Election Direction

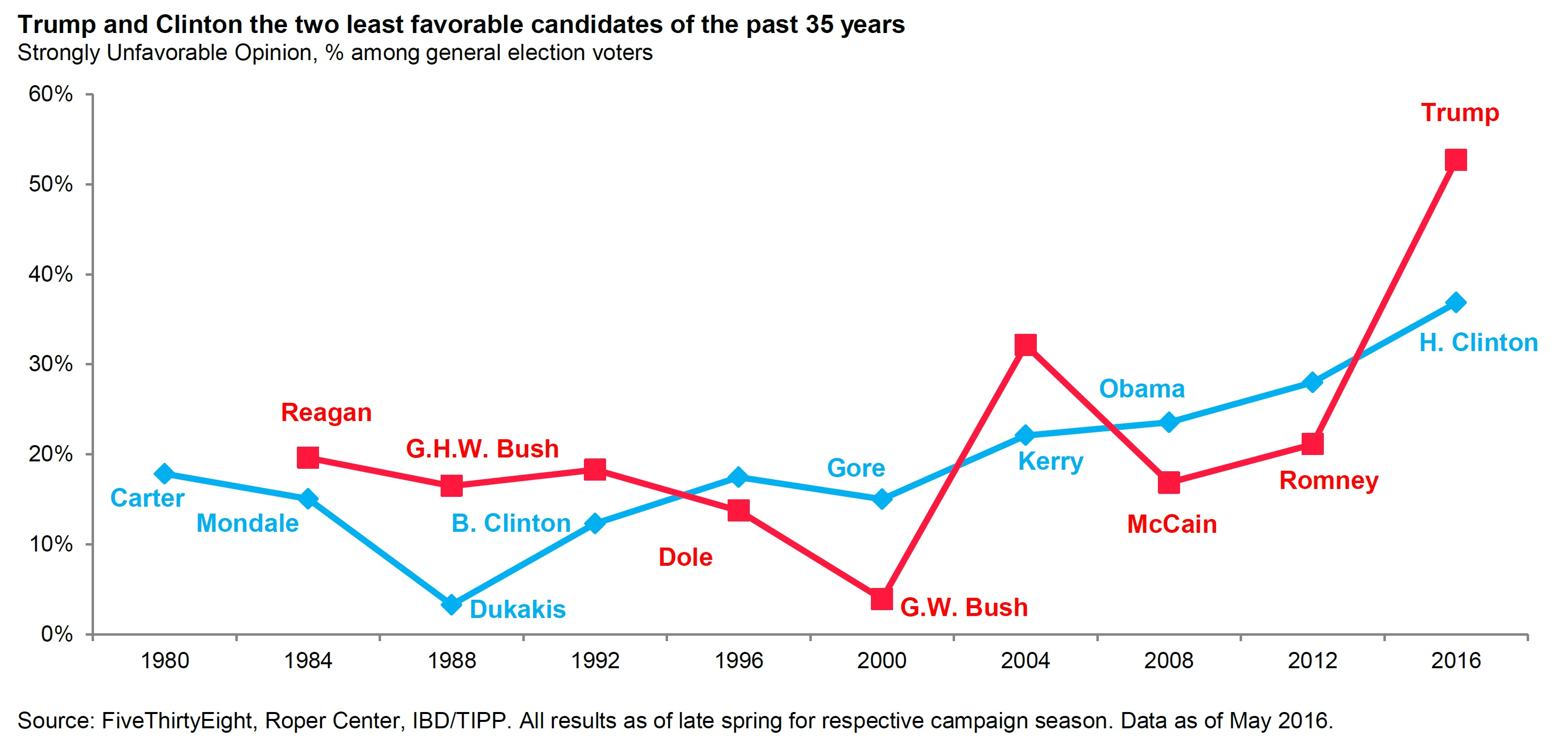

This year’s election stands as one of the most contentious with two of the most unpopular candidates in history.

While the campaigning is certainly providing plenty of material for late night talk show hosts, Saturday Night Live, and cable news channels, the impact of the winning candidate concerns many Americans. Many of our clients are concerned with what will happen to their investment and retirement accounts in the aftermath of this election. While we do not try to time short-term market swings, we do try to maintain an investment discipline that is both long-term in focus and attempts to limit downside risk. Viewed through that lens, what are we watching, analyzing, and positioning for? Here are a few of our thoughts:

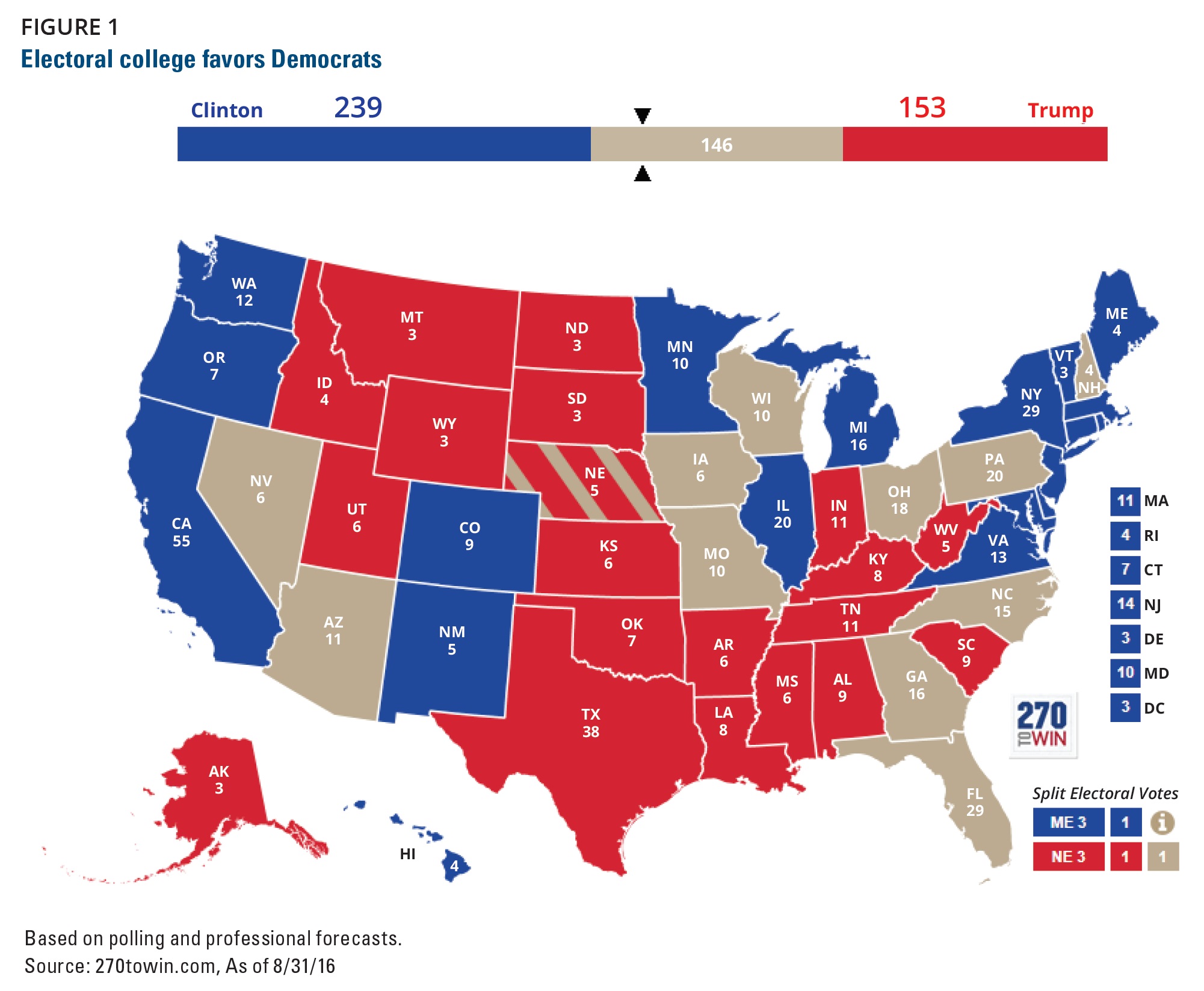

- The market is expecting Clinton to win

The electoral college demographics are such that Clinton has a better starting point on electoral college votes. Trump would have to convert nearly all undecided states to have a chance of winning.

(Source: Hartford Funds)

As the stock market does not like surprises nor does it like uncertainty, anything other than a Clinton win may cause extreme volatility and possibly an immediate sell off, much like what we saw in the aftermath of the surprising Brexit vote.

- Economic fundamentals and stock valuations drive long term market performance

Litman Gregory, one of our research partners, makes a strong point in a recent memo: “Over a full market cycle, returns are driven by fundamentals, not temporary shifts in investor sentiment, short-term momentum trading, flights to safety, or political rhetoric. While the U.S. economy could hardly be called robust, growth is positive, unemployment is down, and wages are up. Consumer spending is increasing, and confidence recently hit a 12-month high. None of these are likely to change overnight based on what happens in November. Yes, fiscal policy can impact all of them in the long-term, and there are important differences in the candidates’ policy stances, but presidents don’t get to decide these things in a vacuum. Without knowing which policy proposals will eventually be enacted, when, or how, making preemptive changes to portfolios is more likely to hurt than help.”

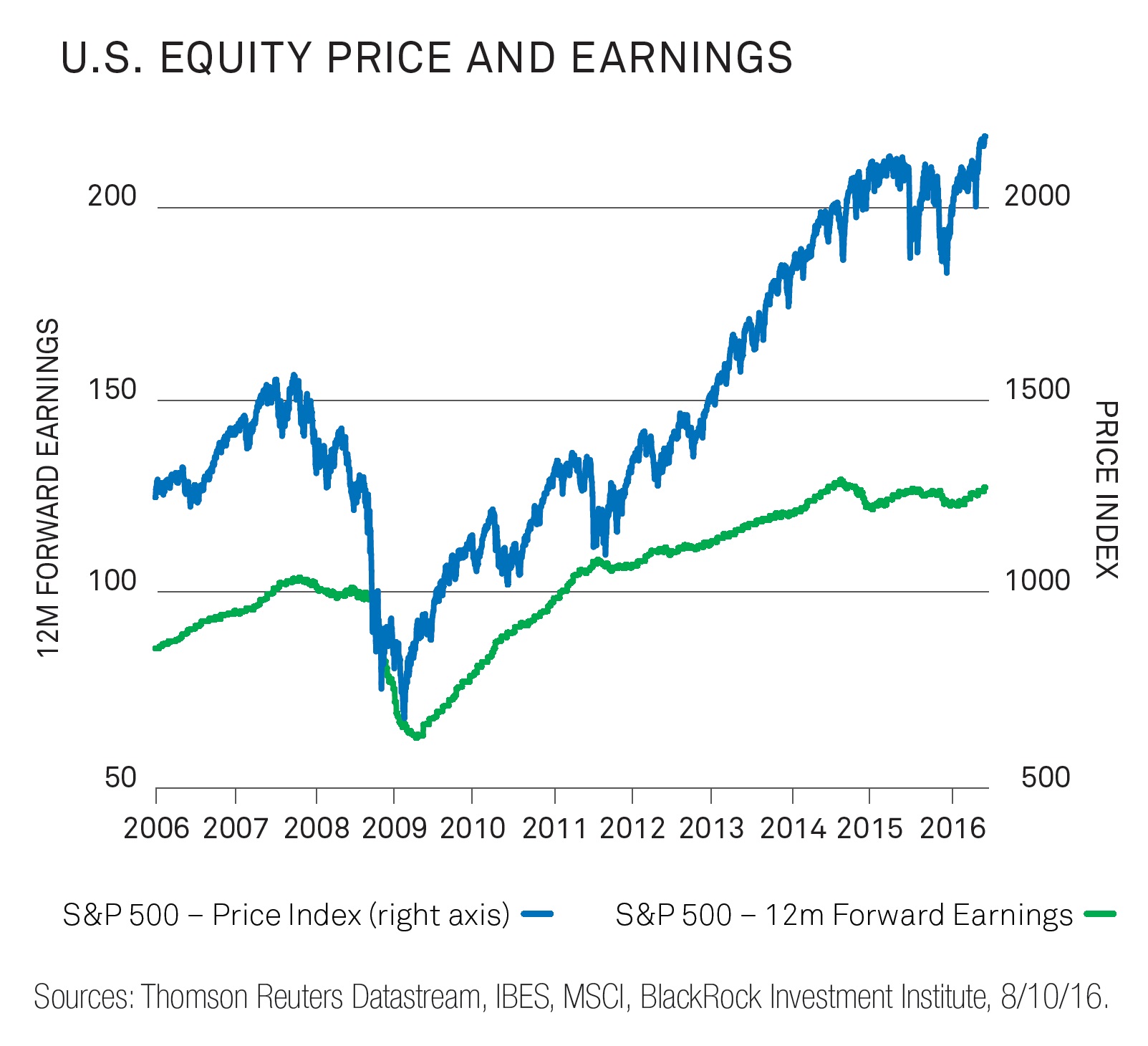

- Stock prices levitating past actual company earnings are concerning

While the debate rhetoric is certainly alarming, from an investment perspective, we are more concerned by the stock market rising way past the point that the actual company earnings support. Stock prices are meant to be a reflection of a company’s future potential earnings—since the beginning of 2014, the stock market has risen almost 18%, yet earnings have remained essentially flat. A potential correction back to the level that current corporate earnings actually support would be painful for most investors.

So, while the elections are grabbing the headlines and causing heartburn in most Americans; as investors, we attempt to tune out all of the noise and focus on the factors that matter. In the long run, constructing portfolios that are based on fundamentals, appropriately diversified, and positioned to minimize risk is more important than positioning around the direction of the election.