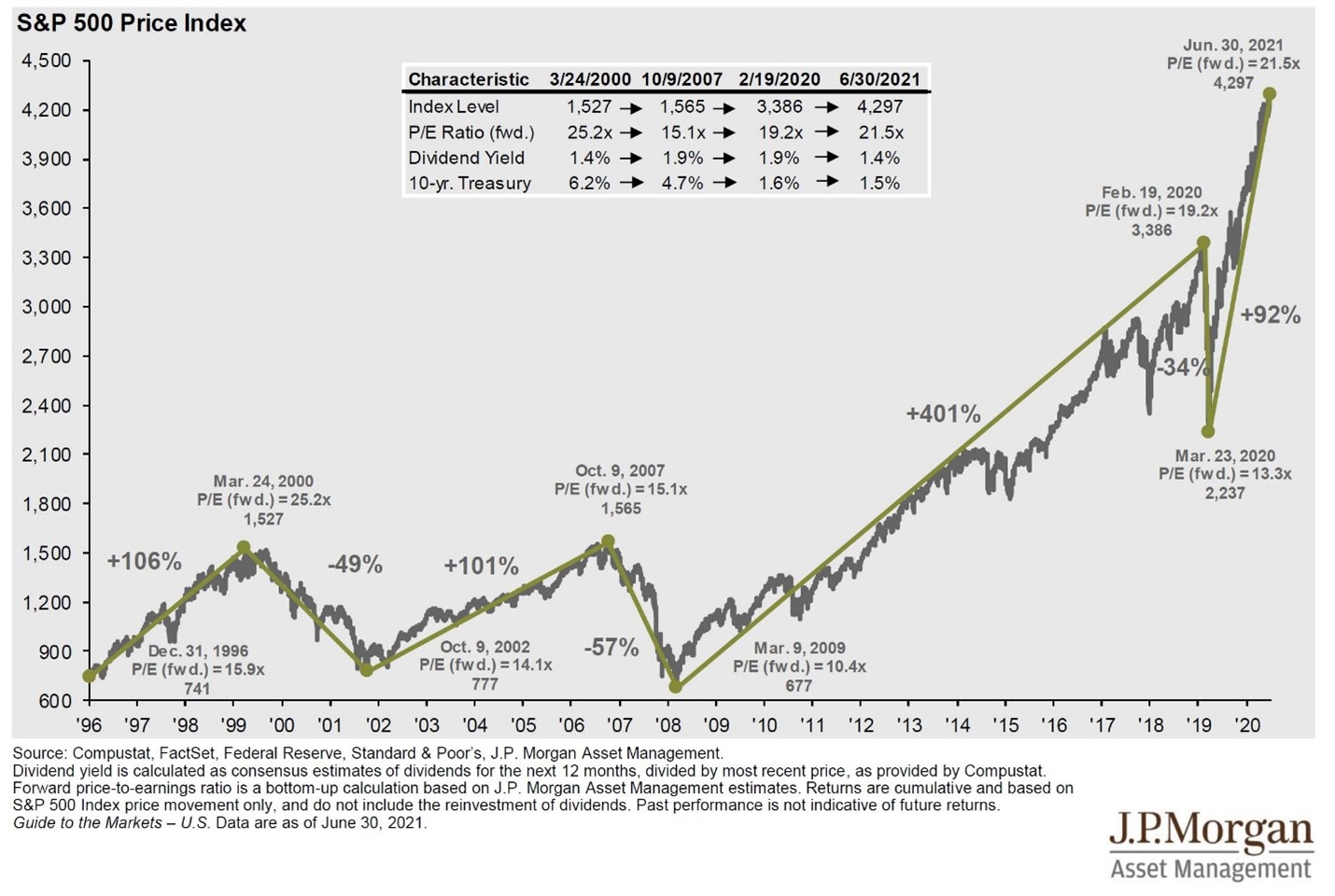

- Despite all the craziness in the market and economy, the S&P is actually following its historical pattern pretty closely this year. We hope that continues! 😊