Coronavirus – Part 2

While we’ve already written on coronavirus a few weeks ago, it seems the virus is still not contained and is wreaking havoc across the globe—and in financial markets as well with the S&P 500 falling by over 3% today. Through February 2020, nearly 25,000 cases of coronavirus have been reported, with nearly 500 deaths. In the next few weeks, the reported cases may accelerate as the virus has just reached South Korea and Italy.

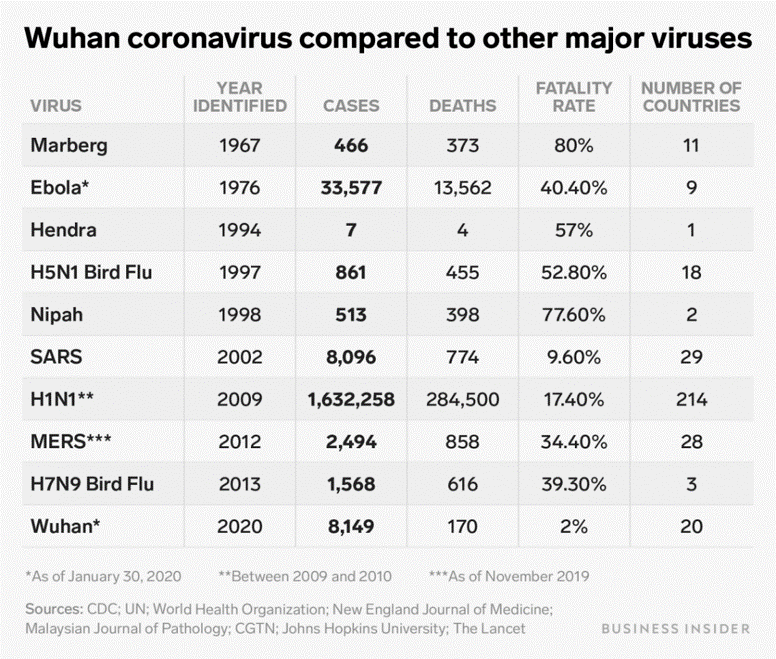

While coronavirus seems to be one of the largest pandemics in recent history, there have been many other more severe pandemics over the past 20 years:

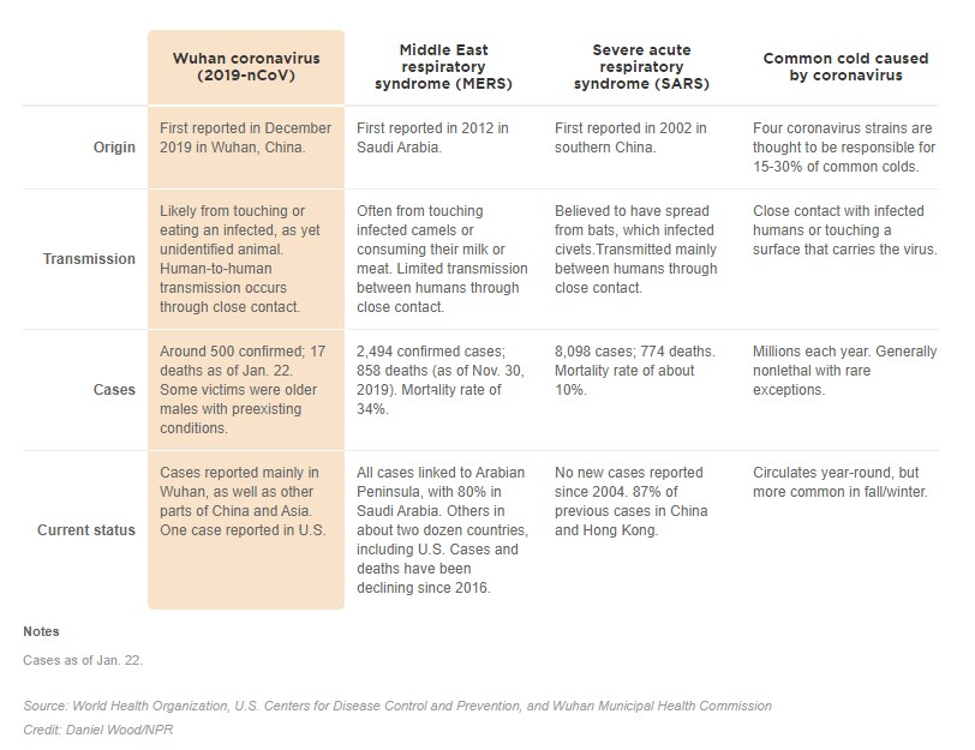

While past performance does not indicate future results, studying similar pandemic episodes does provide some evidence that market impact from worldwide illnesses is a temporary phenomenon. In looking back, the SARS pandemic is one of the best comparisons to coronavirus as they are both respiratory diseases that originated from animals in China.

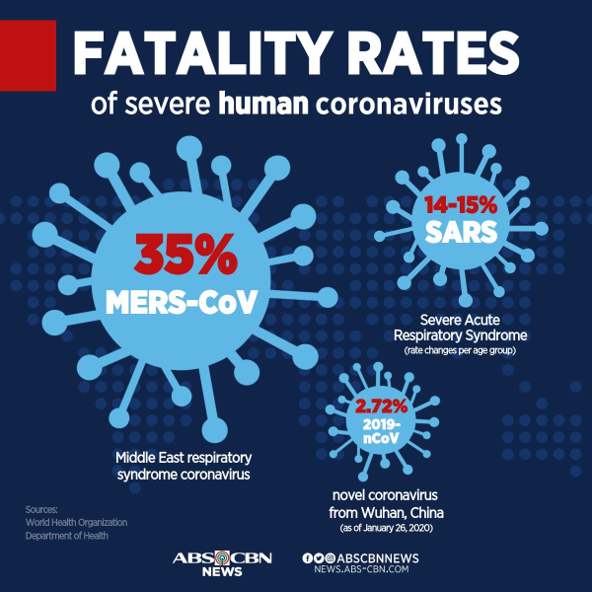

Thankfully, coronavirus has proven to be less deadly than SARS or MERS:

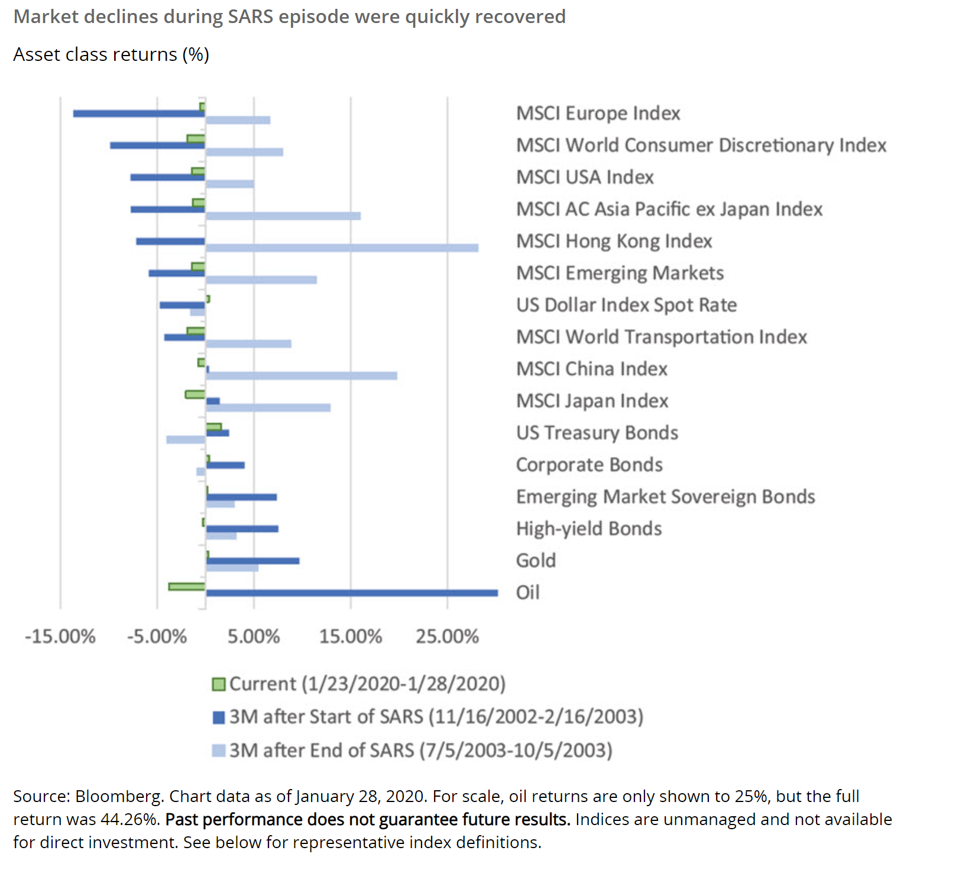

In looking back at the impact of SARS on various asset classes, a study by Hartford funds found that risky asset prices declined substantially in the first three months of the pandemic. Once SARS was contained, and reported cases peaked, those asset classes were able to recover relatively quickly over the next three months:

As the Hartford analysts note: “Differences between the SARS scare and today’s coronavirus include both positive and negative takeaways. On the positive side, the response of the current Chinese government has been faster and better. Any severe knock to the economy is likely to be met with some fiscal and/or monetary easing. On the negative side, lost demand from reduced travel is unlikely to be recovered. The sheer number of people and range of travel are far greater today than in 2002-2003 as well.”

We’ve had several calls from clients today, asking what we need to do in this situation. Our response has been that we’ve already been positioning their accounts to withstand a drawdown like today’s. We have been preparing for a market shock, and so today’s decline—while unfortunate and ugly to watch—has not derailed the plans and goals of our clients.

Our friends at research firm Litman Gregory put it this way in a letter to their clients:

“What we do know for sure is that panicking or overreacting to news headlines is never a good investment approach. There are always uncertainties and unexpected external shocks that can hit financial markets—at any time. But if you are invested in an appropriate portfolio for your risk tolerance, investment objectives, time horizon, and financial goals, then this recent event—or any particular short-term market shock—should not change anything. (If a short-term market shock or sharp drop is keeping you up at night or causing extreme stress, that may be an indication you are not invested in an appropriate portfolio for your risk tolerance.)

We don’t believe most investors can be successful jumping in and out of markets in response to short-term news. If one were to sell equities now in response to the coronavirus, what is the signal—the investment discipline—to “get back in”? Just as the markets are discounting the incremental negative news on coronavirus (prices are falling), they will also be discounting good news as it comes out and prices will rise.

Getting in and out of markets requires making two good timing decisions—the exit point and the re-entry point. That’s very difficult to consistently get right on a short-term basis—especially given all the well-documented natural human behavioral and emotional biases that work against long-term investment success. Remember, when it comes to investing, as Warren Buffett famously said: “Be fearful when others are greedy, and greedy when they are fearful.” Or put differently, “Buy fear, sell greed.”

We couldn’t agree more!! Stay safe~