Reflections

It has been a challenging couple of months, and I was thinking through how wild it has been (January seems like forever ago!).

Here is just a collection of things we’ve seen personally and professionally (they sort of all blend together when you work from home) during the past several weeks…

In no particular order:

- Diversification feels bad but works

Diversification is like Rodney Dangerfield—it can’t get any respect. No one really enjoys it, because by definition, there will always be something that is underperforming. In other words, diversification means you always find something to hate in your portfolio. When the market goes up, you feel upset that your portfolio isn’t doing as well as the best performing asset class. When the market goes down, you feel unhappy when you lose money too. So, diversification never feels great.

BUT, when you look at diversification over the long term, it works:

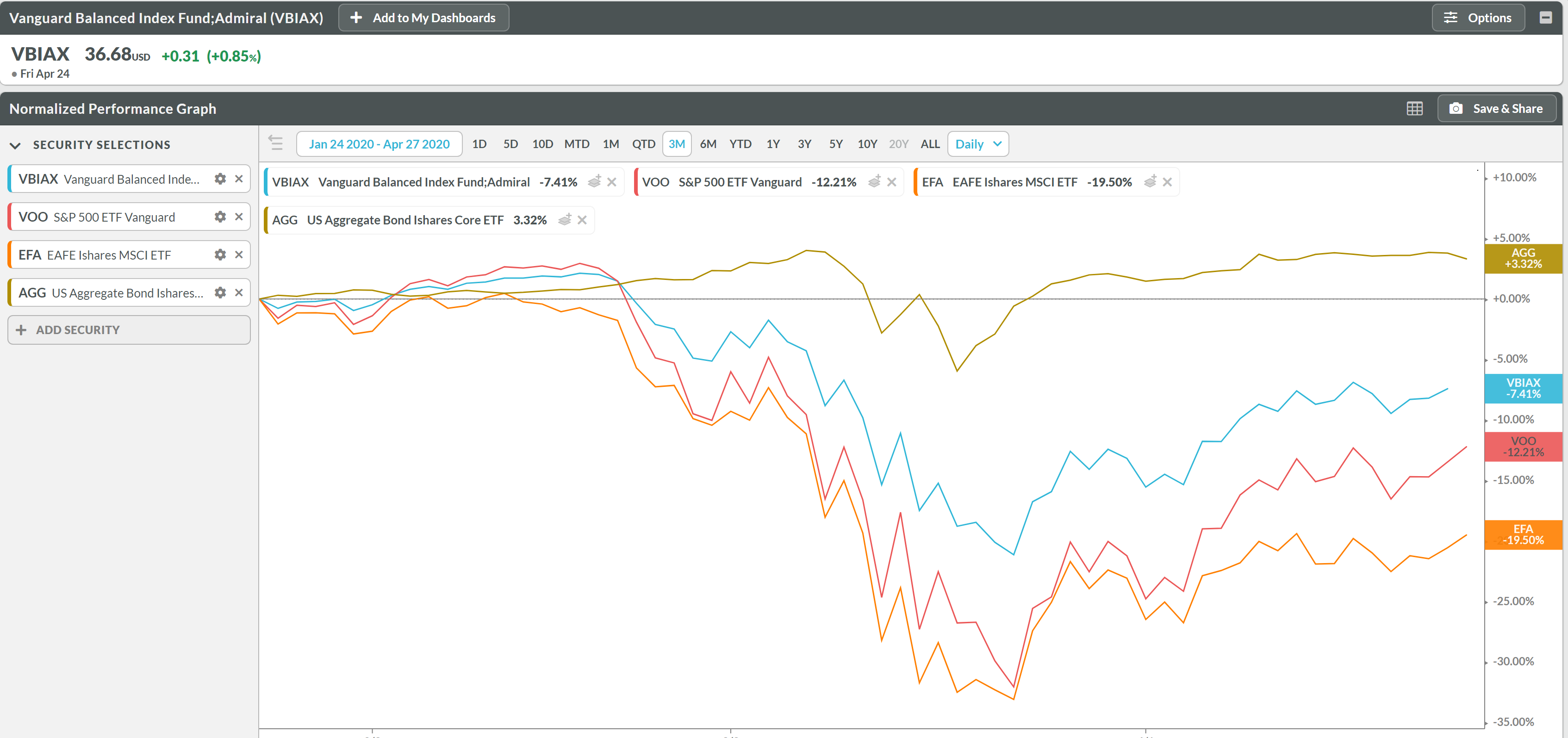

And it worked in the market sell off this year—bonds were up, and the equity markets were down—blending asset classes together helped to cushion the decline in diversified, balanced portfolios (as represented by the Vanguard Balanced Fund here):

- Bonds did their job in the sell off

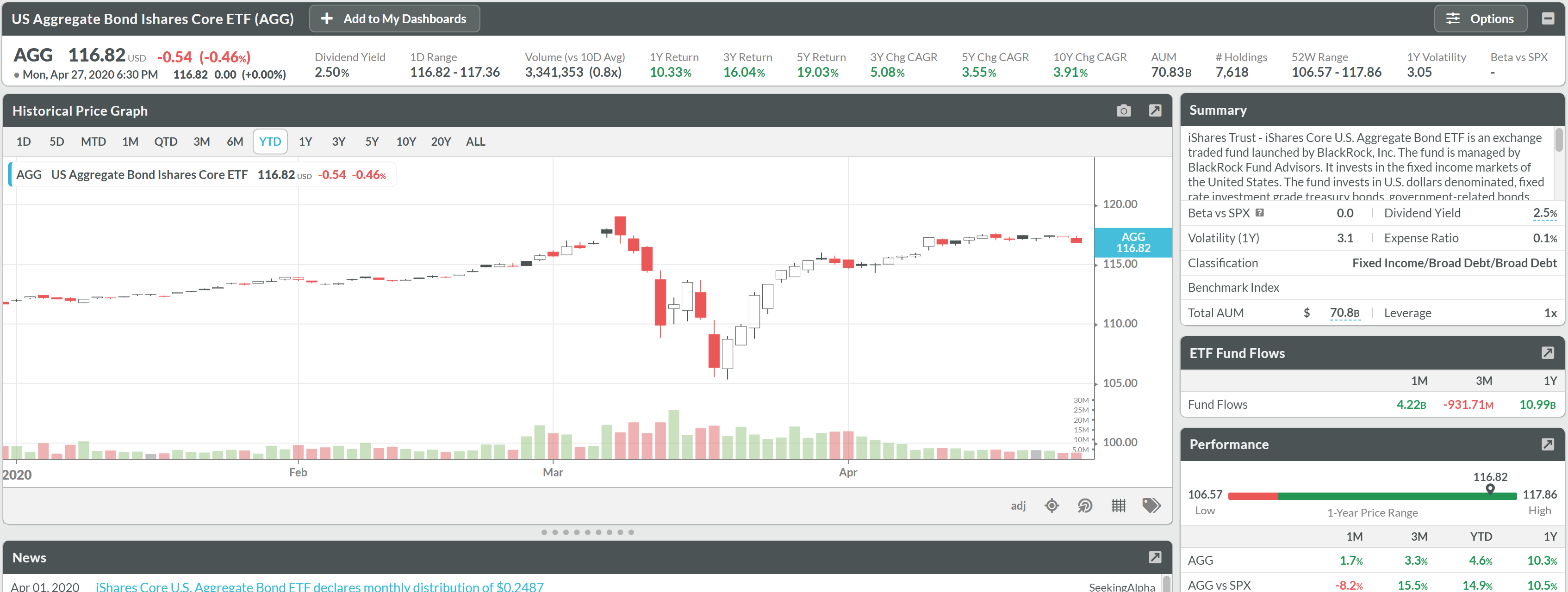

Like point #1, bonds have been boring for years—everyone wanted to own stocks—until 2020:

This is a chart of the US total bond market—which is up 5% this year…up 10% over the past 12 months…up 16% over the past 3 years!

- Dogs don’t care about the virus

This is Milo beside me as I work from home. He could care less about the market, the politics, the future. He’s pretty happy to be safe and warm, at home with his family.

- Kids do care about the virus

Our kids miss routine, school, and their friends. They are as sick of being cooped up with their parents as we are exhausted being cooped up with them. Ethan said I don’t give a spelling test as well as his teacher does. Offended, I asked him why—I was reading the spelling list just as it was written. Ethan just said Mrs. Clay does it better—she says the words better and her pronunciation is more helpful.

And they are bored…and bored kids get weird.

BUT, I digress…

- Roth conversions are popular now

We’ve been doing a lot of Roth IRA conversions as market values of IRA assets are down, and for many folks, their household income will be down for the year too. So, this allows a little more room in their bracket to accelerate the IRA income. By paying taxes now, at depressed asset values, and shifting the IRA assets to a Roth IRA, all future growth on those assets will be sheltered from income taxes in the future.

Given the loads of national debt we’ve incurred in the fiscal and monetary policies used to combat the virus economic impact, higher tax income tax rates in the future may be a distinct possibility, so for some clients, paying taxes today to avoid paying them in the future is pretty prudent strategy.

One Forbes article calls this the “best time in history” to do a Roth conversion. While we don’t necessarily agree with the hyperbole, we do agree that now is a very unique time to think about a Roth conversion.

- Bell curve of activity

As we’ve lived through the fastest drop in the S&P 500 in history, we worked with each client to revisit their investment objectives, comfort levels, and portfolio allocations. We had a few clients who needed to sell for various reasons, and we had an equal number of clients who wanted to buy into the market at much lower prices. But, we were very glad that the majority of our clients were able to stay the course, monitor the situation, and rebalance strategically where it made sense.

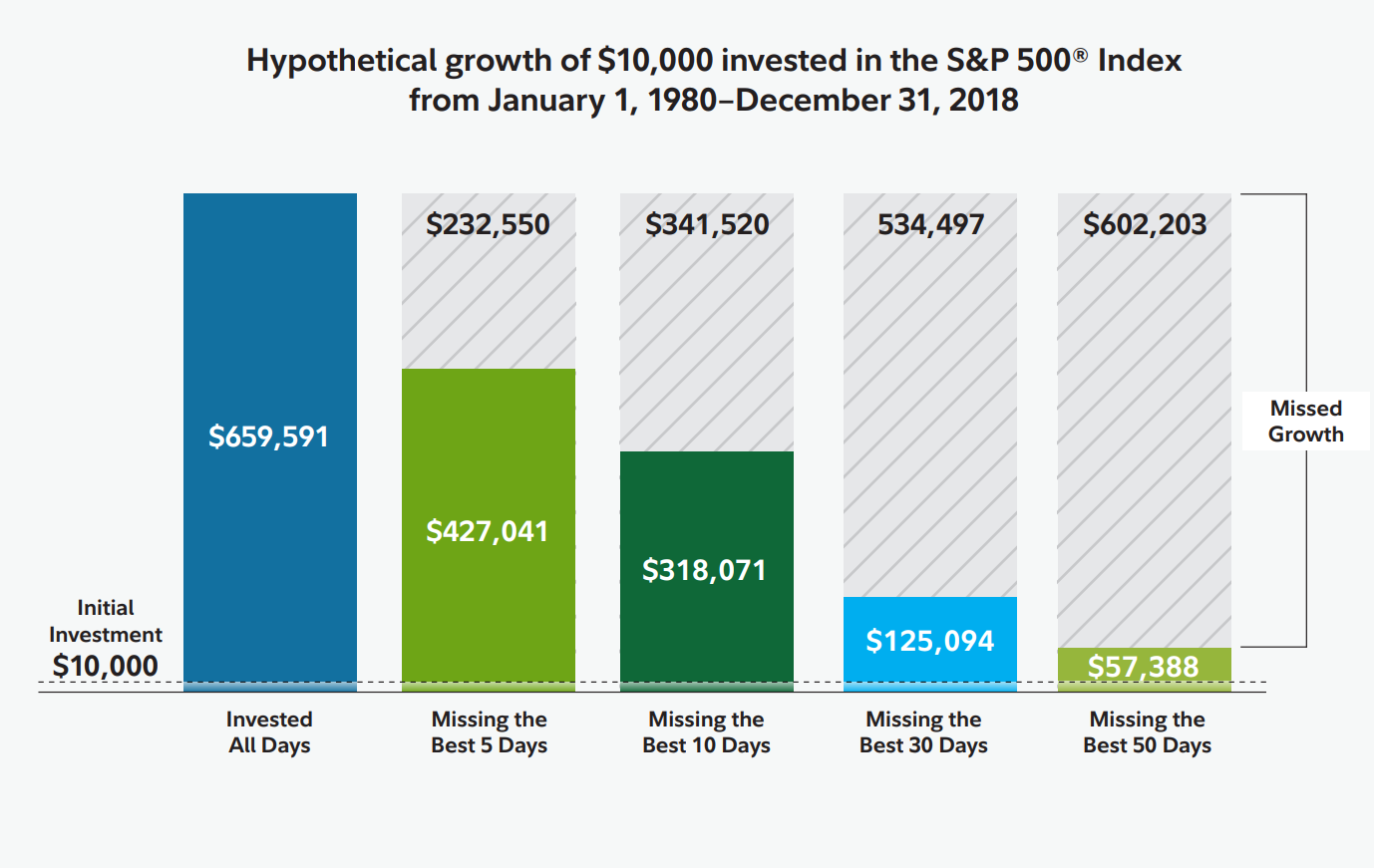

It is hard to not take action when the market declines, but we were really glad to see our clients not trying to time the market—moving to cash and trying to time getting back in. History shows that timing generally won’t work:

- Markets lead the way down—and the way out

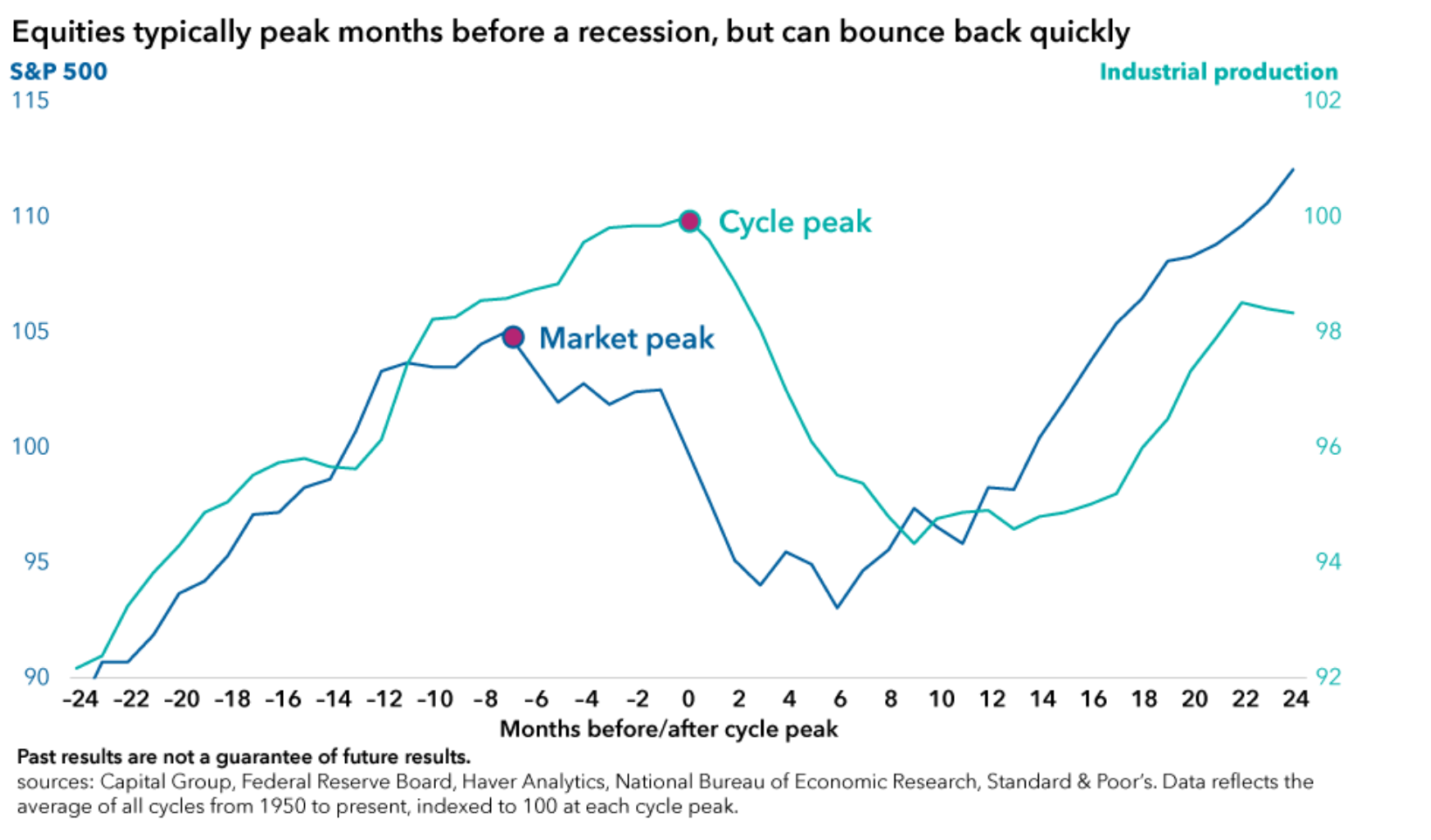

The US Stock market is considered a leading indicator, as it trades on news of what the future looks like. So, while the S&P tends to peak 6 months or so before the economy enters a recession, it also tends to find a bottom before the economic data starts to improve:

In most of the past recessions, the market bottom comes on average of about 5 months prior to the end of the economic recession:

- Fresh air and sunshine matter

While it is a universally known fact that fresh air and sunshine are good for kids and to dogs, some recent government research studies hint that fresh air and sunshine might also help contain coronavirus outbreaks:

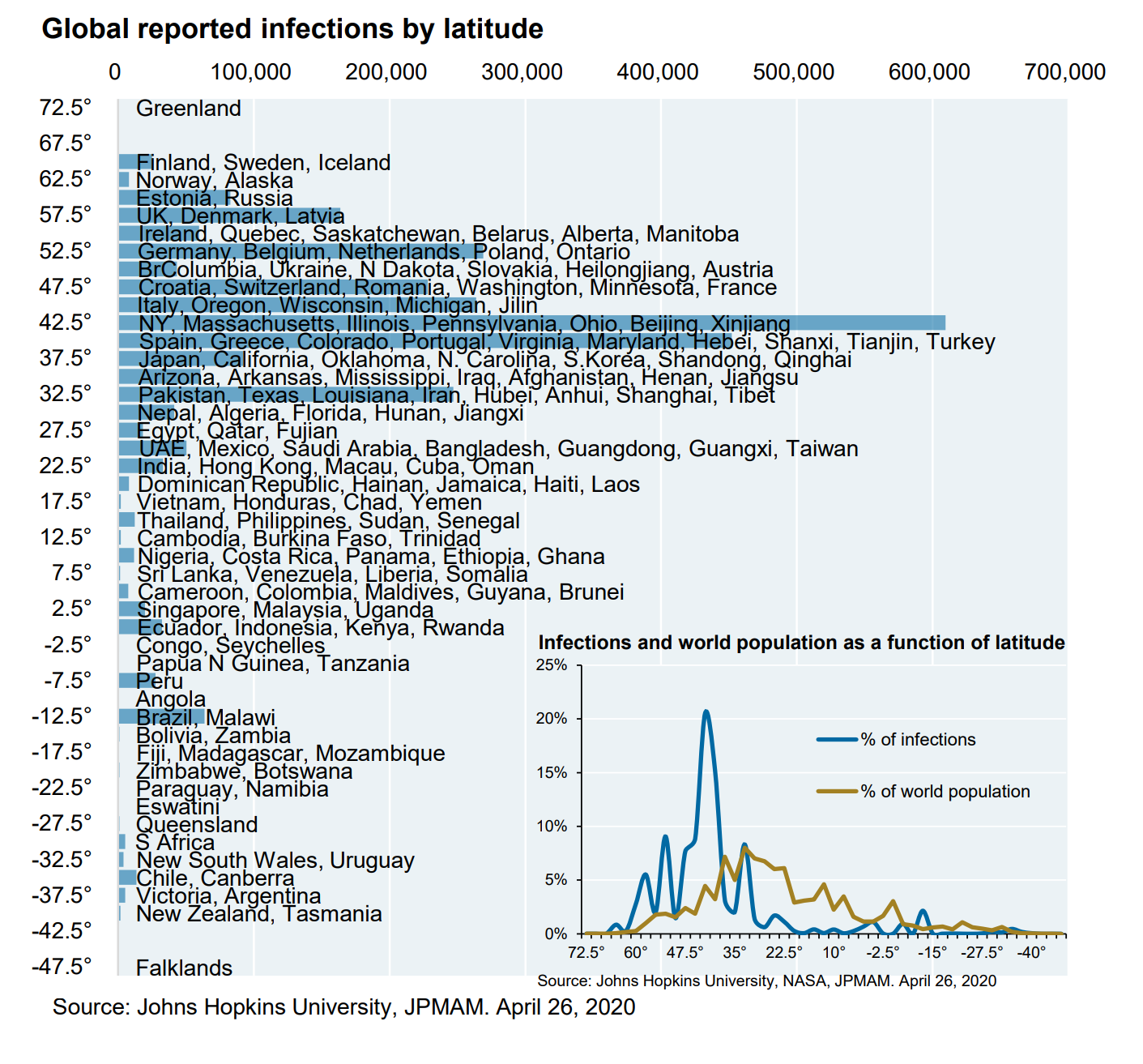

While this research is being debated, it is interesting that much of the outbreak has occurred in a pretty narrow geographical band that has just exited winter:

It may be coincidental, but we are really looking forward to warmer weather now!

- Meridian can work remotely and serve well

While are deeply saddened by the virus and its impact on our nation’s health and economy, this year has put our disaster recovery plans to the test. We’ve been working remotely since the end of March, and we have been able to take care of all of our clients without disruption. We’ve placed thousands of trades, updated financial plans, transferred money, worked with accountants on tax plans, and converted more IRAs than we can count. We’ve talked to most of our clients—some for planning purposes, some for portfolio reviews, but mostly because we just wanted to check in and make sure everyone is coping and doing well.

So, while we are not thankful for the source of the disruption, we are very grateful that we have been able to continue on taking care of our clients despite all of the craziness. And, we are very, very glad that most of the folks we’ve talked to are healthy and coping well.

And finally…

- Zoom sucks

No matter what you use it for—visiting with friends, seeing your students, talking to clients, conference calls—it is a poor imitation of being in person. We miss all of you very much, and we can’t wait to see you in person again when it is safe to do so!!