Get What You Pay For

As you might expect, many of our clients participate in their workplace retirement plans. As part of our services, we assist in advising them on what investments to select within each plan. The goal is to make sure the investments in their retirement plans are “playing nicely” with the assets that we are handling for them. For example, a workplace retirement plan might not have an option to invest in a small cap international equity fund, so we can put a little more in that bucket with the assets we are managing. Or, maybe the workplace plan has a large allocation toward large US companies, so we would reduce investments in that sector.

Depending on the plan offerings, selecting the right investments can be overwhelming if there are too many options and/or the participant doesn’t even know what they’re looking at. I would argue that this is the case for most workers. If you are new to the workforce, it is often the case that your work plan (401k, 403b, 457, or some other confusing number) is your largest asset and maybe even the only one that’s invested in the markets. So, you may not even have access to an advisor at this point in your life.

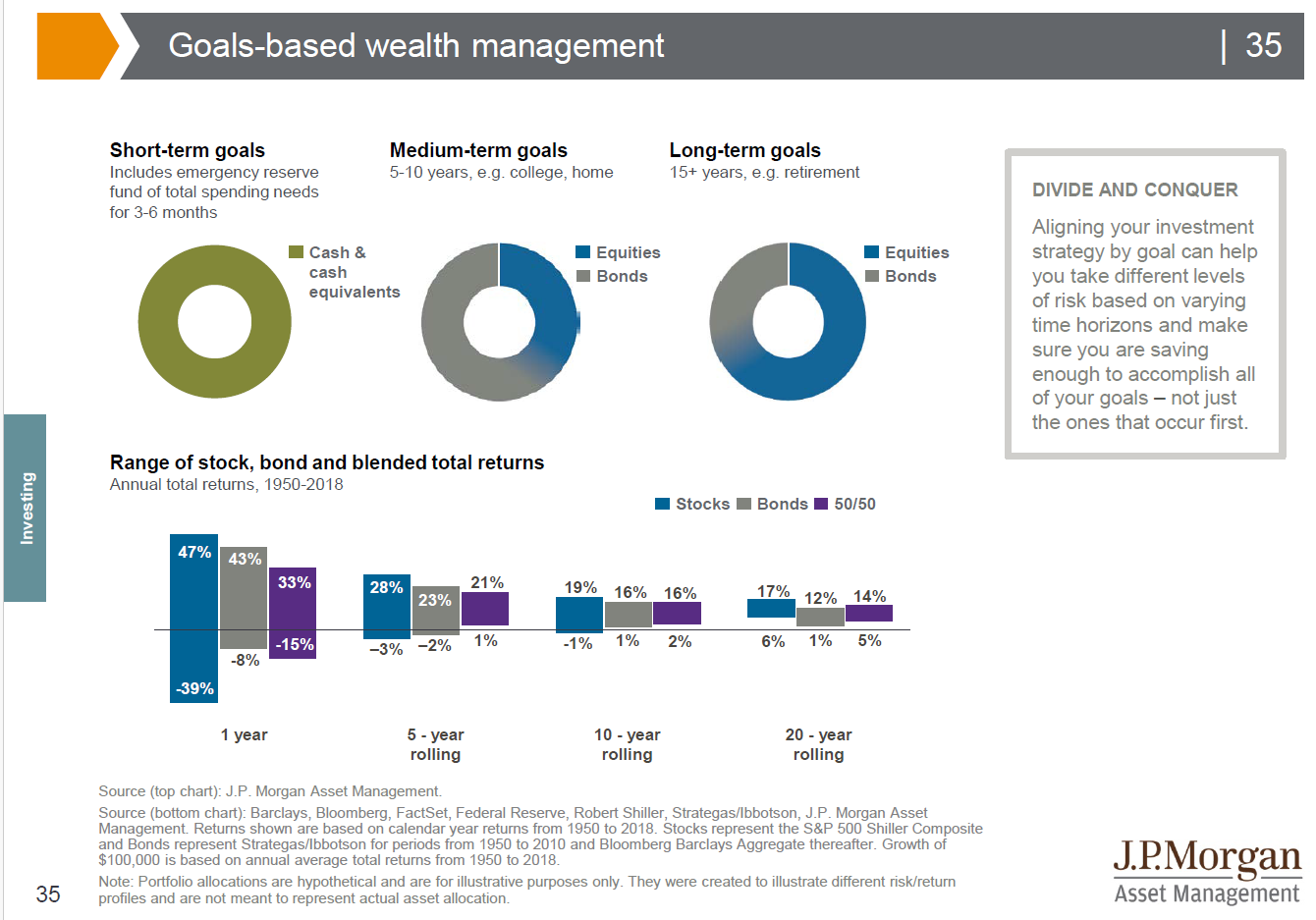

The end goal is to make sure your investment mix is right for your time horizon and needs. In short, the longer you have until you are going to use the money, the more aggressive you should be and vice versa. The chart from JP Morgan (below) gives a good example of different investment mixes and their outcomes over time:

So, where can you turn? In short, start with your Human Resources (HR) area. They will (or should) introduce you to someone with the company that is helping to run your plan (think Fidelity, Vanguard, Principal, etc.). Most larger plans have assigned representatives that are available to help with a specific plan and are familiar with the investment options available. Either your company or you the participant are paying these folks to do this already, but I think their services are vastly underutilized. I believe it’s because people are intimidated, ashamed of what they don’t know, or don’t even know these representatives are available to them. So, take advantage of what you’re already paying for!

Via our taxes, my wife and I are already paying for our children’s education. We have been very happy with their school, and all of the teachers and administrators have been great. One of the things that I try to take advantage of at least once per year is the WATCH D.O.G.S. program. D.O.G.S. stands for Dads of Great Students, and it’s a nationwide program that attempts to get more dads/step-dads/granddads/other male role models involved. Last week, I visited my two oldest.

Lyla and I in the cafeteria.

Coleman getting bunny ears from his buddy

The responsibilities are few, but it is a fun (yet exhausting!) day. Essentially, you visit several different classrooms and assist students with reading assignments or other projects they might be working on. I also received more high-fives (or maybe low-fives since it is elementary school) than at any time in my life!