Investing Early

Nothing seems to go by faster than the time does watching children grow. As most parents can agree, it is bitter sweet to see our little ones transition from one milestone to the next …. Or let’s be honest, in the case of the second, third, fourth child milestones are gone in the blink of an eye. I certainly feel this way with our second, who is now almost 5 months old (how did that happen!?).

However, there are dozens of apps and websites giving mother and father dearest plenty of heads up on when the next “leap” or milestone for baby will occur, what behaviors to look for, and how to prepare ourselves and little baby for this next developmental “achievement”. This kind of guide can be reassuring, but also overwhelming as parents are wrought with fear that little baby might not be following these milestones to a T. Most new parents are already filled with worry that they are not doing “it right” and are inundated with so much information out there, it’s almost impossible not to compare your little one’s growth with the generic guidelines or even with the baby next door.

Much the same can be said for our savings and investments, particularly if you are a new or younger investor. There is an overwhelming amount of information out there about personal finances and where and how to be investing your hard earned cash…. Or even if you should invest it all. And before you know it you are comparing your financial “baby” to someone else’s, questioning yourself “am I doing “it” right?”

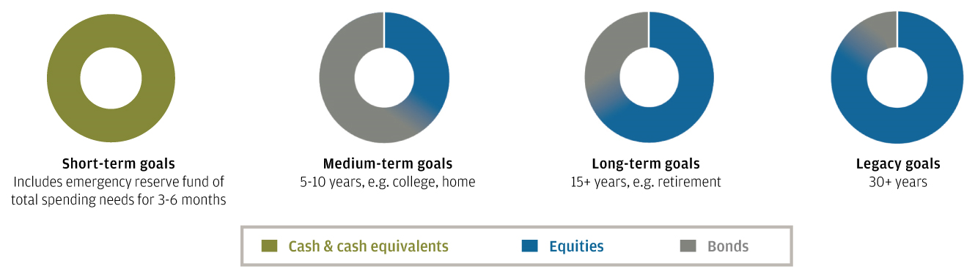

With such a broad topic as whole life investing, I find it useful to break investing down based on goals. Short-term cash needs, goals for the near future and (i.e – 3-10 years give or take) and then long-term goals (retirement usually falls in this bucket) and then continuing to revisit those goals.

Short-term needs are fulfilled by ensuring there is enough in the good ole savings account. Depending on your work, home, and family situation, the “rule of thumb” is to have 3-6 months of living expenses in savings to cover you should anything happen to your job or a big emergency comes up.

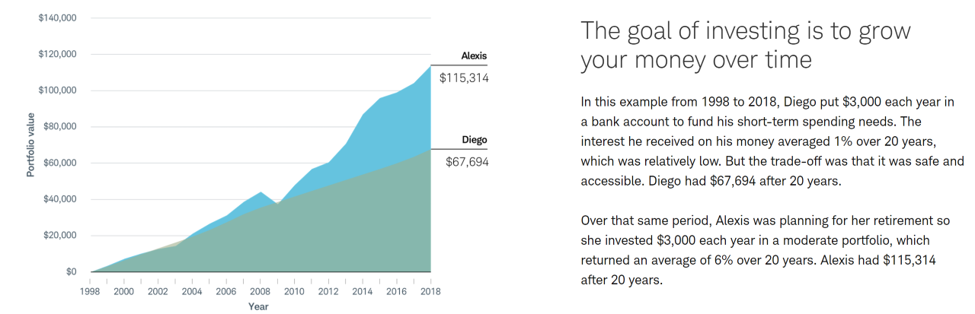

The next “bucket” of investments to focus on are the longer-term (i.e- retirement). If your employer offers a retirement plan, take advantage of it as soon as you are able….even if they do not immediately provide a match. There is enormous benefit of having your money automatically put into a retirement account, which grows tax-deferred with the benefit of the higher contribution limit ($19,000 in 2020 for those under 50).. Start early. Compounding interest is real and is your friend. And while you are in the early phases of your career, if you are able to take advantage of a Roth portion this will provide you with tax-free withdrawals when you are at retirement age.

The period in between short term and long-term goals is usually where the investment options start to seem endless and where most young investors out of uncertainty, just put any extra cash (outside of the emergency fund) back into their savings. Much like the baby milestone apps there are many robo-advisor platforms out there advertising ease of use and boundless options for way to help grow up your “money baby”. Some of these apps definitely serve their purpose but knowing how to choose investments and when to expand out beyond the app can be daunting. This is usually when it’s time to call in the professionals. Fee-only, fiduciaries are a great place to start as we are legally obligated to keep our clients’ best interest in mind. Much like a pediatrician providing advice for growing children, we are here to provide information, help guide you through the milestones in your life / finances, and provide recommendations on how we feel your “money baby” will grow in the most healthy way based upon your risk tolerance (i.e – how much risk are you willing to take for a certain amount of return) and your individual circumstances.

Everyone’s path in investing is going to be different much like how every child grows and develops differently. However, by starting early with a strong foundation, providing consistent care and attention, and knowing when to call in the professionals your “money baby” should live a healthy life soaring through each milestone. Let us know how we can help, even with the baby steps.