Strategizing

Every winter, the Yakel household gets complicated with the start of basketball season. Melanie and Ethan play basketball and I coach the varsity girls at their school. Lots of long nights at the school gym!

This year, the varsity girls team kicked off our season by winning the preseason tip-off tournament and then ending the first half of the season at 6-1. The girls have been working hard and playing well as a team.

All truth be told, I don’t love coaching. I love my kids and the girls on my team—and I always enjoy spending time with them, but the more time I spend at coaching clinics and being around other coaches, I realize that I don’t have the passion for the Xs and Os that other coaches do. 😀

And, probably not surprising, but I have realized I coach like a financial advisor…

- Basics matter—my practices are not built on crazy drills or skills, or on complicated plays. Just getting great at the basic skills—shooting, layups, free throws, spacing, etc.

For our Meridian planning clients, that means things like getting basic emergency savings in place, making sure retirement savings are on track. For Meridian portfolios, that looks like making sure the fundamental asset classes (like both large and small, US and international) are covered with low cost, well performing securities.

2. I hate gambling—full court presses and trapping defenses are not my favorites—they rely too much on lots of things going right. There are many ways they can fail and cause the game to go the wrong way.

Same with investing for our clients—we avoid high risk/low chance of potential success investments. We prefer sticking with investment themes and ideas that can “win” under a variety of economic scenarios, not just one specific set of circumstances.

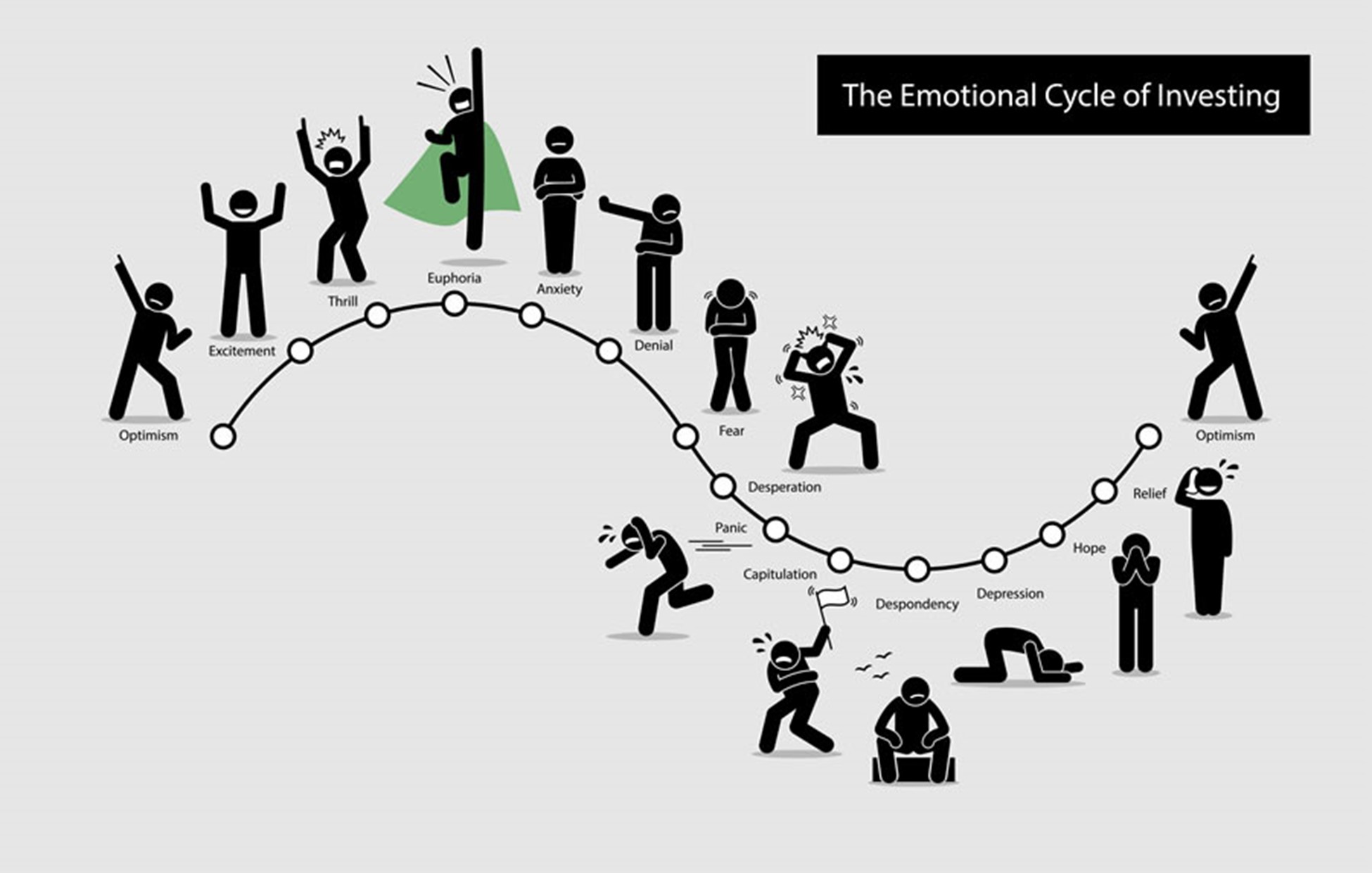

3. Stay calm—as a team, we’ve talked at length about how in every game, getting angry about something is a given, but staying angry is a choice. (Thanks to Kevin Eastman, assistant coach at Boston Celtics for that gem…). The more we play angry or emotional, the less able we are to focus on executing and playing well.

And same in investing—emotions run high in the investing cycle—it’s easy to swing from despair to euphoria and back:

Today, we gear up to return to game play after a three week Christmas break. In this second half of the season, we play a lot of teams that we’ve played earlier in the year. While we are sticking to the main points above, since we do know a little more about what to expect, we are adjusting our game strategy to best compete with each upcoming opponent.

And, that is also what we are working on at Meridian—adjusting our game plan slight for 2022, as the year is shaping up to be a bit similar to 2021—we have lots of accumulated cash to be spent by consumers and state and local governments, rising interest rates, and higher than average inflation:

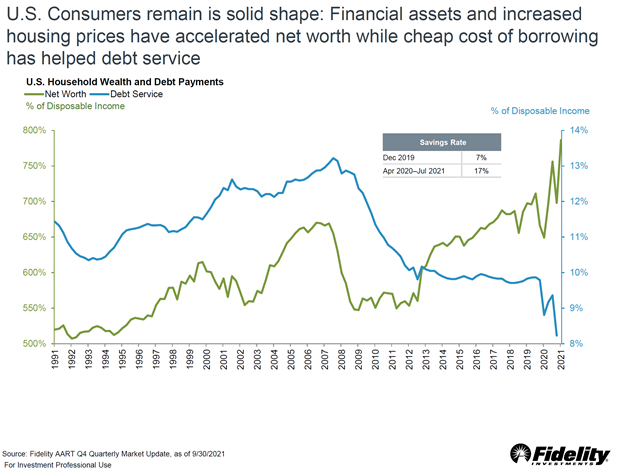

Recognizing that US consumers are in great shape, the US economy appears to have room for continued growth in 2022:

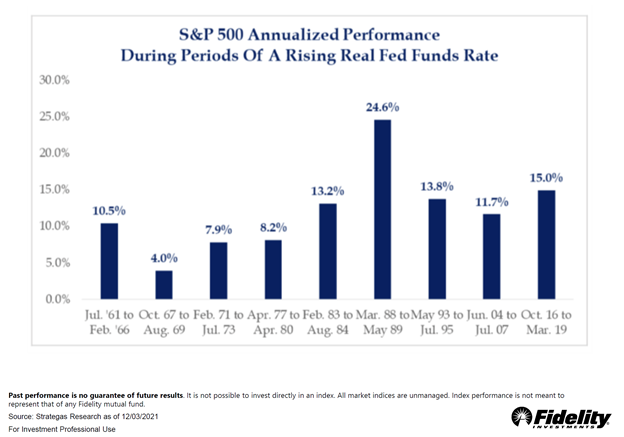

And even rising interest rates have not historically deterred strong market growth:

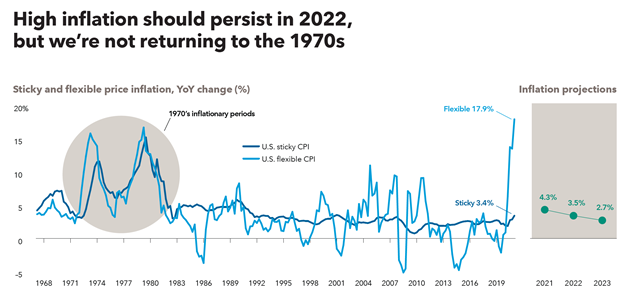

Inflation appears to be moderating:

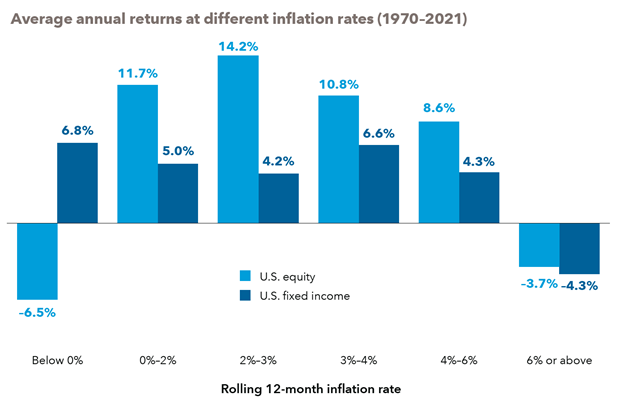

Against this backdrop, historically, both stocks and bonds have performed well in moderate inflationary environments:

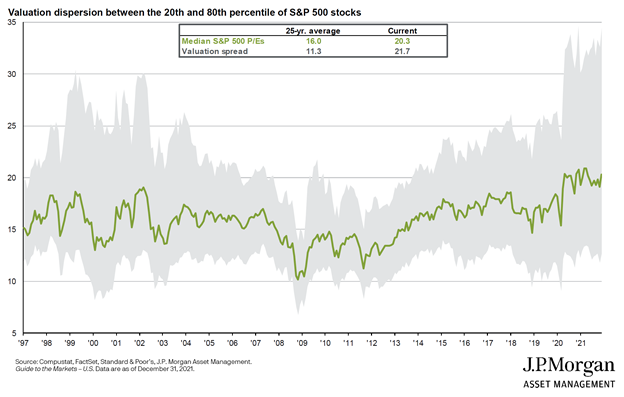

But, valuations between top performing stocks and worst performing stocks is very wide:

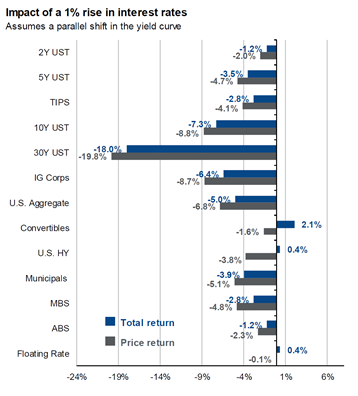

AND, not all bonds are created equal in the face of interest rate increases:

So, as we look to build a playbook for 2022, security selection across both stocks and bonds will be a key part of our strategy!