This Holiday Season, Think of Yourself First

No, I am not advocating behavior that is the opposite of the spirit of the season. But, I am suggesting that you think of yourself first when it comes to planning for your retirement. As a parent of three children, the urge to do whatever I can for their future is very powerful. However, attempting to save for your child’s college education prior to properly mapping out a plan for your own retirement is a bad idea.

There are many options available to pay for college; via grants, loans, home equity lines of credit, etc. Or, (the horror!) you could have your child pay for or contribute toward his or her own college education. Obviously, there are no options to pay for retirement via grants and loans. As planners and investment managers, we have seen a sharp rise in clients that feel they are expected to pay for college. I don’t think this expectation is coming from the children, but it is instead coming from society at large.

Pensions have all but disappeared, so it is up to all of us to save for ourselves. I believe that social security will continue to exist in some form, but it is very likely that it won’t be an amount that is enough with which to live comfortably in retirement.

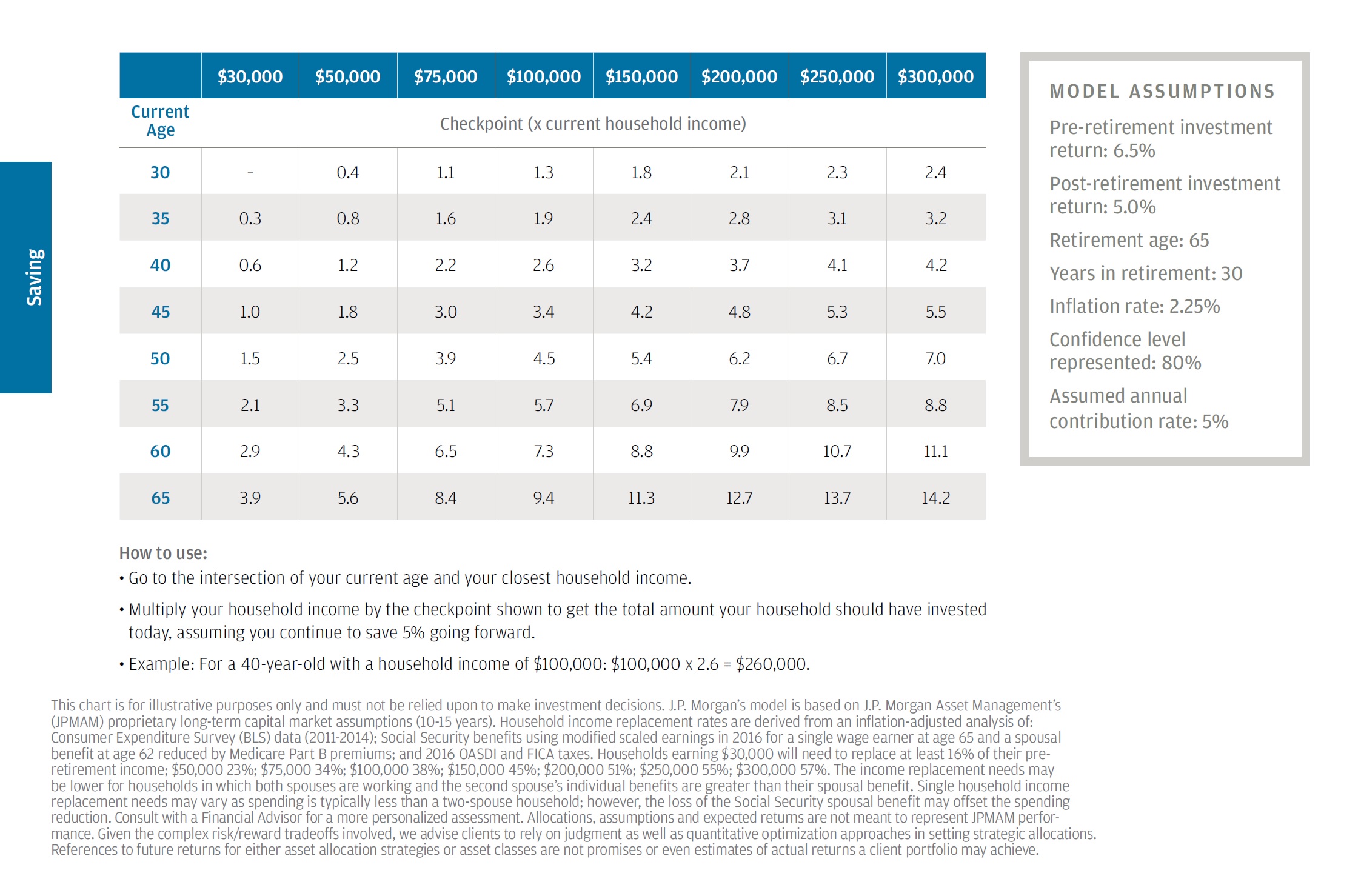

JP Morgan puts out a “Retirement Guide” each year, and this year’s is particularly interesting. There is a lot of great information in the 46 (!) slides, but one that we have found helpful is the Current Retirement Savings Checkpoints chart. It gives you the recommended amount of savings that you should have accumulated for retirement at a certain age. See below. (Click on the image to enlarge it).

If you are behind where you need to be, don’t panic! Figure out what options are available to you through your work plan first, then explore other options such as IRAs and ROTH IRAs that have tax advantages for saving for retirement. Putting money into your child’s college savings plan is always nice and feels good, but not saving enough for your retirement is hard to make up for as you age.

Merry Christmas to you and your families from your friends at Meridian Financial Partners!