Financial Literacy Month!

I’m a big fan of holidays. I inherited this trait from my parents, particularly my mom who always went above and beyond to make even the smallest of celebrations feel special. With a bulk of the “big” holidays behind us, I was excited to hear that this April celebrates the 21st anniversary of Financial Literacy Month.

In 2000, the National Endowment for Financial Education (NEFE) organized a Youth Financial Literacy Day. But in order to avoid the perception of favoring one organization as an educational provider, the NEFE requested that National Jump$tart, a national nonprofit that focuses on transforming the early care and education system, take over promoting and organizing the one day event. Jump$start quickly expanded it to the entire month. This makes sense, as the topic of financial literacy covers an expansive set of information.

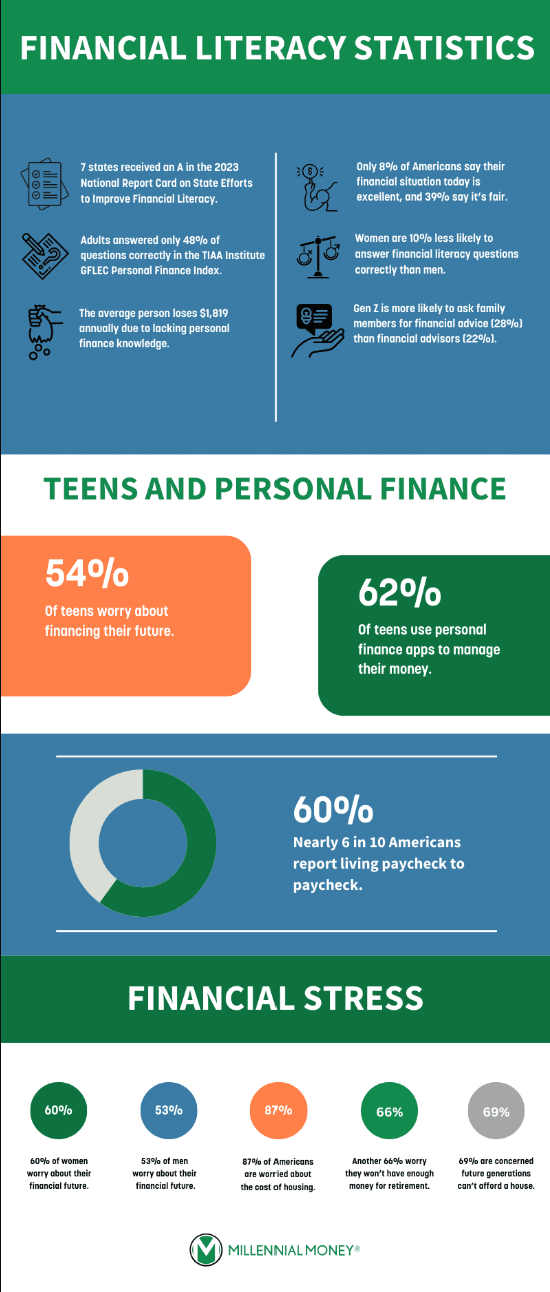

I would assume that most of our readers fall into the financially literate category (and I’d like to think that Meridian’s blogs and content help aid that! 😊). However, statistics on financial literacy for all age ranges are not entirely encouraging.

- The 2023 National Report Card on State Efforts to Improve Financial Literacy gave only 7 states an ‘A’. These states are Alabama, Iowa, Mississippi, Missouri, Tennessee, Utah, and Virginia (woo hoo!).

- On the TIAA Institute-GFLEC Personal Finance Index (P-Fin Index), only 48% of adults answered 23 questions correctly in 2023. This is a decrease from 2022 and previous years.

- 8% of Americans say their financial situation today is excellent, compared to 12% in 2021, and 39% say it’s fair.

- Lack of financial literacy cost Americans a total of more than $388 billion in 2023.

While Financial Literacy Month was originally established to focus on educating youth, being equipped with knowledge allows us to make smart financial decisions during every phase of life.

The pillars of financial literacy cover 5 main categories, which not surprisingly align with the main components of financial planning.

- Earning — Salary, bonuses, stock awards, interest and dividends, Social Security

- Borrowing — credit and credit scores, student loans, mortgages, auto loans, understanding debt ratios

- Budgeting / Spending — includes taxes, debt management, cash flow planning

- Saving / Investing — emergency savings, short term to long term goals, understanding net worth, retirement and employer sponsored plans, asset allocation, risk tolerance,

- Protecting – insurance (homeowners, auto, property, life, disability, medical, long term care), estate planning (wills, trusts, gifting)

And this is an abbreviated list of all the topics that fall into financial literacy categories! To me, this goes to show that no matter what stage of life you are in or what profession you are in, the learning never stops, particularly as your goals adjust and change over time.

While we hope that you reach out to your financial advisor with any financial literacy questions you may have along with the content Meridian puts out weekly, I have included a few documents and websites to complement this month’s theme and hope you and your families find them useful!

Financial Literacy Month Calendar

https://www.morganstanley.com/Themes/financial-literacy

https://www.schwabmoneywise.com/tools-resources/literacy-survey

Although April is the only month officially dedicated to the awareness of financial literacy, Meridian sees every blog, every social media post, every client meeting as an opportunity to improve financial literacy. We welcome and are always open to recommendations on ways we can continue this learning together.

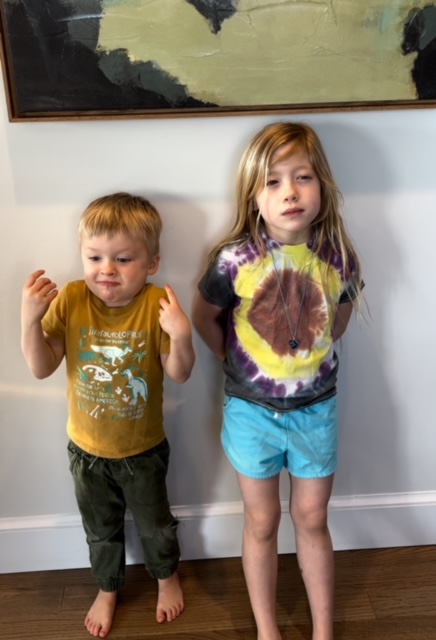

Speaking of learning together, Meridian took a little time to test our families’ financial literacy and received some entertaining and impressive responses. Stay tuned for the final result this month!

A very real reaction to some kid-friendly financial literacy questions