Recovery Will Come (+ Be Like Mike)

It’s difficult for us in the investment community to avoid the topic/question of market recovery and when it will occur. Regardless of how you view the current situation surrounding the pandemic, recovery will occur at some point. Those with a more pessimistic outlook believe that it will take longer than those with a more optimistic outlook. The bottom line is that no one knows for sure, and as is the case with most situations, people will hang their hats on articles/studies/predictions that support their already-formed opinion.

The question in our minds is, ‘has the market already priced in the severity of the downturn?’ In other words, will the market react negatively a second time to what are sure to be bad earnings reports across the board. We don’t know for sure, but as always, taking the long view can provide more clarity.

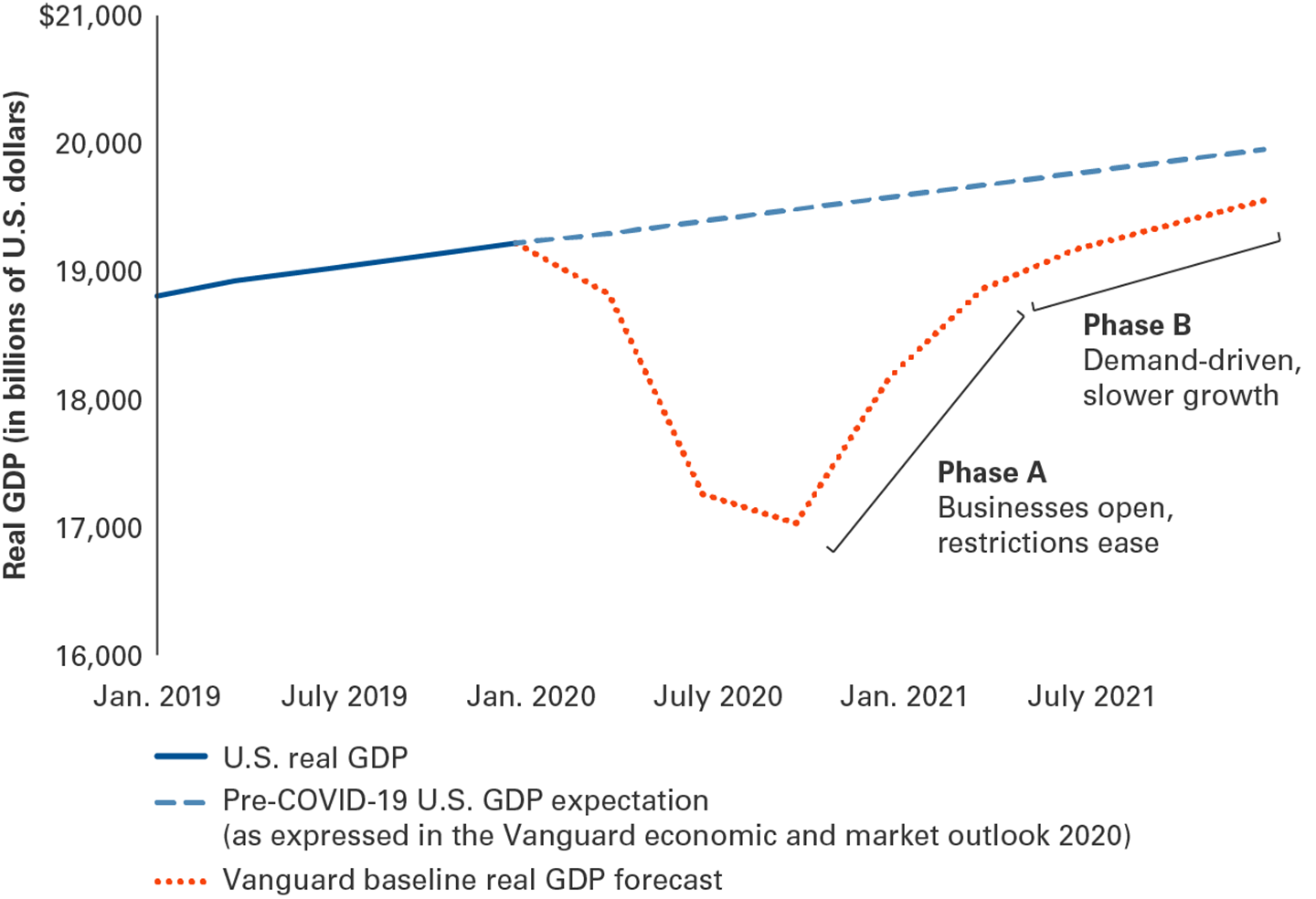

Recently, I have come across two charts that I think layout a reasonable expectation of what’s to come from a US GDP growth standpoint as well as from a global perspective.

The first (and less colorful!) comes from a Vanguard article titled “How growth resumes: A two-phase recovery.” From Vanguard: “Getting business activity back to where it was before the pandemic could take two years—a U-shaped recovery—given shocks to both supply (stemming from containment measures) and demand (stemming from consumers’ likely reluctance to immediately resume face-to-face activities such as dining out, traveling, or attending large events). Some parts of the economy will recover more quickly than others. But it is unlikely we’ll see the labor market as tight as it had been until after 2023, which means the U.S. Federal Reserve may be on hold near 0% interest rates for that long as well.”

The second chart (actually an animated GIF) shows projections from the International Monetary Fund (IMF) for GDP growth across the globe in 2020 and 2021. An interesting disclaimer on this chart says, “The IMF’s forecasts are based on assumptions that the pandemic fades in the second half of 2020, containment efforts are gradually unwound, and governments provide policy support.” At this point in time, that seems to be a reasonable assumption.

For me personally (and for a lot of us), live professional sports’ return will be a great and welcome sign. Until then, I am clamoring to find something sports-related to cling to other than Korean Baseball (yes, ESPN is now airing live games!). Recently, that has been ESPN’s “The Last Dance” documentary of the Michael Jordan-led Bulls. Both I and my wife grew up watching that team and were huge fans (despite neither of us having Chicago ties). I had forgotten how invested I was in the Bulls team and specifically the duo of Michael Jordan and Scottie Pippen. They were so likeable and fun to watch, as opposed to their nemeses (Isaiah Thomas and the Pistons and Reggie Miller and the Pacers).

My wife saved two great souvenir jerseys from that era (above). I think they are pretty darn cool and plan to get them mounted in some fashion. They take me back to my childhood days of pretending to be Jordan while dunking over my brother on a 5-foot hoop!

Jordan didn’t win all of the time, but he did win most of the time. He learned that if he involved his teammates, he could win more consistently over the long term. I think the same can be applied to your investments and a properly diversified portfolio.

Nathan