The Good Ole Days

Recently, a friend of mine passed along an article from a local news outlet (Fauquier Magazine) from March of 1991 that featured my grandfather on the cover. I had seen the magazine and the article before, but it was a nice reminder of my “G.P.” in his younger days. He was a successful local business owner, as well as an avid sailor. The fact that he put “Capt Bly” (in reference to the historical figure of Mutiny on the Bounty fame) on his license plate should tell you all you need to know about how he ran his ship!

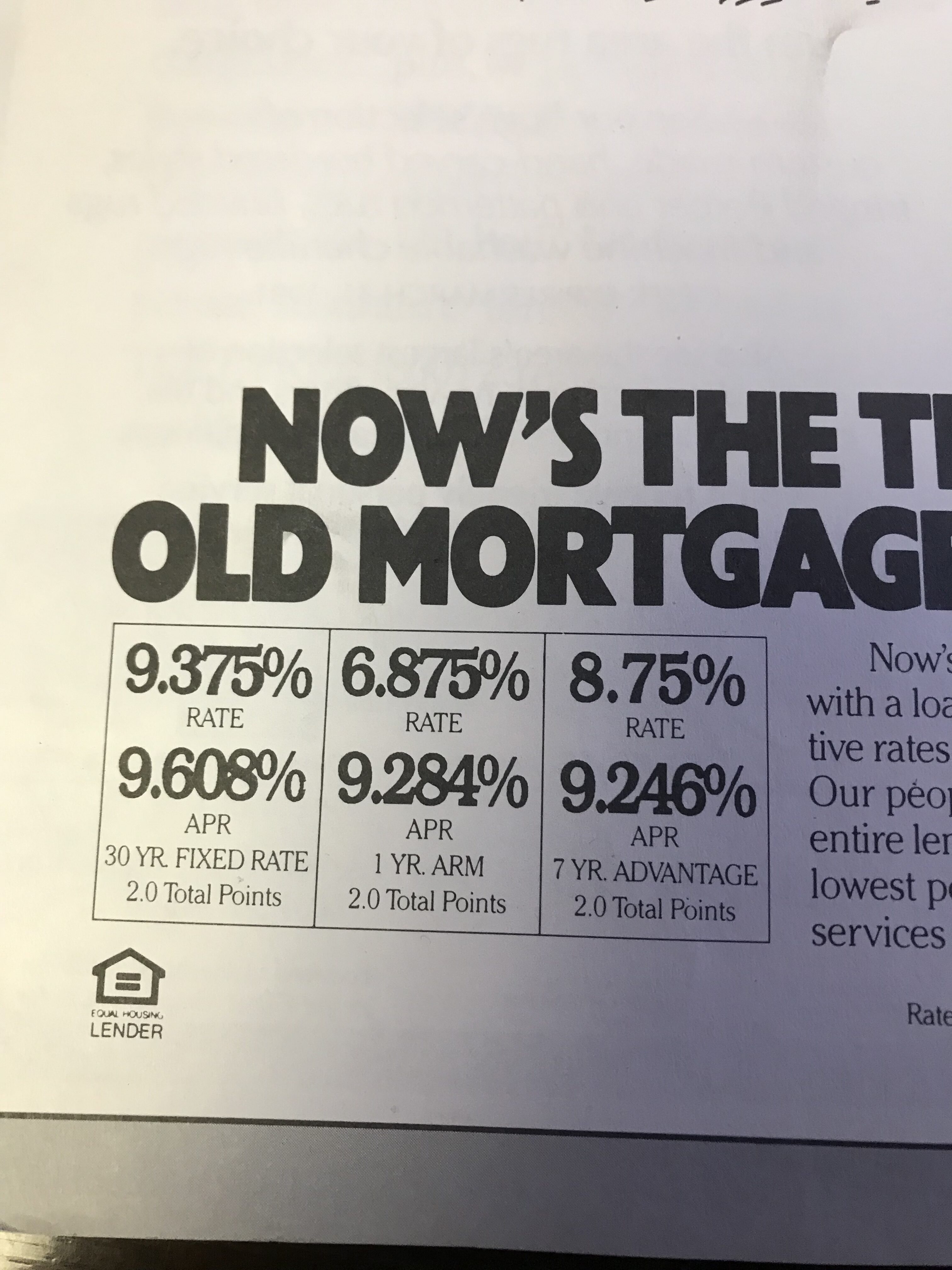

It was also interesting to look through the magazine’s old ads from the early 1990’s. The one that caught my eye was a local bank advertising mortgage loans. Based on the picture below, you should have considered yourself fortunate to get a 9.375% 30-year fixed loan with 2 points!

Looking back over the history of 30-year fixed mortgage rates since 1970, I suppose if you took out your initial loan in the 1980’s, then you really were happy to refinance at 9.375%.

30 Year Fixed Mortgage Rate – Historical Chart

Source: www.macrotrends.net

As is often the case, CD rates were almost just as high, meaning depositors were earning a very high rate of return in 1991. A 1-year CD would earn you somewhere above 7%. Those days are long gone, and we as investors need to be willing to take some level of risk to get even a 4% return. So, even in this period of heightened market volatility, investing in instruments other than bank savings accounts and CDs is a must if you want to beat inflation over the long term.

According to Bankrate.com, the National Average for a 1 year CD is 0.88%. As of December of 2018, the annual inflation rate sits at 1.9%. That means that if you own a CD that is earning 0.88%, you are guaranteeing yourself real rate of return of -1.02%.

As they say in the fitness industry, it can take short-term pain (market volatility) to get long-term gains.