The Who, What, Where, When, How and Why of Emergency Funds

Last week, Sarah Irving wrote a fantastic blog highlighting the importance of financial literacy, which included the following statistic: 60% of woman and 53% of men worry about their financial future. One of our most important recommendations when it comes to financial well-being is establishing an emergency fund. Not only does it offer a financial cushion in the event of unexpected expenses, it also creates peace of mind. Here is the who, what, when, where, how, and why of emergency savings (albeit in a slightly different order):

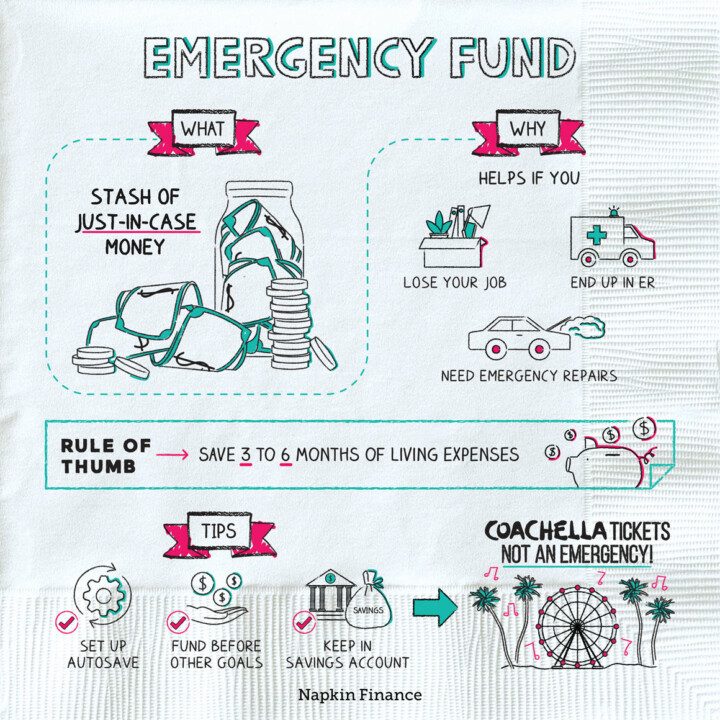

What is an emergency fund?

An emergency fund is a separate funds set aside used to cover or offset the expense of an unforeseen situation. It should not be considered a nest egg or calculated as part of a long-term savings plan for college tuition, a new car, or a vacation. Instead, this fund serves as a safety net, only to be tapped when an emergency occurs.

Who needs an emergency fund?

The answer to who needs an emergency fund is simple – everyone! Having funds available for when life throws curve balls is a crucial part of a successful financial picture.

But, according to Bankrate’s annual emergency savings study, more than 1 in 5 Americans have no emergency savings, leaving them vulnerable if unexpected expenses or changes of income occur.

Bankrate asked: How much do you have in emergency savings — that is, money that is readily available in either a checking account, savings account, or money market?

Why is it important to have an emergency fund?

Emergency funds create a financial buffer that can keep you afloat in a time of need without having to rely on credit cards or high-interest loans. Emergency funds also give you peace of mind, knowing that if the unexpected occurs, you and your family can tackle that challenge without worrying as much about the financial side.

How much should you have in your emergency fund?

The short answer: 3 to 6 months of your living expenses.

The long answer: The right amount depends on your financial circumstances. If you share expenses with another person, like a spouse, the amount may be lower because you can share the expense between two people. If you are self-employed or work seasonally, that amount may be higher, because replacing income may be more difficult.

By setting a specific dollar amount, you will have a goal to build to and when you draw from your emergency savings, you will know how much to contribute in order to replenish the account. When you do have to use this fund, it’s important to work to rebuild it.

That general target goal of three to six months of living expenses can be a daunting number. A great first step is setting aside one month of living expenses and building from there. You can boost those savings by creating automated transfers to your emergency savings account. Another way to build your account is moving any windfall funds to your emergency savings, things like a bonus or larger than anticipated tax refund.

Where should you keep your emergency fund?

Emergency funds should be kept in cash – not literally cash under the mattress- but rather in a bank account that you can access quickly and easily. Choose a bank that is insured by the FDIC (or NCUA if it is a credit union), meaning that your funds are protected by the government up to $250,000 if something were to happen to the bank. With higher interest rates, a high yield savings account linked to your normal bank accounts may be a good way to keep your emergency funds working for you while keeping them liquid and accessible.

When should you use an emergency fund?

Definitely an emergency: Anything unexpected that you absolutely must pay for. Examples include losing your job, having unexpected medical bills, or major home repairs.

Definitely not an emergency: Things you want but don’t really need, or things that you could save up for, things like last minute trips or concert tickets. If you know that your car is nearing the end of its time, that is an opportunity to save up for a new vehicle, rather than tapping into emergency savings.

Joy here is not concerned about establishing emergency savings, though she does seem a little concerned about how she ended up in these light up butterfly wings.