A Slippery Slope

Each time I write these posts, it’s tempting to talk about diversification every time. Especially in the current volatile market environment. While I won’t totally give into that temptation this time, I do think it’s good to talk about the somewhat boring topic of bonds. They’re only boring until they’re helping to smooth out some of the bumps that the stock market inevitably brings.

There are many variations of bonds, but almost every bond pays a fixed interest rate that can not only provide a predictable stream of income, but also a fairly predictable growth rate. When interest rates go up, the prices of existing bonds fall (interest rate risk). However, the important thing to remember about bonds is that as long as the issuer doesn’t default (go out of business), the investor will receive the face value of the bond at maturity.

Usually (I emphasize usually), when stocks perform poorly, there will be a flight to safety in the form of investors buying more conservative assets. Often, this means existing bond prices will go up (even in a rising rate environment), because investors are willing to pay more for the privilege of receiving a fixed interest payment.

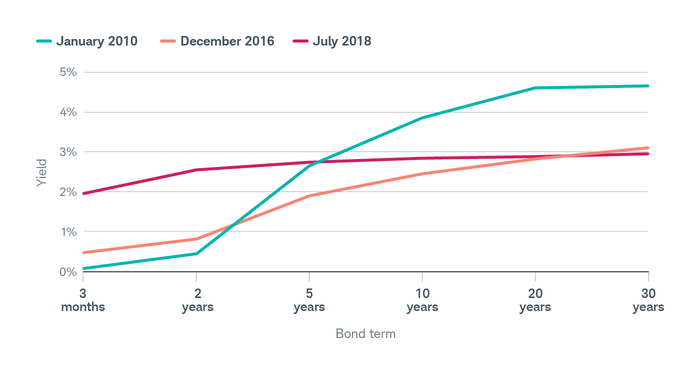

Recently, there has been a lot of talk about an impending inverted yield curve and the potential for a recession. An inverted yield curve occurs when short-term rates are higher than long-term rates. We aren’t there yet, but as you can see from the chart below, we are getting closer.

The yield curve flattens as the gap between short- and long-term rates narrows.

As mentioned in a recent Charles Schwab article from Kathy Jones with the Schwab Center for Financial Research: “Although the Treasury yield curve has flattened considerably during the past eight years, it hasn’t inverted…even if that does occur, it doesn’t automatically augur a recession. In fact, the yield curve has sent a number of false signals – most recently in June 1998, when no recession came to pass despite the curve’s brief inversion.”

So, much like a dip in the stock market should not mean panicked selling, nor should a period of rising rates mean abandoning your bond portfolio. In fact, bonds historically not only recover after downturns in prices, but they do so far more quickly than stocks.

Here’s hoping our next road to recovery is more predictable than the recent snowstorm we received on November 15th!

Nathan