Like a ROTH to a Flame

I apologize for the lame title to this post, but it seemed a little more attention grabbing than ‘help your kid open a ROTH IRA.’ If you have a child who is earning income, he is eligible to open a ROTH IRA (in Virginia, the minimum working age is 14), and you should probably help him do so. This topic has recently been front of mind for me, since my oldest recently turned 14. He doesn’t have a job just yet, but hopefully that will change soon!

Asking a 14–18-year-old to put some of his first-job money into a retirement account may sound difficult if not impossible. However, it can be a very helpful way to not only teach a young person about investing, but also get them used to putting away some of their pay on a regular (if not automated) basis. If your child is under the age of 18, he will need you to act as the custodian of the account and will need your consent and signatures. In Virginia, custodians can remain in that role until the child reaches age 25 (or sooner, if the custodian so chooses). Most financial institutions will allow you to link a bank account to make funding the ROTH easier, and you can set up automated contributions if you wish.

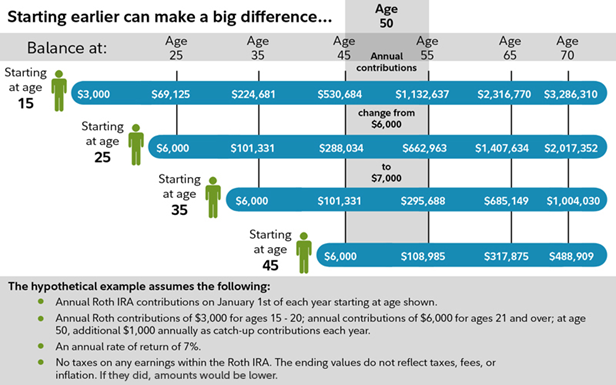

If you aren’t already aware, ROTH IRAs are funded with after-tax money (no deduction), but that makes no difference to a dependent child who does not need any deductions. The money can not only grow for a long period of time, but it can also be withdrawn tax free in retirement. Like any investment strategy, starting early has big advantages.

Here’s a good summary from Forbes:

Rules for Roth IRAs for Kids

- There’s no minimum age limit to contribute to a Roth IRA for kids. If an infant is chosen as the next Gerber Baby and earns $10,000 in their first month, up to the annual limit can be contributed to their Roth IRA.

- The contribution limit is 100% of the child’s earned income or $6,500 in 2023, whichever is less.

- Gift income does not count toward earned income for contribution eligibility.

- Contributions are not tax deductible.

- The account’s growth and qualified distributions are not taxed.

- Contributions can be withdrawn without penalty anytime.

- Earnings generally can’t be withdrawn without penalty until your child is 59½, with some exceptions.

- Earnings can be withdrawn without penalty up to certain limits to pay for college, buy a first home, pay certain medical bills and for any reason after a total and permanent disability.

- Early distributions of earnings that don’t fall under one of the exceptions are subject to a 10% IRS penalty tax plus any applicable income taxes.

- The custodian no longer controls the account when the child reaches the age of majority in their state.

- The child will never have to take required minimum distributions from the account in retirement (unless tax laws change).

As I may have mentioned before, my dad strongly suggested (maybe forced me?) to open a ROTH IRA not long after starting my first job, and while I didn’t fully understand the reasoning at the time, I am certainly thankful for that guidance today. The kid in the picture below doesn’t know it yet, but he will be getting the same “strong recommendation” from me in the near future!

Coleman not working…yet

One last note, if you have a child who earned income in 2023, you still have time to contribute to his ROTH (the deadline is the tax filing due date). You can contribute up to 100% of the child’s income to a maximum of $6,500 for 2023. This would still also allow for contributions for the 2024 tax year (maximum is $7,000).

Best of luck convincing your child this is a good idea!

Nathan

Nathan, I think this is a good idea. When I turned twelve, I got a newspaper route. My mother made me save half of my earnings every month. I wanted to spend the whole amount, but she said save half. She was right. When I turned sixteen, I had saved enough money to buy my first car, a used 1966 VW Bus. I was the happiest kid in the world. It sure taught me a lesson about saving money. If it had not been for that, I may never have met you and Sarah. Thanks, Waldo.

Thanks for sharing Waldo. It certainly helps to have the guidance of parents/family early on in life. Also, your first car sounds way cooler than mine…a 1988 Mazda 929 with a blue driver’s side door (the rest of the car was gray)!

Hello, saving is good for sure but the jersey is very good!

Dan

Agreed on the jersey! He received a few compliments!

This has to be about the puniest title to a post I have seen yet, love it. Thank you for the always informative and interesting blogs.

HA! Thank you!