Everyone needs an Estate Plan

Happy Estate Planning Week! I’m sure you knew this holiday existed 😄

Estate planning encompasses the growth, conservation, and transfer of an individual’s wealth through the creation and maintenance of an “estate plan.” The purpose of estate planning is to develop a strategy that will maintain the financial security of individuals through their lifetime and ensure the intended transfer of their property and assets at death, while taking into consideration the unique circumstances of the family and the potential costs of different methods. All too often, we hear:

- “I’m too young to do estate planning.”

- “All my property is titled in joint tenancy with my spouse so I don’t need a will.”

- “Estate planning is only for the super-rich.”

- “Estate planning is too complicated and expensive.”

- “Doesn’t the government provide for that?”

- “We did our wills right after we got married 30 years ago and see no need for further planning.”

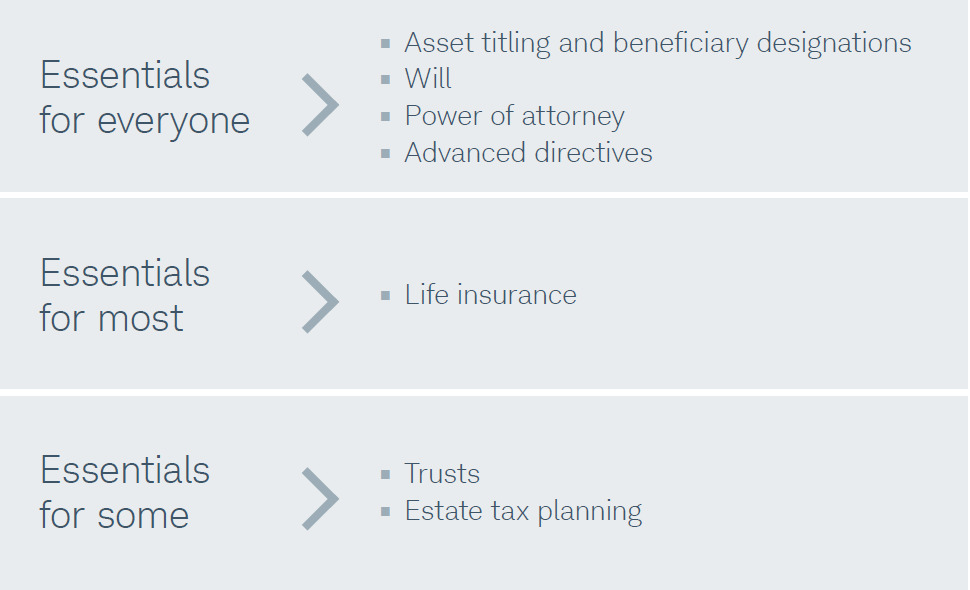

Estate planning is a crucial activity for people of all ages and all levels of wealth (not just the ultra-high net worth folks). When done properly, it can safeguard more than an individual’s finances, it can create a legacy. However, it is estimated that 67% of Americans do not have an up-to-date estate plan.

No one can predict the future, but one thing is sure: if we leave unanswered questions about how to settle our affairs, life for those we love could be even more difficult. That’s why answering questions now and formalizing them in an estate plan is an important step that shouldn’t wait:

- Doesn’t everything go to my spouse?

- Do I have the right beneficiaries on my accounts?

- If I’m out of it, who will call the shots?

- Who will take care of the kids?

- Who gets what when I’m gone?

- Would a trust make sense for me and who should be my trustee?

- How can I preserve more money for my heirs?

- Who knows where to find my records?

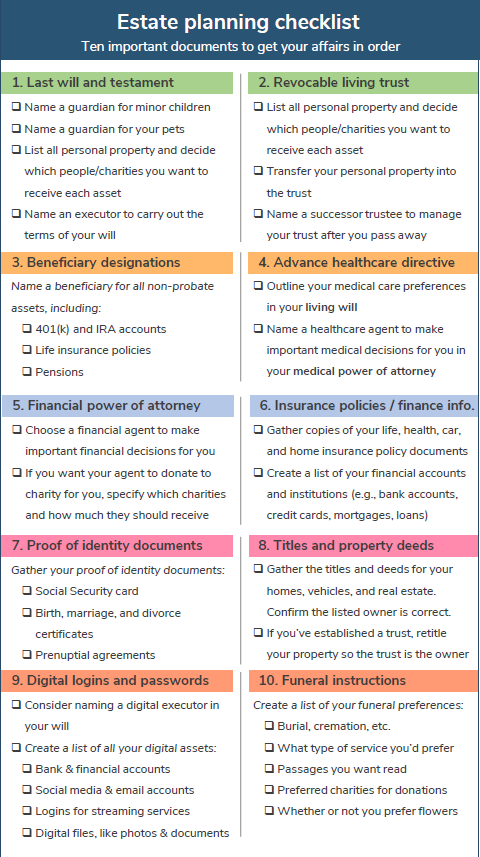

Estate planning aims both to allow individuals to pass their assets to beneficiaries as they see fit, and to minimize the state and federal taxes that accompany the transfer of significant wealth. Additionally, estate planning can enable individuals to decide which people and charitable organizations will receive their wealth at their death. The lack of estate planning may cause an individual’s assets to be distributed to unintended parties by default. Careful planning can also prevent family members or other beneficiaries from being subjected to complex legal and administrative processes requiring significant expenditure of time. If you have young children, you absolutely need a will. Without a will, the state will choose a guardian from among your relatives, and it may or may not be the person you would have chosen.

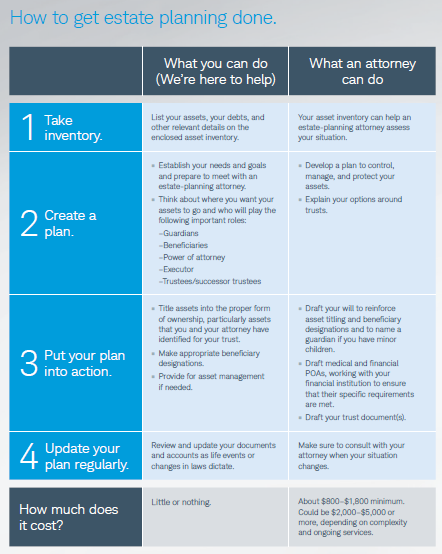

While we cannot create your estate planning documents here at Meridian, your estate plan is a vital part of your financial plan. And we highly recommend a couple local attorneys that can help you create your custom estate plan to fulfill your wishes.

With the saying “practice what you preach” it’s looking like Tom and I need to get an will in place soon with our twins arriving in March!