Forward Thinking

The markets have always been a predictor of what’s to come. Everything feels bad, looks bad, and the outlook seems pretty bad on many fronts for the rest of this year. The market, both on the stock and the bond side, agrees with that sentiment. Hence, the terrible performance for both stocks and bonds so far this year.

While we are by no means calling any sort of bottom in the stock or bond world, a lot of what investors are concerned about has likely already been priced into the markets. The war in Ukraine will (very sadly) drag on, COVID will probably spike periodically, inflation will continue to be an issue, and the Fed has told everyone that it plans to continue to raise interest rates. These are all known, and investors have sold off assets as a result.

A recent introduction to a report by Bespoke Investment Group summed it up well:

“With headlines like “Nowhere Near Bottom” shown at the top of Drudge Report today, the pain in financial markets has clearly made its way from Wall Street to Main Street. Sentiment levels remain at some of their most bearish readings of the last 50 years. Probably the most bullish indicator we can find right now is just how bearish everyone is. It’s usually when no on can find anything positive on the horizon that bottoms are made. Historically, when investor sentiment has been this bearish, forward returns going out one month to one year have been very positive.”

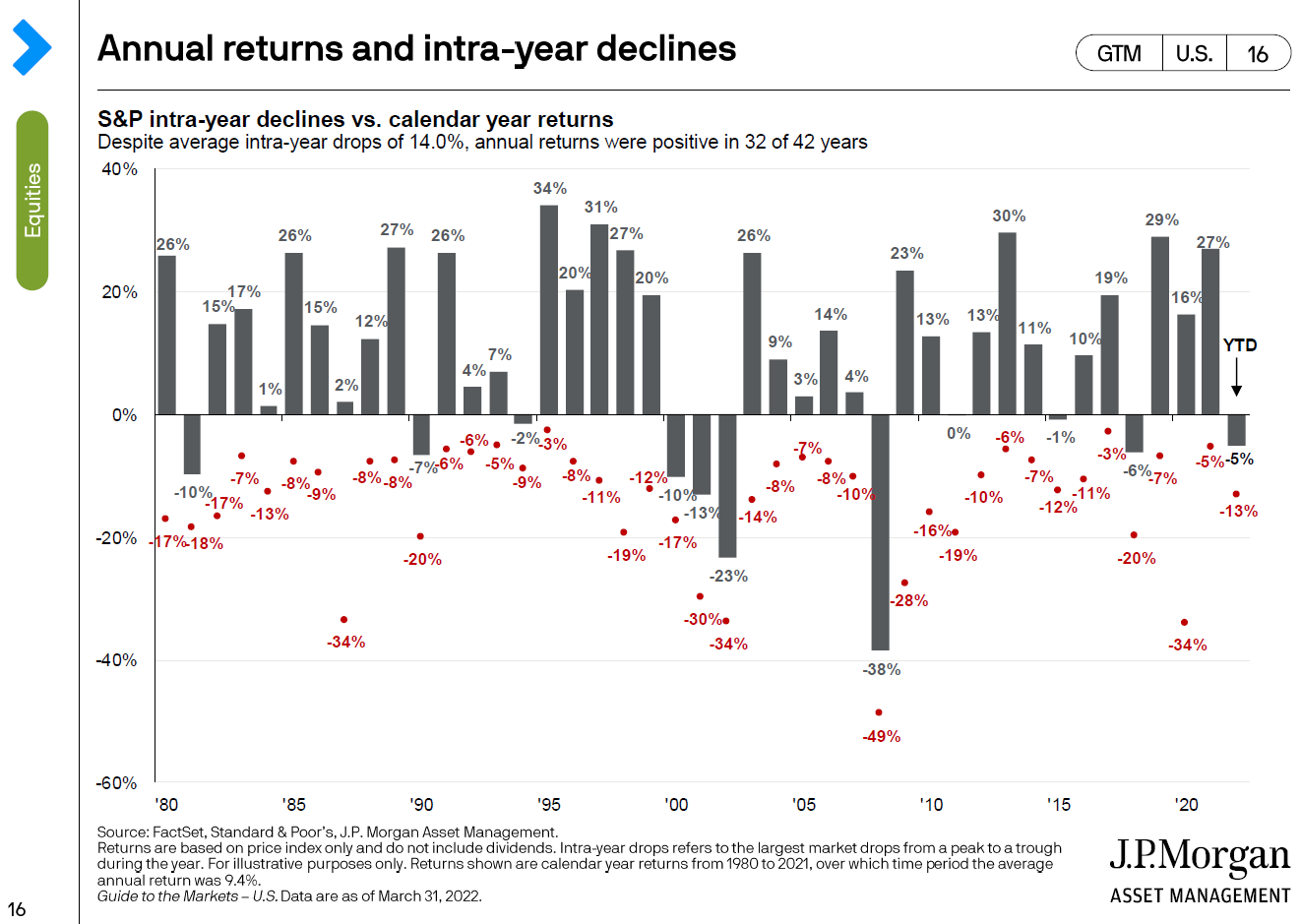

In fact, the average intra-year drop of the S&P 500 has been 14% since 1980. And, in 32 out of 42 years, the annual returns were positive. As I write this the S&P 500 is down about 15%…now it’s -15.6%…now it’s back to -14%. Needless to say, there has been quite a bit of volatility, but the percentage decline so far this year is not out of the ordinary.

While we hate to compare investing to gambling, betting on any investment over a short period of time is a gamble. We do remain confident that remaining invested appropriately over the long term is much less of a gamble. There is a reason why bettors were paid $818 on a $10 bet (80-1 odds) when Rich Strike (perfect name!) won the Kentucky Derby this past Saturday. Before the race started, there was very little chance of that outcome. Rich Strike’s win was the second biggest upset in the Kentucky Derby’s history (you have to go all the way back to 1913 to find the biggest upset).

While this next chart from Bespoke isn’t necessarily designed to be an optimistic one, it does provide a good reminder of how the market has behaved over a longer period and gives some decent perspective.

My business partner hates when I attempt to make predictions, but I do predict more volatility to come. Much like we endured Gold Cup (aka COLD Cup) this past Saturday (okay, most of it), we will endure this most recent and more protracted downturn. As investors, this is something that we must be willing to go through in order to be rewarded with higher returns over time.

Proof we were there!

Here’s hoping that markets recover prior to the end of the year, and there is never another Gold Cup with worse weather!