Investing Lessons from Gold Cup

This weekend was the 94th running of the Virginia Gold Cup. Our Meridian family had a spot and enjoyed visiting with each other and friends. While Gold Cup is a little challenging when we bring our children (and it is unexpectedly a million degrees and full sun), it is a favorite event of my husband.

Jonathan enjoys the betting. Me, not so much. At Meridian, we do nothing but measure and account for risk…avoiding unnecessary risk taking. Jonathan is unhindered by the odds… exhibiting several cognitive biases…

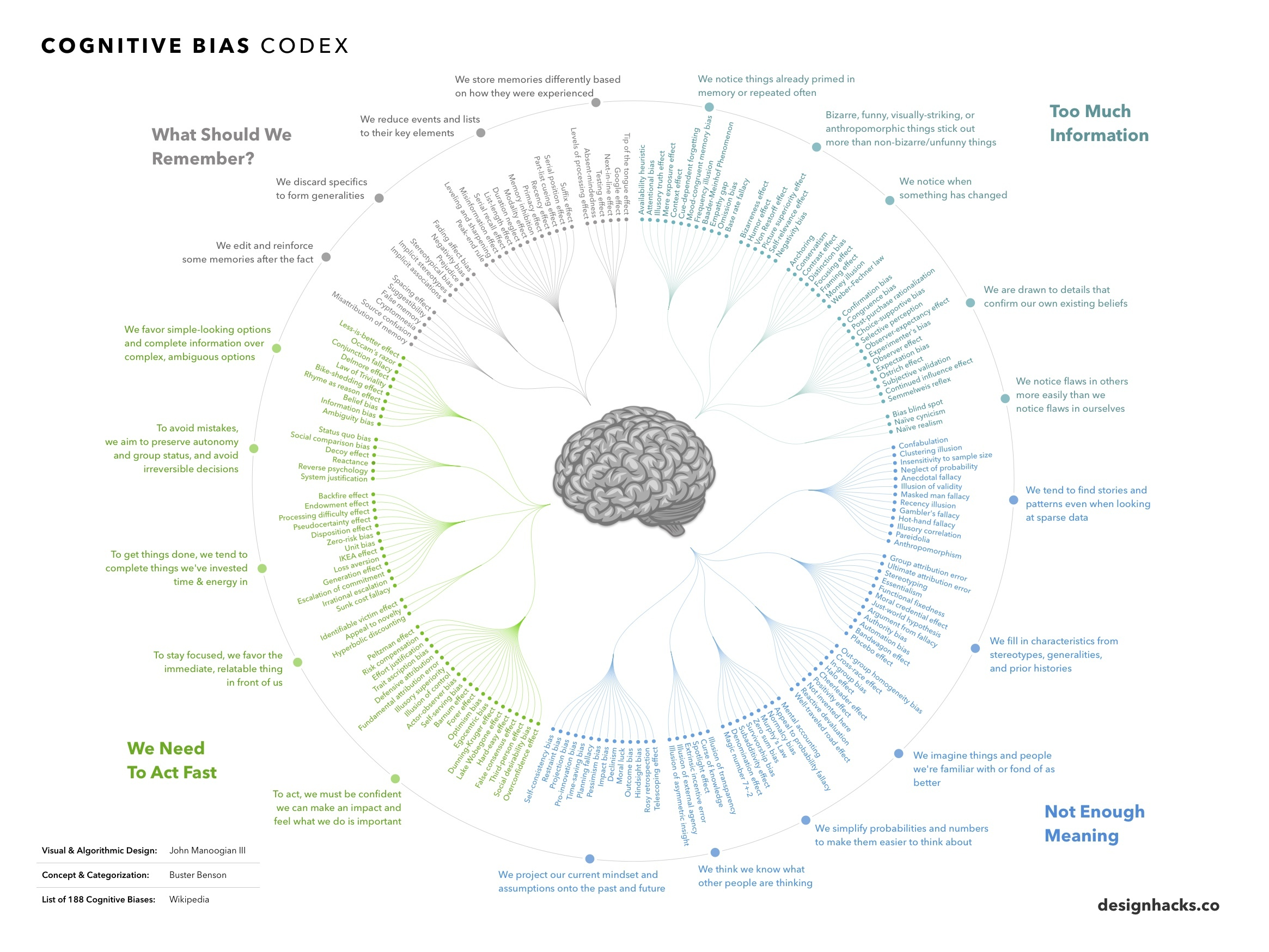

Cognitive biases are ‘shortcuts’ that our brain uses to process information quickly, find meaning, and decide what information to store. Ordinarily, they are good things, but in financial events, they can work against us. For example:

- Overconfidence – the tendency to be more confident in your abilities than your actual skill suggests.

- Sunk cost fallacy – once you already have money into something, you keep spending, thinking the tide will turn. The more you invest, the harder it is to stop.

- Optimism bias – you over estimate the probability of positive outcomes.

There are actually over 100 cognitive biases that influence our decision making ability.

https://www.visualcapitalist.com/wp-content/uploads/2017/09/cognitive-bias-infographic.html

My favorite one from Gold Cup was Jonathan’s clear demonstration of selection bias (or selective memory). Our brains are hard coded to selectively remember what we enjoyed or desired outcomes, more than those that were negative or unpleasant. So, wins are more memorable than losses.

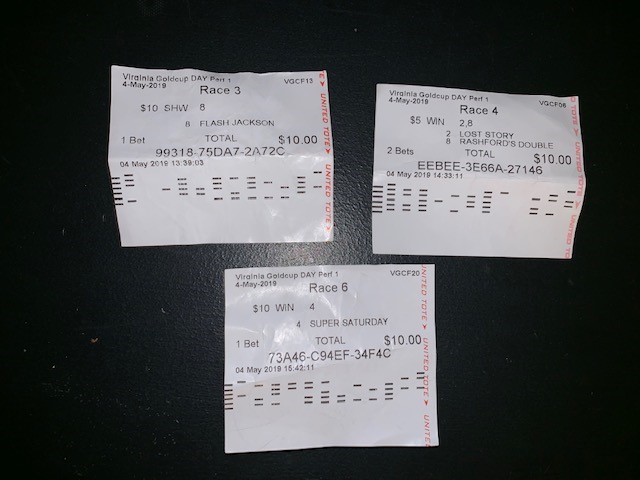

Jonathan did pick the winner of the 5th race…so, if you ask him how the day went, he’ll tell you he won $14. Which is technically true—he did win $14…on that race. Here are the other tickets that didn’t work out so well for him:

Given that he had $5 on the race he won, he actually spent $35 to win $14. Not a resounding win, but the losses are unmemorable, so selective recall deletes them!

Investors suffer from the same cognitive biases…overconfidence, optimism, selective memory. Everyone likes to share their best stock ideas—the ones that they doubled their money on—but no one really likes to share how many of their stock picks were real stinkers.

One way to defeat selection bias is to keep a journal of stock picks, with results. Or, just build a prudent, low cost portfolio and let it grow without constant meddling! If you need help doing so, just let us know!!