“Shaken, Not Stirred” – James Bond(s)

Bonds have been grabbing a lot of headlines, lately. Up until recently, all of those headlines were generally bad and involved declining (shaken AND stirred?) prices. It has been a frustrating last year and a half for conservative bond investors not used to seeing their account values fluctuate. However, behind the positive November stock market returns was also one of the best months for bonds in almost 40 years.

James Bond contemplating the below illustration (which I have used before!) Image: SONY

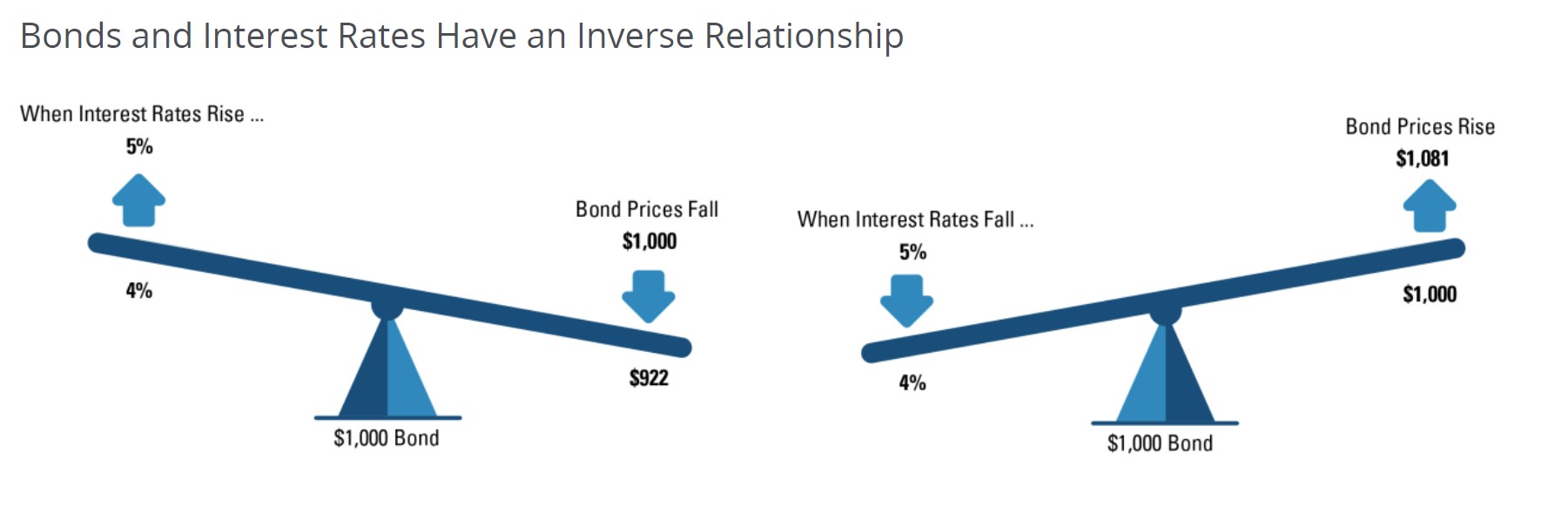

For illustrative purposes only. Assumes bond with a fixed semi-annual coupon and 10-year maturity. Source: Hartford Funds

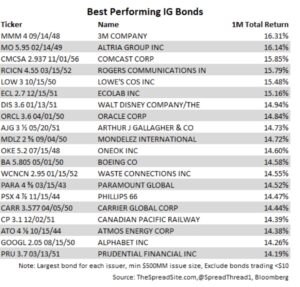

Below is a chart showing the best performing investment grade (IG) bonds in November. Investment grade bonds have a lower risk of default than their higher risk/interest rate counterparts and have a rating of BBB- or better (using Standard and Poor’s and Fitch’s rating system).

For comparison’s sake, the S&P 500 was up 9.1% over the same period. For our clients, we typically aren’t investing in bonds with an expectation of return from price increases, but this is certainly nice to see. Going forward, it is reasonable to expect that a bond’s interest rate will be its return over time.

The price jumps are mainly due to the change in tone around the “higher for longer” interest rate conversation. With inflation numbers starting to approach the Fed’s target of 2% more quickly than expected, the rhetoric has now changed to more rate cuts next year. “We’re not going to see 5 percent on the US 10-year again,” said Karen Ward, chief market strategist for Europe at JPMorgan Asset Management. “If you missed 5, don’t miss 4.5. Bonds are very high on the Christmas wish list in my house.”

With record trillions of dollars still in money market funds, it might be time to take a look at using bonds to lock in some of your interest rates. Money market funds are simply owning highly rated, short-term bonds for their investors, so you can expect those rates to come down over time as well.

It is human nature to want both safety and high returns, and the ability to achieve that combination is rarely if ever possible. We sometimes want what we can’t have! Very much like our two dogs, who will fight over the same toy, even though there are 20+ others available to them. They only want the one the other has!

Waiting for you to drop that…

As this is my last blog for 2023, Merry Christmas and Happy New Year to you and yours!

Nathan