A Great Value

Shopping season is here—unless you are one of those super organized people who shop all year for Christmas and store up gifts in your hall closet, most of us spend December running around, looking for that special gift for those on our list, and hopefully finding a good deal as well. With the retailers tossing in all sorts of specials and discounts, even if a gift is expensive (like the Phantom 4 drone my husband wants), it may be worth it as the Christmas savings make the price a good value (unlike the Phantom 4 drone my husband wants).

In that spirit, Vanguard published the results of a recent study in which they attempted to quantify the value of working with a financial advisor. In studying the value of all that a good advisor can do for their clients, they conservatively estimate that an advisor is worth about 3% in net returns annually to a client.

In the event that you do not have the time or the interest to read their 25+ page report, here is how they arrived at that 3% figure:

- Building a suitable asset allocation that uses diversified investments (0%)—Interestingly, Vanguard could not find a way to calculate the value of a well thought out investment plan. They highlight how critical a smart asset allocation is in the paper, but because each portfolio is unique, the average value of diversifying and crafting a prudent asset allocation cannot be quanitified.

- Cost effective implementation (.4%)—Vanguard found that the average investor could save .28-.39% annually by moving to low cost funds. Additionally, this does not include the possible performance difference, as additional studies have shown that lower cost investments tend to outperform higher costing investments over time.

- Rebalancing the portfolio (.35%)—If a portfolio is not rebalanced regularly, it can “drift” and the investor is left with a much riskier portfolio than they originally set out to own. The goal of rebalancing is to minimize risk, and doing so can save money when the market declines.

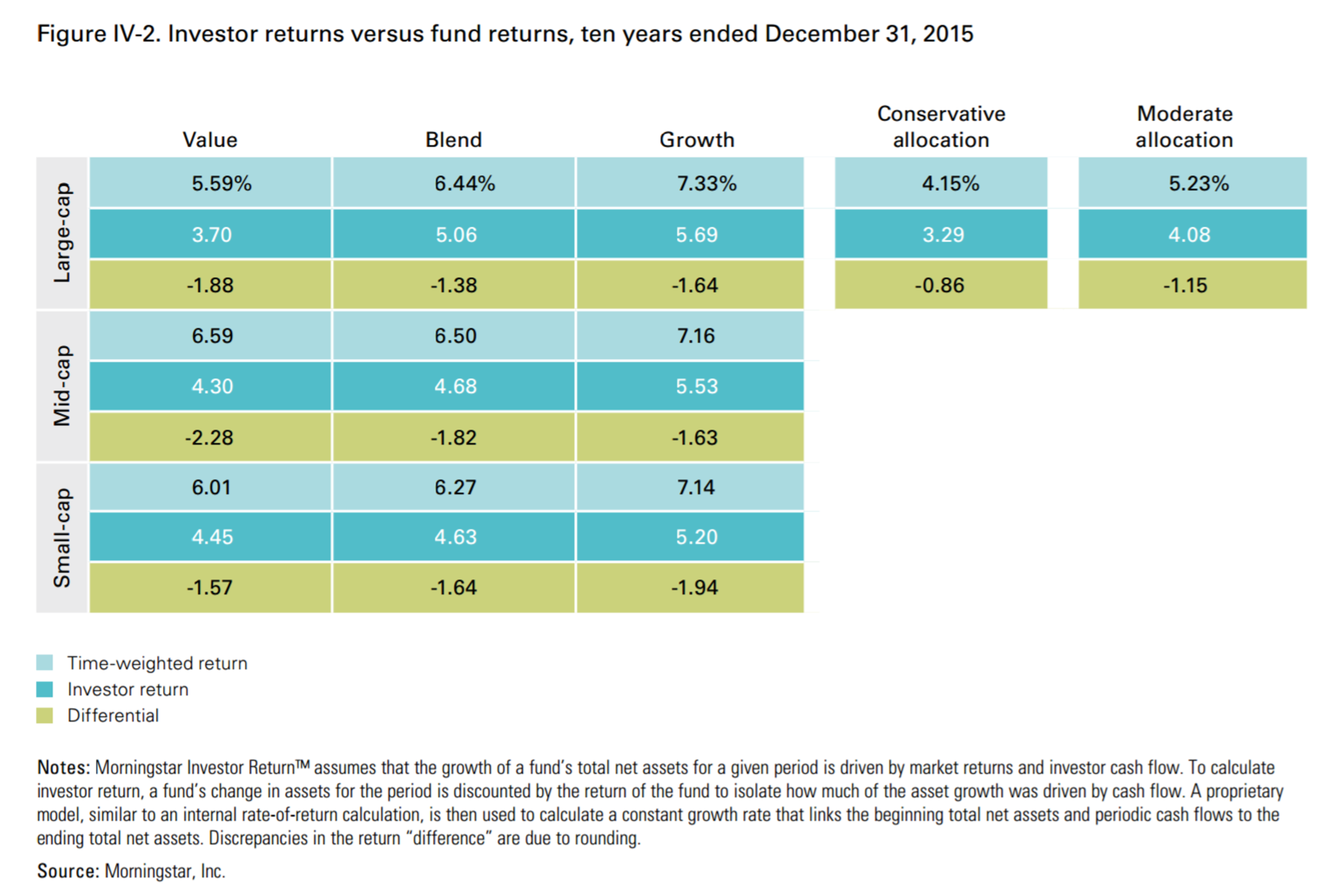

- Coaching (1.5%)–This is the highest value an advisor can provide, simply being a sounding board and an objective opinion when a client is worried or swept up in emotion. An advisor can help a client maintain their long-term perspective and a disciplined approach. Morningstar research also validates Vanguard’s findings here—Morningstar studied the returns published by mutual funds, and then the average investor return per funds (based on when investors bought and sold the fund). As it turns out, investors get excited and tend to buy funds that have performed well right before they underperform, and they tend to get worried and sell funds right before they recover. So, in the chart below, the published return for the funds is in the light blue boxes, split into large to small companies and value to growth companies. The investor return is in the dark blue box. You can see that investors tended to underperform the funds by 1.38-2.28% annually.

- Asset location (Up to .75%)—By strategically locating assets that cause higher taxes inside tax deferred accounts, advisors can save clients taxes and allow the portfolio compound and grow without the impact of taxes annually.

- Withdrawal strategies (Up to 1.1%)—Advisors who implement informed withdrawal order strategies can minimize the total taxes paid over the course of their client’s retirement. Deciding how much to withdraw, from which account, and when to draw are all important questions that an advisor can manage to optimize retirement spending for a client.

When these benefits are totaled, they average about 3% annually—given that the average advisor fee is about 1%, it seems like a pretty good value and a great Christmas deal!