Risk vs. Return (or Cute vs. Stinky)

As investment managers, we are constantly trying to walk the line between risk and return. And, more importantly, we are trying to find the right mix for our clients’ particular situation. Typically, the more risk you take, the more return you can expect over time. It’s a fairly simple concept, but it can be difficult to explain what that means to your investment portfolio.

As mentioned in previous posts, clients are asking us why their investment aren’t going up as much as the S&P 500 or some similar all-one-type-of-stock index. And, the reason is that as prudent investors, we are never going to be invested in all one type of company stock or one geographical location (i.e. all US).

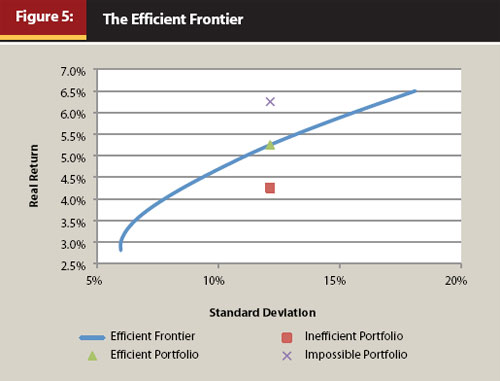

Many investment managers adhere to what is called Modern Portfolio Theory (MPT), which was first published in 1952 in the Journal of Finance by Harry Markowitz. The theory introduced many types statistical analysis that related to risk and return. One of the core principals of the theory is the Efficient Frontier. It is a graphical representation of potential investment outcomes, and it also gives an investor the “optimal portfolio” for his or her risk/return appetite. See below:

Source: Journal of Financial Planning

Think of Standard Deviation as a fancy term for ‘risk.’ The higher the number, the more volatility (ups and downs) you can expect. If you want low risk, you must be willing to accept a lower return. If you want high returns, you must be willing to expect more ups and downs. I have come to call them “heartburn moments.”

An Efficient Portfolio will fall somewhere on that frontier (blue line on chart above), depending on an investors desired outcome. An Inefficient Portfolio will fall below the frontier line and is undesirable. Finding an investment mix that lives consistently above the Efficient Frontier is considered impossible.

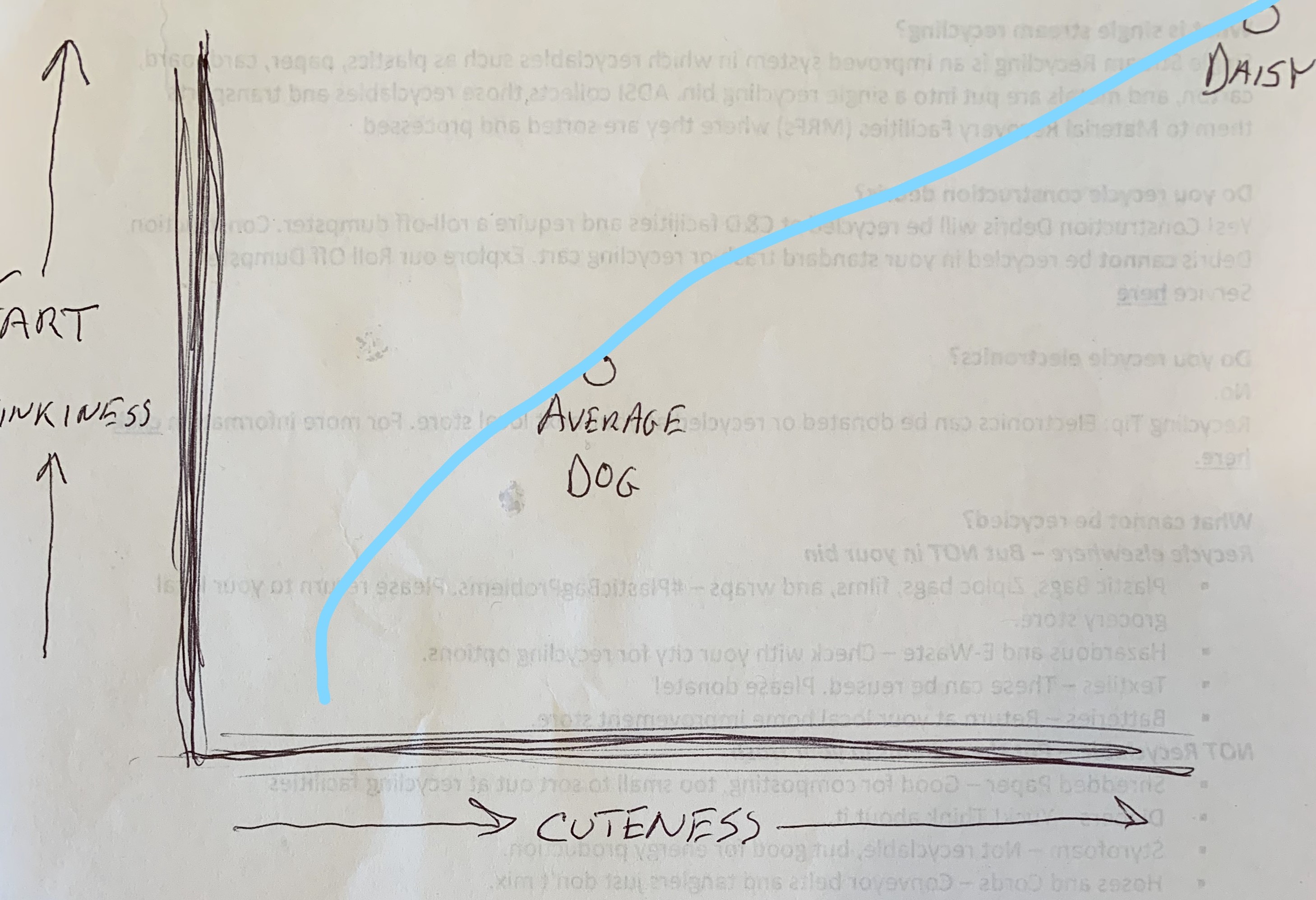

As I may have mentioned once or twice (or three times!), we recently acquired a very cute French Bulldog named Daisy. Her cuteness may only be outweighed by her *ahem* odoriferous flatulence aka fart stinkiness. And, since my wife is in the data analytics business and I’m in the investment business, I drew a chart that I thought might be funny (maybe only to me!):

Under my just-introduced Modern Dog Acquisition Theory (MDAT), you will see that Daisy lies on the outer edges of the frontier in both Fart Stinkiness and Cuteness. I would argue that it’s impossible to find a dog that is both cute and whose flatulence is non-offensive. Further, if you’ve got an ugly dog with offensive flatulence, you can probably do better!

Thank goodness you can’t smell a picture!

Note: MDAT has not been (and never will be) fully tested. Please forgive the terrible drawing, but hopefully it gets some sort of point across.