Taking the Reins

Last weekend our oldest turned four, so we figured what better way to celebrate, than taking her to go ride a real-life pony. She also deserved a mega award for being patient with me and my husband constantly working on renovations on the house and the rescheduling of most extra-curricular activities due to Covid.

Unlike many of our clients (and a select few of Meridian staff), I have not spent a lot of time around horses and to be honest, their majesty and size are intimidating to me. I acknowledge this has to do with the fact that I just don’t know a lot about them… I am unfamiliar. Our daughter has never met an animal she doesn’t love… but sometimes her love is shown through a type of headlock and “slap” petting, always with the most wholesome intentions. Knowing this about her, I reminded her repeatedly to not walk close behind the horse or touch his backend, fearing she would good kick to the face which not even all of the birthday cake and ice cream in the world could fix.

The instructors at the farm were incredibly patient and very knowledgeable. And wouldn’t you know that one of the first things they taught her was how to walk around her pony, and how to pet it gently or even hug it on the backend to let it know you were walking behind it.

Rightly so my advice to our daughter was based around me trying to protect her, but also from my lack of familiarity with horses and how to interact properly with them. I was, in a way, showing what those in behavioral finance call, familiarity bias or in this case, lack of familiarity.

Our experiences and environments past and present shape who we are and the decisions we make whether it’s with our children or through our financial and investment choices. Behavioral finance examines behavior in the context of personal finance and examines how individuals may react to markets, market behavior, portfolios, and investing.

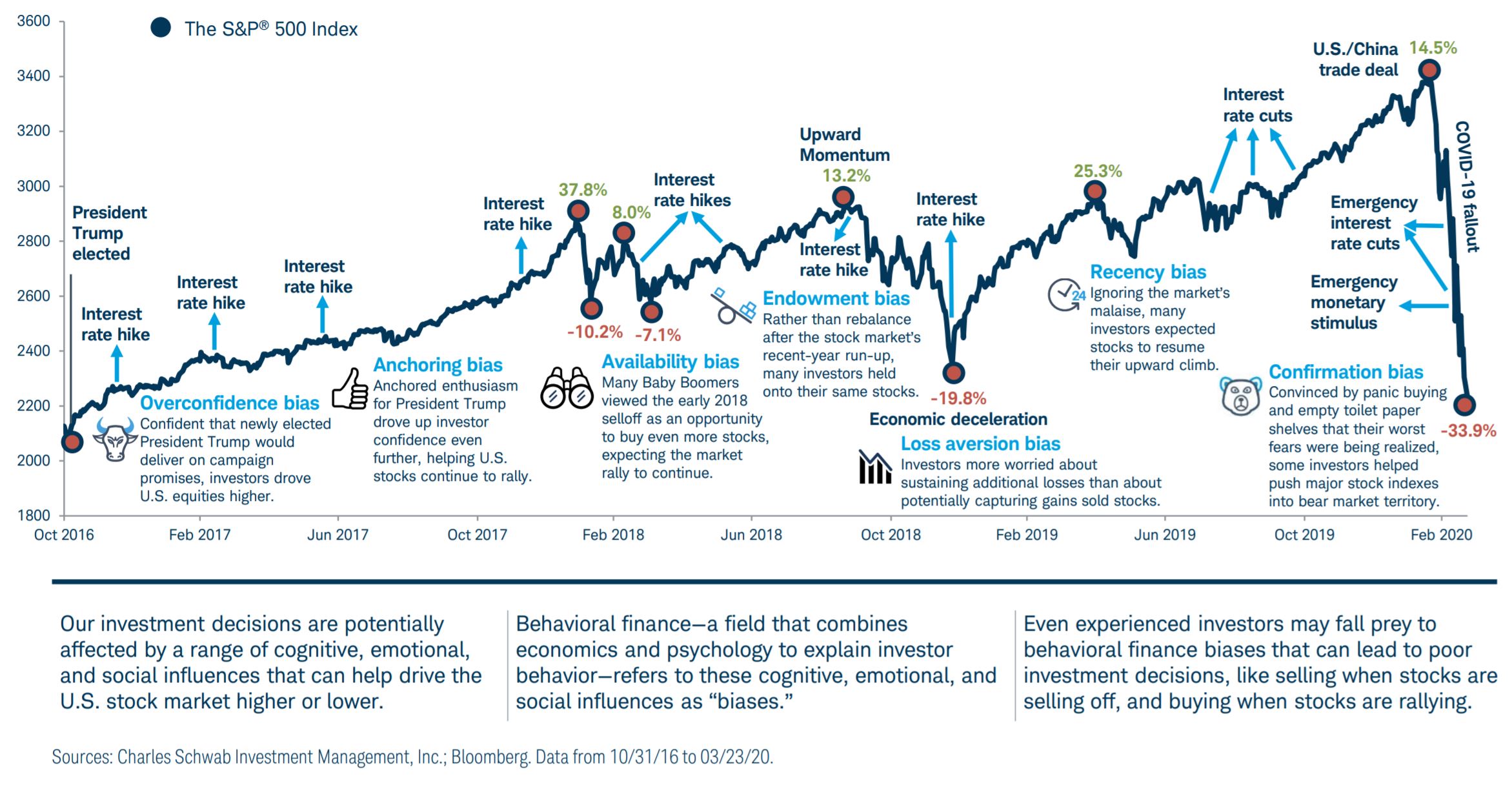

Volatility in the markets whether they are going up or down tends to illuminate common heuristics that behavioral finance links with normal investors. I’d like to point out these are normal behaviors that even the most seasoned investor can and more than likely will fall into.

As the chart indicates, different points in current events, the market, and environments cause investors to make decisions they more than likely would not have made if everything remained status quo. It is almost impossible to argue that finance and psychology do not go hand in hand. Having an understanding of the idiosyncrasies that can occur as an investor is important to the success of long-term planning.

A few of the common behaviors:

- Familiarity Bias – the tendency to make decisions based on one’s own experience or knowledge and therefore overestimate / underestimate the risk of those opportunities which are familiar / unfamiliar

- Herding – tending to follow the masses or “herd”

- Recency – giving weight and greater emphasis on recent events or stimuli with the belief that those recent events will continue.

- Overconfidence – the tendency to overestimate skill and accuracy

- Loss aversion – the tendency to feel the pain of a loss greater than the delight of a gain; therefore prioritizing the avoidance of loss to sometimes an irrational level.

- Confirmation – the tendency to focus mainly on information that reinforces one’s own views, inadvertently missing opportunities.

- Anchoring – the tendency to focus on a specific reference point, such as an index, when making decisions, also referred to as belief perseverance

- Disposition effect – also known as regret avoidance is the tendency to hold onto something even if it is not performing well

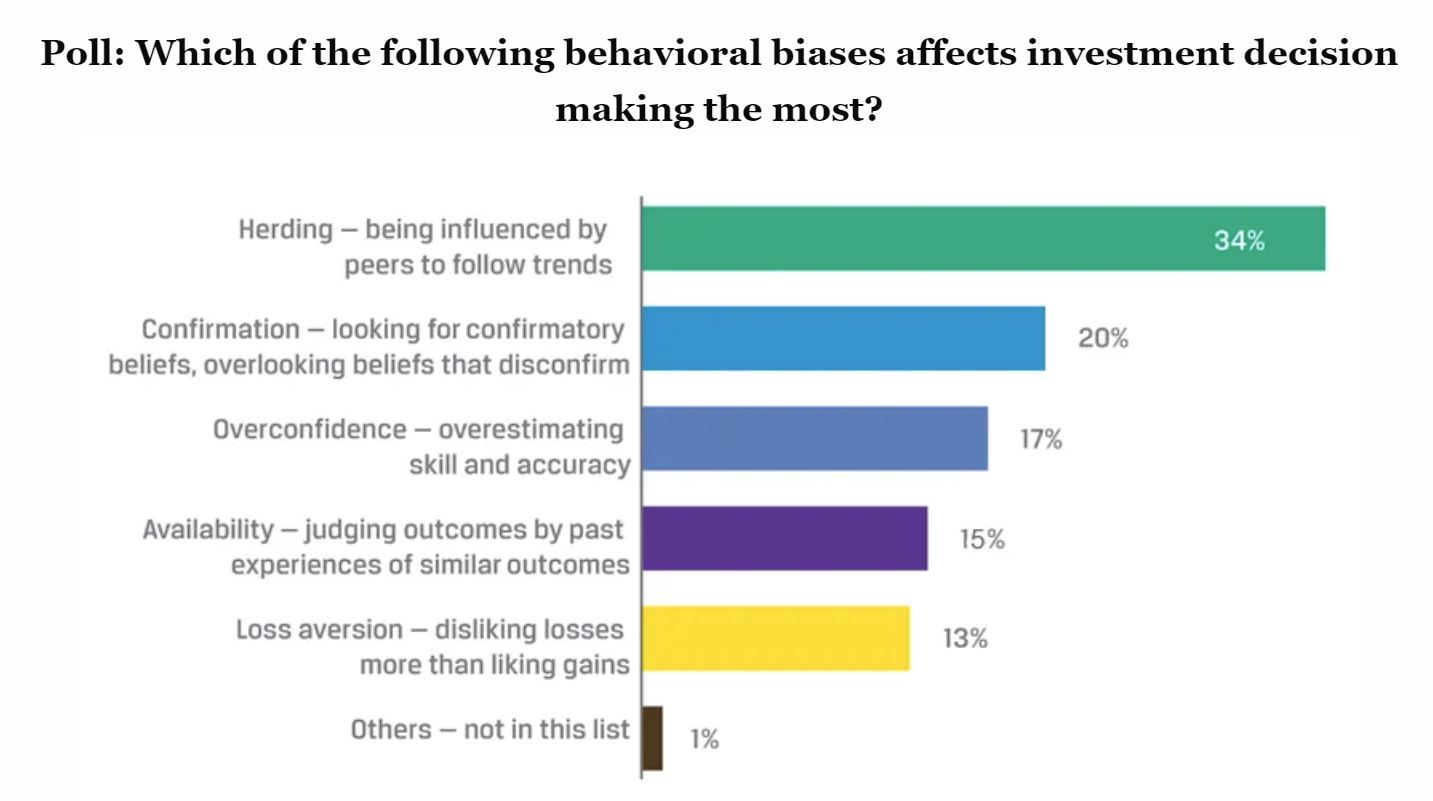

Below the CFA Institute released their results from a poll of the most commonly observed behaviors found in investors.

Again it is important to note that most normal investors experience these thought patterns and while the word biases tends to have a negative connotation, these behaviors are not necessarily negative.

As financial advisors and financial planners, it important to us to not only be aware of these biases, but to understand the reasoning behind why these heuristics exist. Backgrounds, experiences, preferences, beliefs all play a crucial part in building a long-term plan that maximizes each individual’s specific goals and objectives. By acknowledging and being familiar with these behaviors, we can better understand what is truly important to the success of a plan and also what drives an urge to make decisions that may deviate from the overall plan. And while financial plans should change with life developments, there is a lot to be said for allowing a solid, well thought out plan to take the reins, providing peace of mind, even during the most volatile times.