Spring Forecast

Spring in Virginia is here—which usually means wildly unpredictable weather…and pollen…lots and lots of pollen:

As weathermen attempt precise and accurate forecasts, daily things change—determining the weather more than 7 days out is an exercise in futility, with only about half of 10 day forecasts being close to accurate. However, in Virginia, it is a pretty good bet that we’ll get one last dump of snow in February/March and that August will be “Hell’s Front Porch”…

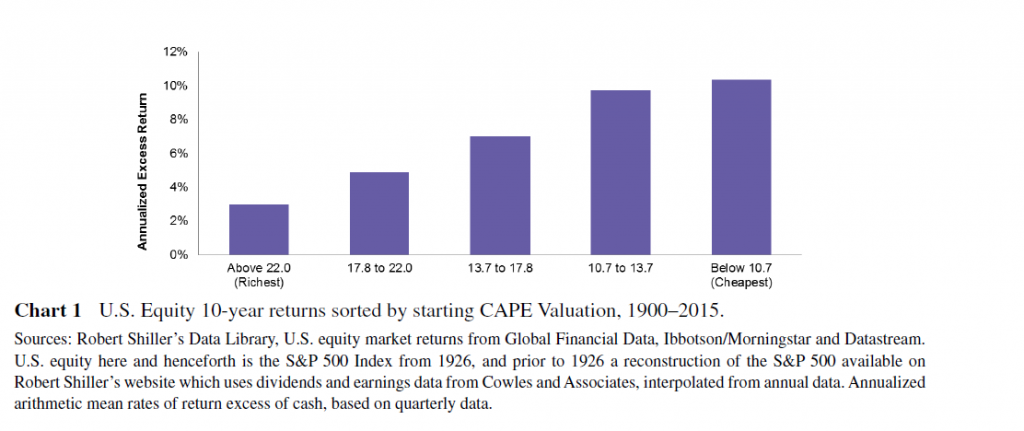

Likewise, the stock market is difficult to predict with any accuracy even in a one day forecast. However, generally, the starting valuation of stocks determines their general return a decade later. The higher stock valuations are currently, the lower the returns usually are in the next 10 year. As research from investment firm AQR shows, when stocks are purchased at lower valuations (as measured by their 10 year price to earnings ratio), the average excess return over cash returns is much higher than when stocks are purchased at higher valuations:

And this inherently makes sense—the more of a discount you get when you buy an asset, the better chance you have of gaining money when you sell it. If you overpay for something (a car, a house, a stock), then it is much more difficult to sell that asset later at a high profit than if you had gotten a great deal on the purchase.

Currently, the 10 year price to earnings ratio for the stock market is sitting around 30, simply indicating that returns of the stock market generally may be lower than in the past decade.

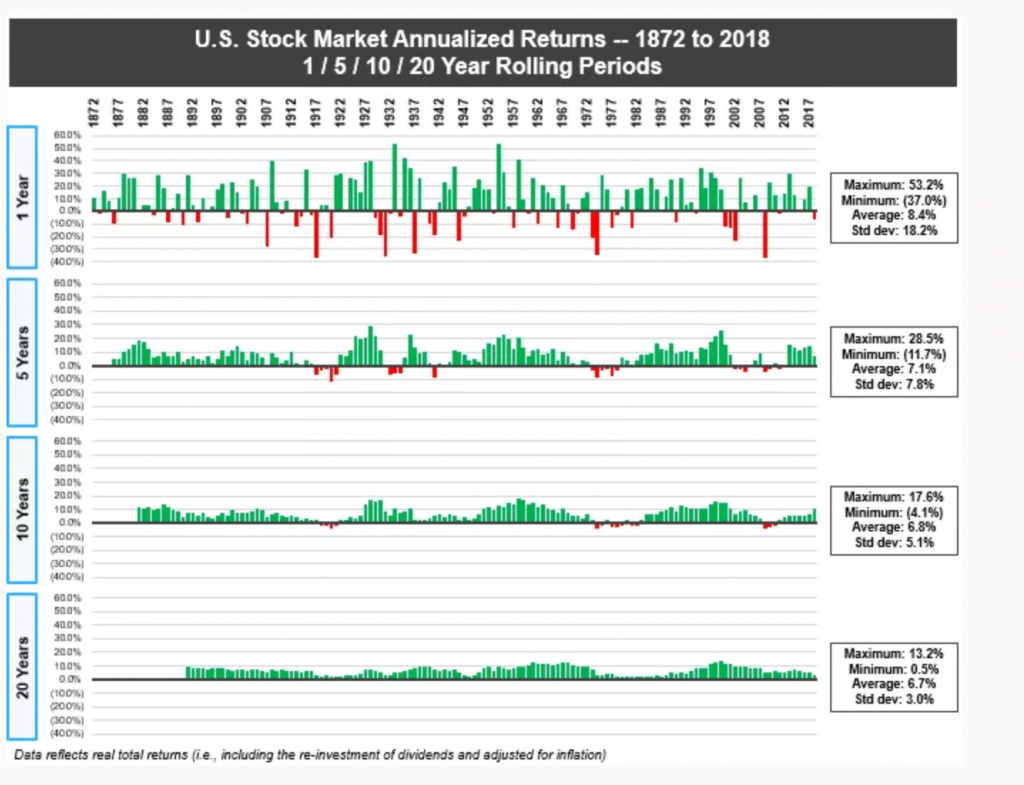

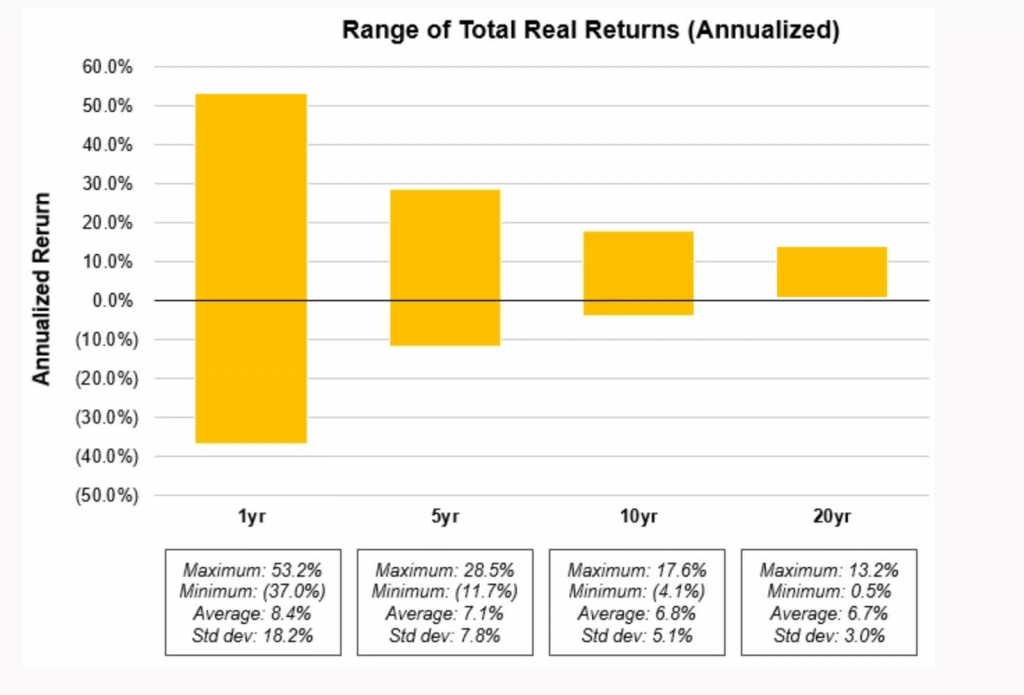

However, these projected potential low returns should not discourage investors. Over long periods of time, the stock market has provided generous returns for those willing to stay invested. As this cool chart from Measure of a Plan shows, the longer an investor’s time horizon, the strongest a chance of positive stock market returns:

You can see this chart animated at Visual Capitalist. The one year market returns are hard to forecast, and vary wildly (between -37% and 53%…yikes!). But the longer the time frame—like a 20 year time horizon—the more narrow the range of outcomes (.5% to 13%) and more “predictable” in nature they become.

So, enjoy the sunshine today—eventually we’ll get to “Actual Spring” on the list of Virginia’s 12 seasons—and stay invested despite the short term forecasts~

Milo certainly is loving the cool air and warm sun!