Irrational Decisions (+ RIP Daniel Kahneman)

Daniel Kahneman’s work perfectly outlines what we as advisors and planners are often dealing with when speaking to clients, giving advice, and making recommendations. One of his main conclusions was that individuals do not always make rational decisions when faced with uncertainty. Unfortunately, when it comes to stock market behavior, there is very little certainty, especially in the short term. We have witnessed firsthand when a client opts for a guaranteed short-term rate, when all evidence points to better investment options that will yield a higher return over time.

Kahneman was an eminent psychologist and economist and passed away at age 90 on March 27th. He left an indelible mark on the field of behavioral economics with his groundbreaking research and insights into human decision-making. Born in Tel Aviv, Israel, in 1934, Kahneman’s journey from studying the complexities of the mind to revolutionizing economic theory has earned him numerous accolades, including the Nobel Prize in Economic Sciences in 2002. Kahneman made key contributions to behavioral economics and the profound impact they have had on our understanding of human behavior and decision-making.

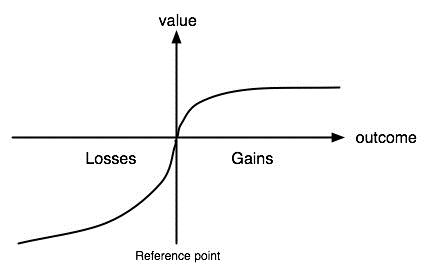

As mentioned, one of Kahneman’s most influential contributions to behavioral economics is Prospect Theory, developed alongside Amos Tversky in 1979. This theory challenges traditional economic assumptions by proposing that individuals do not always make rational decisions when faced with uncertainty. Instead, they evaluate potential outcomes relative to a reference point and exhibit risk aversion or risk-seeking behavior based on perceived gains and losses.

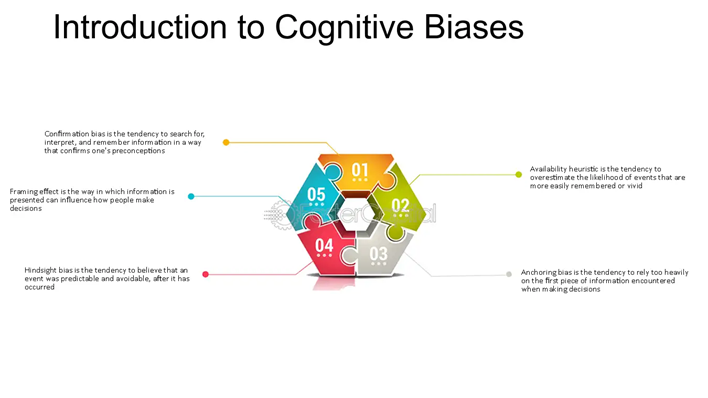

Kahneman’s research has identified numerous cognitive biases and heuristics that shape human judgment and decision-making. From anchoring bias to availability heuristic, these mental shortcuts often lead to systematic errors in reasoning.

Source: Introduction to Cognitive Biases – Cognitive Biases: Decoding the Mind: Daniel Kahneman and Cognitive Biases

Daniel Kahneman’s contributions to behavioral economics have reshaped our understanding of decision-making processes and challenged conventional economic models. His work has also provided some data and evidence as to why clients and investment managers alike make the decisions they do. Sometimes human nature flies in the face of rational decision-making, and it is a hard thing to overcome.

Speaking of decision-making, our daughter recently made some possibly irrational choices when insisting on going the hard way up the climbing wall. To her credit, she did not give up until she reached the bell at the top, but both my wife and I had sore necks from looking up at her for hours on end!

Lastly, Happy Masters week! (that’s a golf tournament if you didn’t know). I am a hopeless Rory McIlroy fan, so I always think ‘this is the year!’ I think I really might be this time! I think there’s some cognitive bias in there somewhere…

Nathan