Better Late Than Never…

Sorry for the delayed blog post (we usually post on Tuesdays), but we’ve been at the Wealth/Stack conference in Arizona and have been totally occupied. Wealth/Stack has been a great conference to hear where the future of financial advice and investment management is heading. In two very compressed and full days, Nathan and I heard sessions on cryptocurrency, artificial intelligence, cannabis, cyber security, robo investing, and all sorts of new technologies to help our clients get financially organized and make their lives simpler.

One of the bigger and hotly debated sessions was on the future of financial advice with the new fiduciary rule passed by the SEC that is set to go into effect in June 2020. The rule—called Regulation Best Interest (Reg BI for short)–is a hot mess and, as passed, dramatically waters down the duties that brokers owe their clients when providing financial advice.

As a quick refresher, there are three main standards of care that can apply to a financial advisor. The first is the lowest—Caveat Emptor or ‘Buyer Beware’. This standard of care presumes no duty to act in the customer’s best interest in any way…and it is assumed that the salesperson is most likely only operating in their own best interest. This is the category for unveiled salesmen—these are the folks that you know are trying to sell you a product or service and it is up to you to do your own due diligence on their product.

The next standard of care is the suitability standard. Under this legal standard, a broker would have the duty to only recommend products that are suitable to a customer based on the customers situation (i.e. age, income, goals). This standard does not mean that the broker must recommend products that are in the customer’s best interests, just that the product could work for the generic customer profile. Under this standard, the broker can recommend products that are substandard, high cost, poor performing, proprietary, etc. IF the product type is suitable for the customer. Conflicts of interest are inherent in this standard, as often the broker is compensated by the product, direct incentivizing them to sell it.

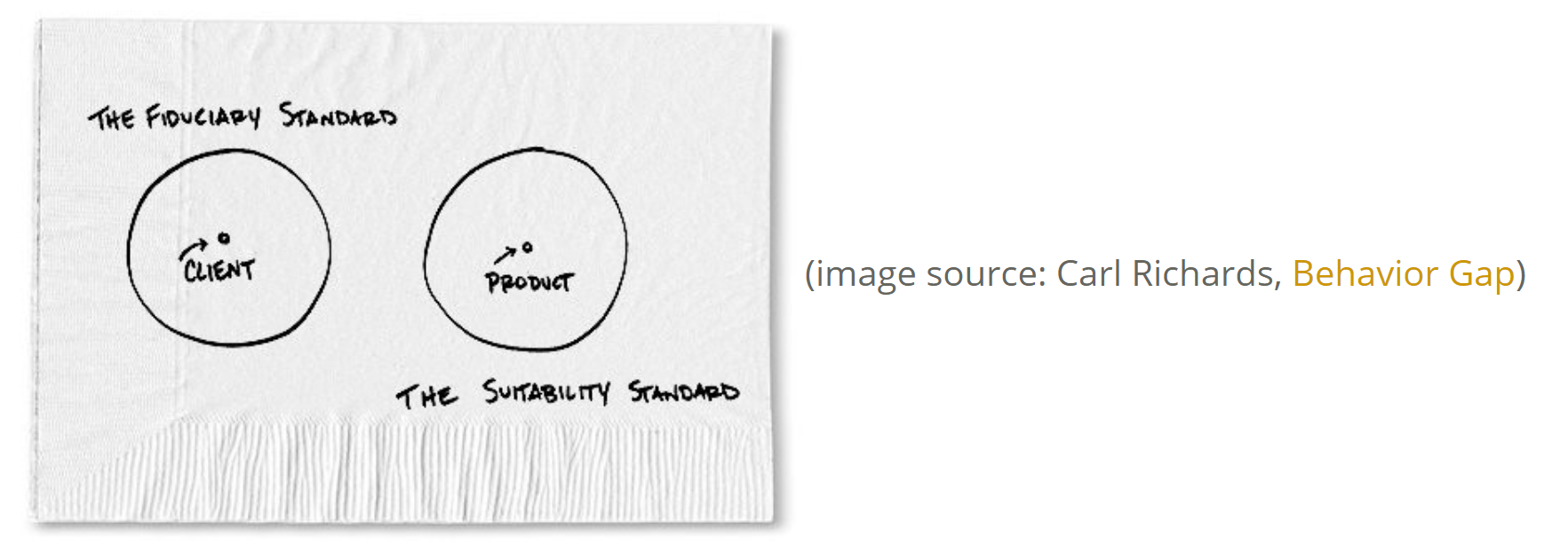

The final standard of care is the fiduciary standard—under this standard, an advisor has the obligation to act in their clients’ best interests at all times, putting the needs of the client above their own. Carl Richards of Behavior Gap demonstrates the difference between the fiduciary standard and suitability standard so perfectly in this simple image:

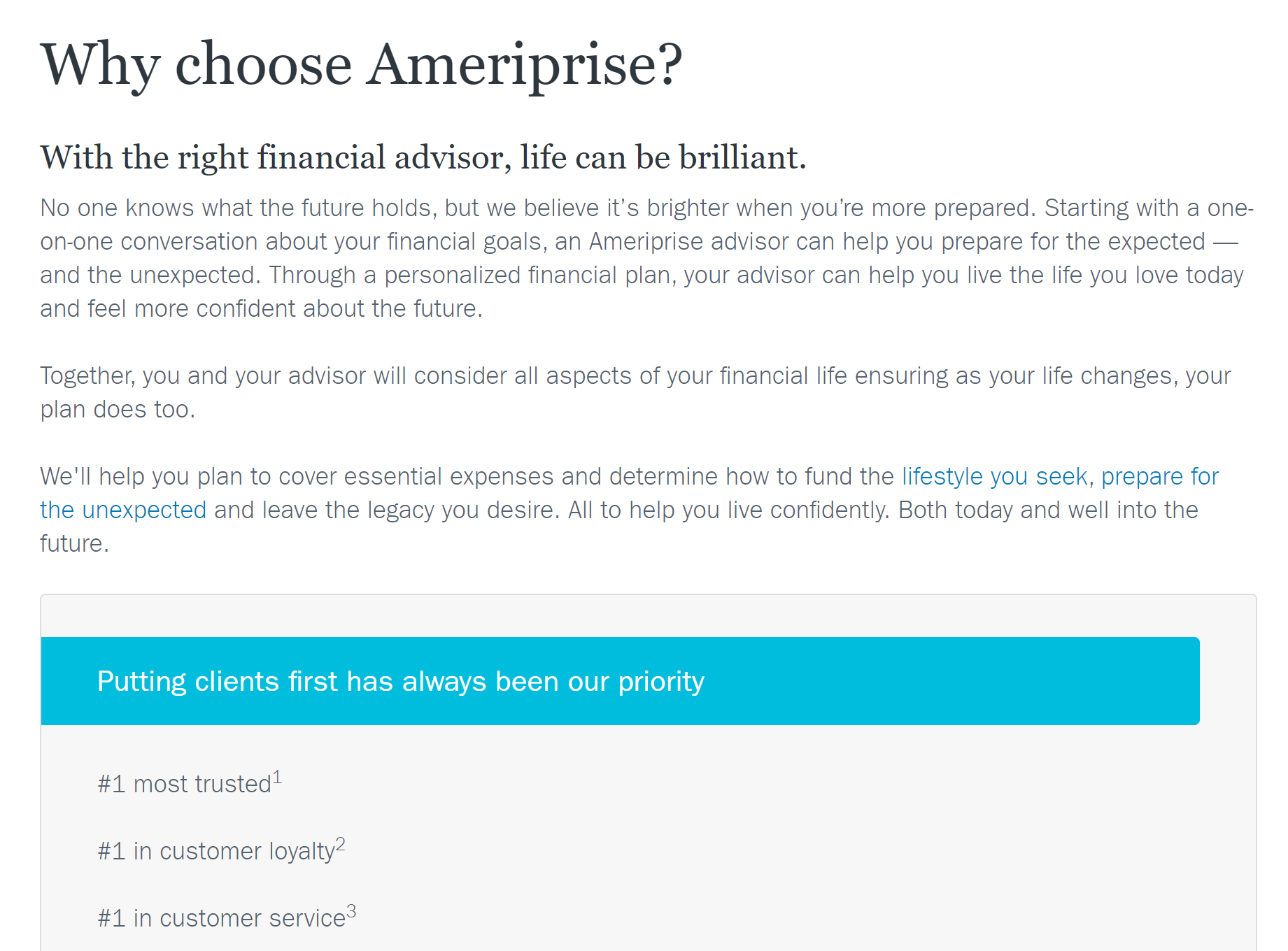

For decades, investor protection groups have lobbied to make the distinction between brokers (suitability standard) and advisors (fiduciary standard) clear to investors. Brokers label themselves as financial advisors, wealth managers, financial planners, etc. and their websites market their whole life planning services, making them virtually indistinguishable from fiduciary investment advisors, yet they are held to a much lower duty of care! It can be remarkable difficult to know what you are getting:

For example, this from Ameriprise:

But, when you try to find out how advisors are compensated, you are directed to a 47 page document that lays out finally tells you that your advisor is actually a broker who can sell you over 25 different products and can be compensated over 10 different ways!!

So, the problem with Regulation Best Interest is that instead of requiring brokers under the suitability standard to clearly label themselves as such, or bar them from using titles and language that imply a deeper standard of care, the SEC went in the complete opposite direction. Reg BI allows brokers to continue to operating as normal, working on commission, with conflicts of interest…they just have to disclose the conflicts to the customer on a long, legal form. If they offer financial planning, those services will be exempt from regulation under Reg BI—in other words, there will be no requirement for a broker to act in a client’s best interest when providing them long term financial advice!

Barbara Roper, Director of Investor Protection at the Consumer Federation of America, said:

“The SEC just handed the brokerage industry its dream standard – one that lets them market themselves as acting in customers’ best interest without actually requiring them to do so. Having spent millions on lobbying and in court to achieve that goal, they won’t give it up easily.”

But, the brokerage industry may have to keep on fighting to keep it that way…on Monday, eight states filed lawsuits against the SEC over Reg BI, stating that Reg BI “undermines critical consumer protections for retail investors, increases confusion about the standards of conduct that apply when investors receive recommendations and advice from broker-dealers or investment advisers, makes it easier for brokers to market themselves as trusted advisers (while nonetheless permitting them to engage in harmful conflicts of interest that siphon investors’ hard-earned savings), and contradicts Congress’s express direction.” New York Attorney General, Letitia James issued a statement saying: “With this rule, the SEC is choosing Wall Street over Main Street. Instead of adopting the investor protections of Dodd-Frank, this watered-down rule puts brokers first. The SEC is now promulgating a rule that fails to address the confusion felt by consumers and fails to remedy the conflicting advice that motivated Congress to act in the first place.”

The bottom line for us at Meridian is that we are Fiduciaries—with a capital F. We founded Meridian on the principle that anyone seeking financial advice should work with an advisor that has a duty to work in the client’s best interest alone. We take that obligation to safeguard our client’s best interests seriously and are humbled to be able to serve over 320 families and organizations in that way.

So, ultimately Reg BI doesn’t impact Meridian and our willing embrace of the fiduciary duty—it just means it will be harder to distinguish us from the rest of the brokers who only pay lip service to working in a client’s best interest. We only hope that one day, the SEC, Congress, and the State regulations can help make the distinction clearer…