Care for a summary?

Life as we know it right now is in a strange state of trying to maintain some resemblance of normalcy as we develop new routines and readjust our daily habits. (On a personal note, I have an even GREATER appreciation for all of the teachers and childcare providers out there.) We truly are living through a historical event unlike one modern time has ever experienced. In an effort to “flatten the curve” of the spread of COVID-19 the closing of businesses, schools, churches, and a halt in nonessential transportation has been strongly encouraged. While this is an effective procedure at fighting the pandemic, it will unfortunately have a dramatic impact on the economy.

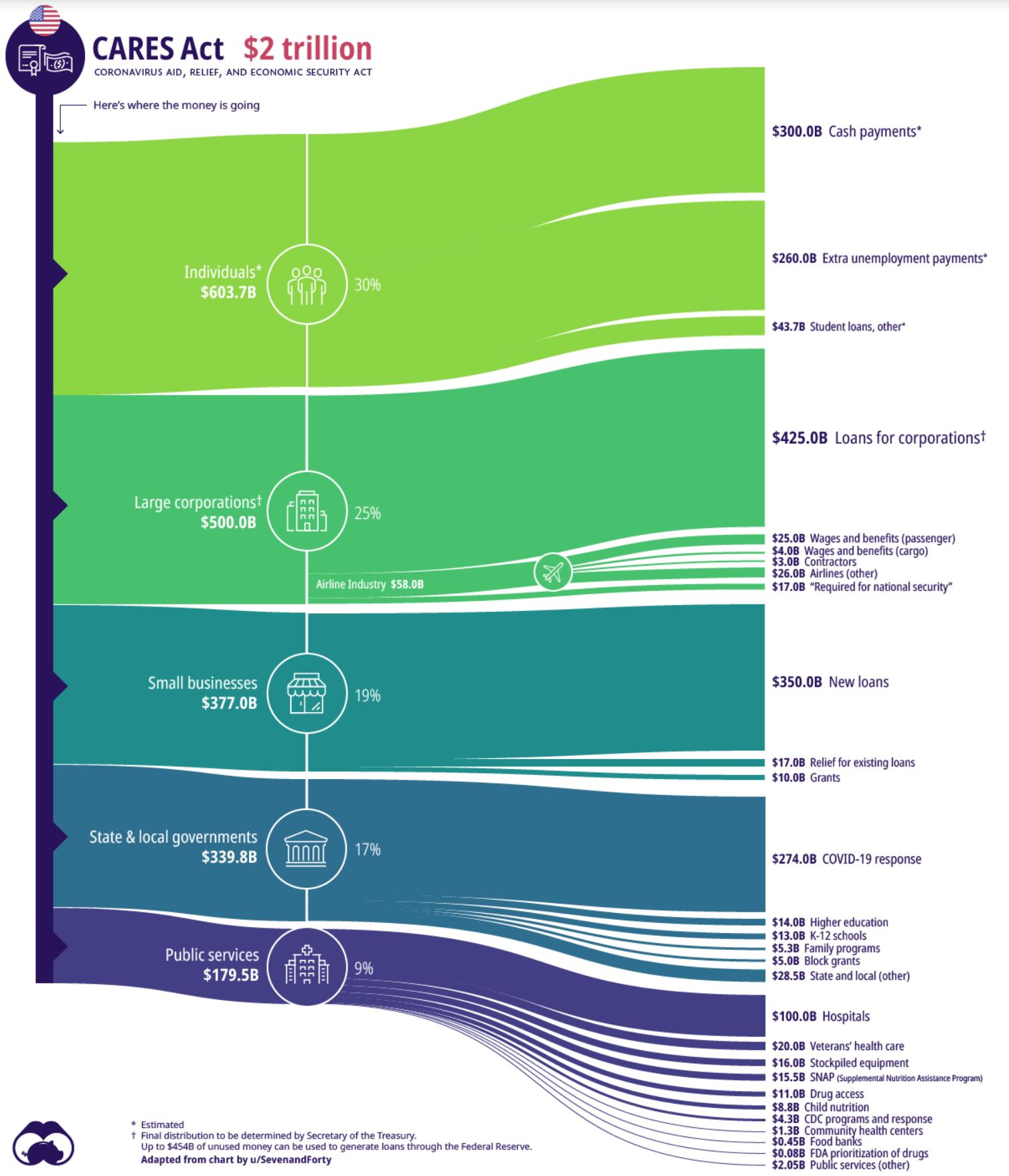

Last Friday, Congress signed into law the Coronavirus Aid, Relief, and Economic Security Act, otherwise known as the CARES Act of 2020, which is now the largest economic stimulus package in our history. This package is estimated to provide $2 trillion dollars to speed relief to individuals and businesses negatively impacted by the virus.

The bill is an 880-page and complex document detailing to whom and how the relief will be distributed. Visual capitalist provided an excellent chart of how the funds are broken down.

Now for the highlights of the bill:

Individuals – $603.7 billion

The largest portion (and receiving the greatest interest from the general public) provides cash payments to individuals with the hope it will help keep them engaged in the economy.

- Single filers earning up to $75,000 (based on either 2018 or 2019 tax filing) one-time cash payment of $1,200. Phased out if earning $99,000 or greater.

- Married couples earning up to $150,000 each receive a payment of $1,200. Phased out if earning $198,000 or greater.

- An additional $500 per child for families. Eligibility limits mentioned above increase depending on the number of children.

- **Those receiving SS benefits and do not file a tax return are still eligible

- Extra unemployment payments of $600 / week for four months on top of what state programs pay. This bill includes, self-employed, independent contractors, and gig economy workers

- Temporary suspension of student loan debt held by the federal government – no interest accrued or payments due until the end of September 2020.

- Waiver of 10% early withdrawal penalty from retirement funds

- 2020 RMDs suspended

- 2019 tax return deadline extended to July 15. Those already filed or plan to can still expect to receive a refund if they are owed one.

Small Businesses: $377 billion

- Up to $10 million per business available as a forgivable loan to keep workers employed, cover payroll, rent, mortgage, utilities, health insurance premiums.

- $10 billion set aside to provide grants up to $10,000 to cover short-term operating costs.

Big Businesses: $500 billion

- $500 billion set aside to provide loans, loan guarantees, and other investments (not to exceed five years and not forgivable). Most notably, $58 billion is allotted for commercial and cargo airlines as well as airline contractors.

State and Local Governments – $340 billion

- $274 billion toward specific COVID-19 response efforts, $14 billion for higher education, $13 billion for K-12 schools, $5.3 billion for programs for children and families, and $5 billion for Community Development Block Grants

Public and Health Services – $179.5 billion

- Hospitals to receive $100 billion in grants to help fight COVID-19

- $80 million for FDA to prioritize and expedite approval of new drugs

- The remainder is split between supporting treatments, the CDC, community health centers, veterans’ health care, medicine and supplies, child nutrition, and various other programs.

This again is just a high-level summary. If you are feeling particularly cabin feverish (and who isn’t!?) here is the link to the entire bill. https://assets.bwbx.io/documents/users/iqjWHBFdfxIU/rSVHQuPeCB_g/v0

While this bill will more than likely have some kinks to be worked out, it is a huge step to alleviating some of the financial burden most families, businesses, and organizations will be feeling while we as a country build a path of eventual from the pandemic. For me, the nickname of the act (CARES) is also a good reminder that as members of society we should continue to treat each other with kindness, care, and the remembrance that we are all in this together!

If you have specific questions on how this might affect you, your family, and / or friends, please don’t hesitate to reach out to your advisor. We care about you.