Words from the Wise

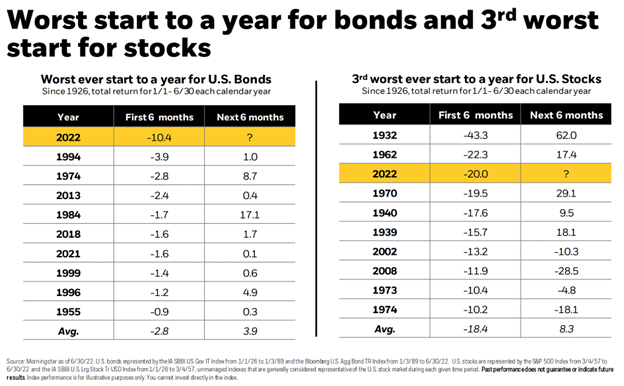

If you’ve turned on the TV, seen a newspaper, been on social media at all–or followed this blog–you are already aware that it has been a rough year so far in the markets. In fact, it has been historically awful.

The challenge in times like these is to stay focused and clearheaded when our natural human tendency is to avoid pain and loss at all costs.

Davis Funds published a great series about the wisdom of great investors…please check out the full content here (it has infographics and further information for each point). But, here are a few of the nuggets of wisdom from some of the greatest investing minds in history:

- Keep your emotions in check

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. You need to keep raw irrational emotion under control”

– From Charlie Munger—Warren Buffett’s long term partner and right hand man

“Your success in investing will depend in part on your character and guts and in part on your ability to realize, at the height of ebullience and the depth of despair alike, that this too, shall pass.”

-From Jack Bogle—founder of Vanguard and father of index funds

- Disregard economic forecasts

“The function of economic forecasting is to make astrology look respectable.”

-From John Kenneth Galbraith—Harvard economist, national economic advisor to five presidents

“I make no attempt to forecast the market—my efforts are devoted to finding undervalued securities.”

-From Warren Buffett—legendary value investor known as the “Oracle of Omaha”

- Don’t try to time the market

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.”

-From Peter Lynch– one of the most successful investors of all time as the manager of the iconic Fidelity Magellan fund

“The idea that a bell rings to signal when to get into or out of the stock market is simply not credible. After nearly fifty years in this business, I don’t know anybody who has done it successfully and consistently. I don’t know anybody who knows anybody who has.”

-From Jack Bogle

- Be patient and think long term

“The stock market is a device to transfer money from the impatient to the patient.”

-From Warren Buffett

“Waiting helps you as an investor and a lot of people just can’t stand to wait. If you didn’t get the deferred-gratification gene, you’ve got to work very hard to overcome that.”

– From Charlie Munger

- A market correction is an opportunity

“The intelligent investor is a realist who sells to optimists and buys from pessimists.”

-From Benjamin Graham—famous investor and father of value investing

“You make most of your money in a bear market, you just don’t realize it at the time.”

-From Shelby Cullom Davis—legendary investor who started with $50,000 and ended with $900 million

- Markets fluctuate—stay the course

“History provides a crucial insight regarding market crises: they are inevitable, painful, and ultimately surmountable.”

-From Shelby Cullom Davis

“In the short run, the market is a voting mace. In the long run, it is a weighing machine.”

-From Benjamin Graham

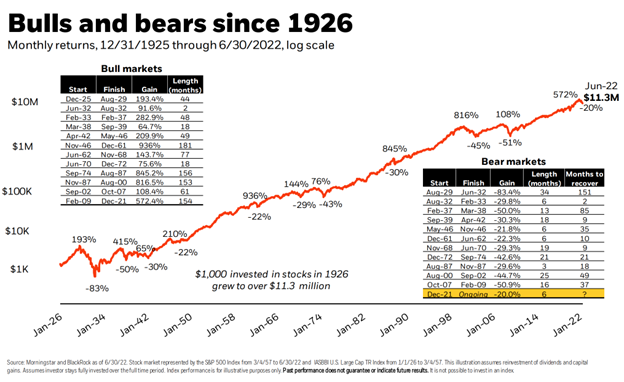

Continuing that last point, a wide lens of history bears out that truth—bear and bull markets come and go, it’s staying invested that matters!

Thanks to Davis Funds for compiling so many great insights on timeless wisdom on building wealth!