Don’t Be a Waffler

When you’re an 8-year-old kid like my son Coleman, and you LOVE sports, it’s okay to be a waffler. He is willing to (and pretty much does!) try anything and everything that involves a ball, stick, glove, goal, hoop, etc. As a result, he has asked us to sign him up for several different leagues each season. While we as parents do try to encourage him, we try limit him to one activity at a time. Mostly because we don’t want to wear him out, but also because we can’t transport him to and fro every single weekday afternoon/evening. 😊

Most recently, he has been playing ice hockey and really seems to be enjoying it. However, after a play date with one of his buddies, he suddenly wanted to sign up for flag football. I wonder where he got that idea! Visions of not freezing my butt off in a hockey rink sprung to mind, and I was quickly on board as well. However, knowing Coleman the way I do, I asked him the age-old question, “Are you sure this is what you’d like to do?” And, the expected reply came, “YES, I am sure!”

Then, in the least surprising turn of events ever – after his next hockey practice; “Dad, I think I’d actually like to keep playing hockey in the spring, so I don’t forget all of the skills I’ve learned.” Very solid reasoning, but of course I had already signed him up for flag football. And, because of the “no refund policy” in the fine print of the football sign-up, we will be breaking our own rule and doing TWO sports in the spring. Maybe I can convince my wife to cover the hockey practices this go around…

An investor who is a waffler will often hurt his or her own returns in a significant manner; especially over the long term. Waffling between ‘staying in’ or ‘staying out’ of the market will almost certainly result in undue stress and poor investment performance. Both Sarah (my business partner) and I have said this many times in this space before, and we’ll say it again many more times: Ignore the noise, stick with your plan, and stay invested in YOUR appropriate mix of assets.

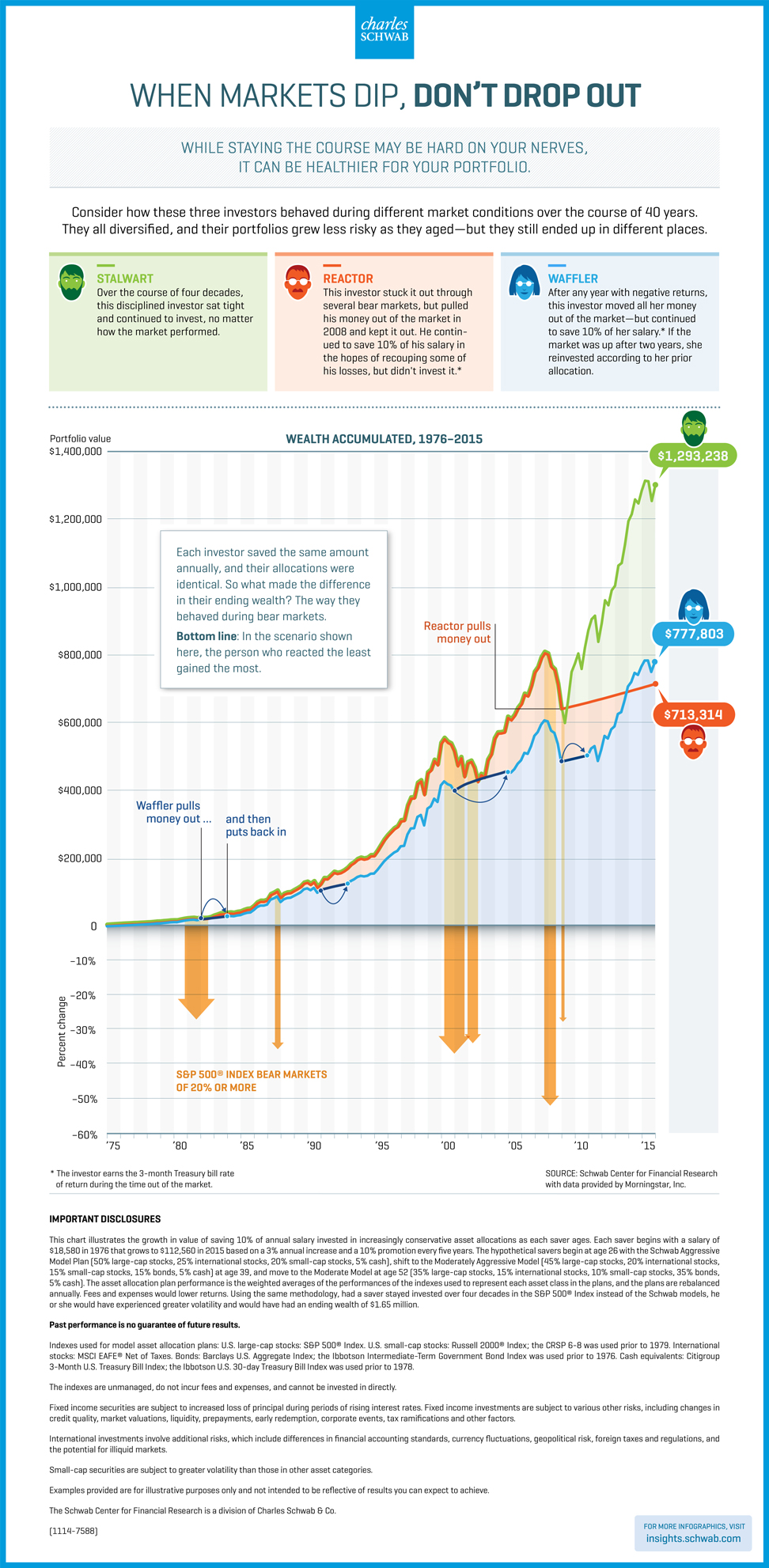

Charles Schwab’s Center for Financial Research puts out some great material on market volatility and what to do about it. In a recent commentary, they outlined the following: “Resist the urge to sell based solely on recent market movements. Selling stocks when markets drop can make temporary losses permanent. Staying the course, while difficult emotionally, may be healthier for your portfolio. This doesn’t mean you should hold on blindly, but we suggest taking into account an investment’s future prospects and the role it plays in your portfolio, rather than being guided by noise and fear.” There is also a great infographic that I will attempt to post here, but it can also be found via this link for easier reading: https://www.schwab.com/resource-center/insights/content/when-markets-dip-dont-drop-out.

When Markets Dip, Don’t Drop Out explains the hypothetical returns of three types of investors throughout a 40-year market history. The graphic was created in 2016, but the information and results still resonate today. Not surprisingly, the “Stalwart” that stayed invested through thick and thin, enjoyed significantly better results.

So, unless you are an 8-year-old deciding on which sport to play, don’t be a waffler!