Tax Time?

As the calendar turns to 2022, many people immediately start to think about filing taxes. While it’s generally a good thing to avoid procrastination (which I try to tell myself all the time!), you must wait for a) the IRS to actually accept your return and b) your tax forms to get prepared. Believe it or not, the IRS does not even begin accepting returns until Monday, January 24th. So, if you do happen to have all your ducks in a row on January 1st (congratulations!), you still have to wait to file.

More commonly, you need to wait for banks, brokerage firms, and other investment companies to prepare the necessary forms you need to complete your return. For most custodians (aka holders of your money), those forms start to go out in mid-February. If you have online access to your account, you can access forms faster than waiting for them in the mail. However, we often recommend setting your tax forms to be mailed (vs. “paperless”), because we have had a few folks forget to include their 1099s when filing.

Key Dates:

- Monday, January 24th – the IRS begins accepting returns

- Late January to early February – very few 1099s will be issued – if you only hold individual stocks in your brokerage account, then you may receive your form early

- Mid-February – most 1099s start to get issued – for investment accounts, this will include information on capital gains, dividends, and interest – for retirement accounts, the 1099-R will include the amount withdrawn and the taxes withheld (if any)

- Monday, April 18th – this year, because Emancipation Day is being observed in the District of Columbia on Friday, April 15th, the next business day falls on Monday, April 18th

- October 17th, 2022 – filings are due for those that filed for extensions

Fun fact: Maine and Massachusetts get an extra day to file (April 19th), because Patriots’ Day is an official holiday. What a win for the procrastinators out there! We have already seen the headlines about refunds potentially being delayed this year, so you should request those to be deposited directly into your bank account to expedite processing.

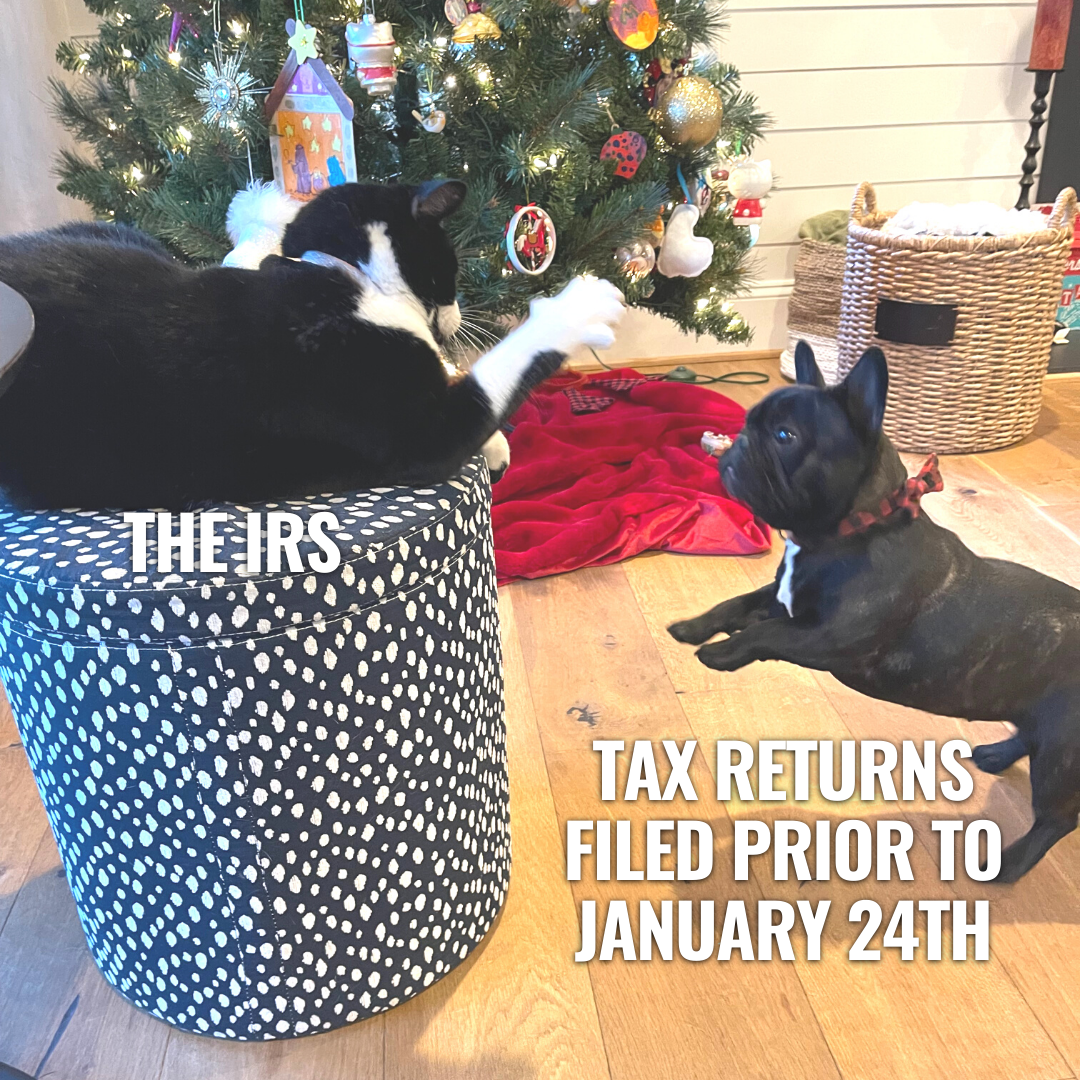

My hope is that no one needs to take advantage of the extra few days to file, but definitely don’t try to file before January 24th. Much like our cat Dexter when our dog Rosie attempts to play with him, you will get rejected!