The Best Things In Life Are Free, Plus Tax

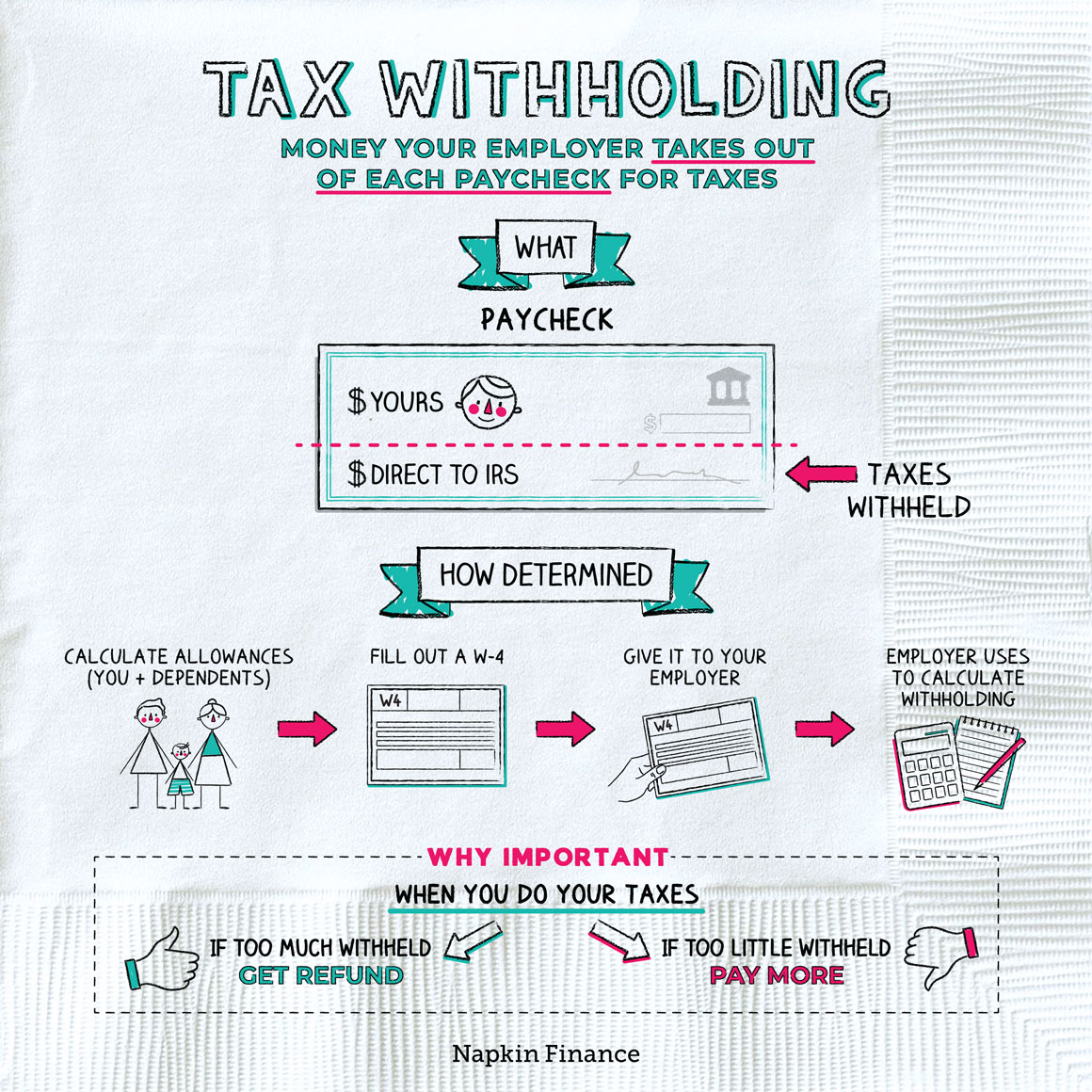

This tax season has been really complicated due to all of the pandemic-related policy changes. But some people are being surprised by tax bills for a very simple reason: They aren’t having enough money withheld from their paychecks throughout the year.

If you’re a W-2 employee, your company should withhold a certain amount of money from each paycheck and pay federal and state taxes on your behalf. In most cases, employees get to decide how much money is withheld. It’s important to have the right amount of money withheld to avoid owing a penalty when you file your taxes.

You will also want to update your withholding as tax policy changes. For example, the tax reform measures that took effect in 2018 removed the personal exemption, which had allowed filers to subtract a certain amount from their taxable income for themselves as well as each dependent. As a result, your taxable income may have increased even if your salary didn’t change.

If you want to avoid a large tax bill, you may need to change your withholding. The IRS recommends updating it early in the year for changes in your life, such as marriage, divorce, working a second job, running a side business or receiving any other income without withholding can affect the amount of tax you owe. And if you work as an employee, you don’t have to make estimated tax payments if you have more tax withheld from your paycheck. This may be a convenient option if you also have a side job or a part-time business.

To figure out how much you should have withheld from each paycheck to avoid a tax bill, try out this helpful tool from the IRS. Compare the result to a pay stub to see if you’re having enough withheld.

If not, updating your withholdings should only take a few minutes using your company benefits portal. And if you’re not sure how to change this, talk to human resources. You can update your W-4 anytime you need to adjust your withholdings. A few minutes now could save you a lot of stress during the 2021 tax season!