Why Is Taking Financial Risk Important?

No matter where you are on your financial journey, controlling your finances is one of the most important things you can do for your future. While it’s challenging to break the cycle of living paycheck-to-paycheck or find money to invest when you’re supporting kids or helping aging parents, building your own financial house should be a priority.

Unfortunately, you can’t just save money to build long-term wealth. It may seem like the safest way to get ahead is to keep increasing deposits to your savings account. But your money won’t be making much money, especially if it’s at a traditional bank.

You’re also risking your money’s future buying power to inflation, even if you have a high-interest online savings account. For insight into the recent inflation hike, check out Sarah Irving’s recent blog.

That’s why it is essential to consider taking more financial risk – to achieve a greater return. Your future self will thank you when your net worth grows along with your confidence.

What is Financial Risk?

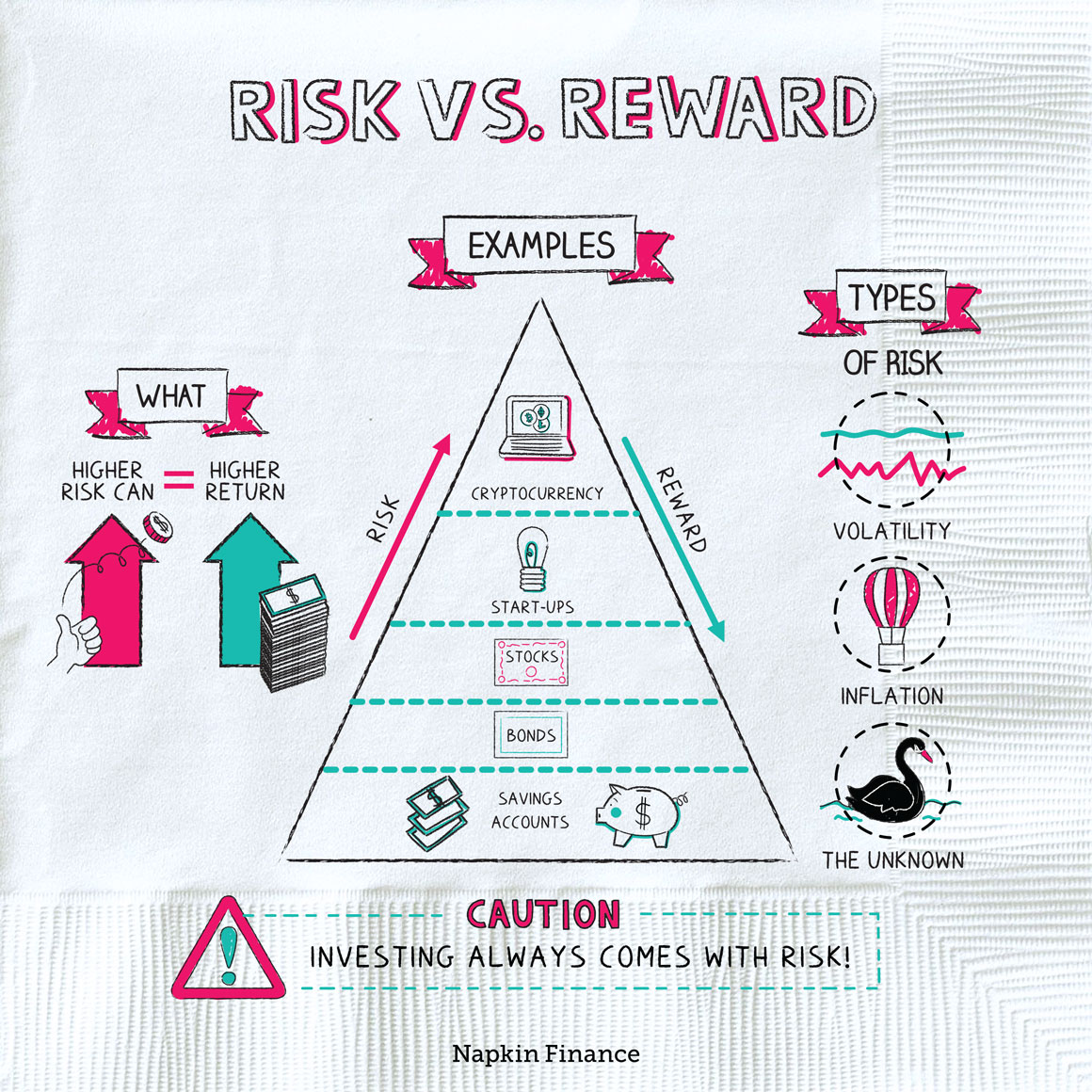

According to the U.S. Securities and Exchange Commission’s Investor.gov website, risk is the “degree of uncertainty and/or potential financial loss inherent in an investment decision.”

“All investments involve some degree of risk,” even those appearing safe. It may make sense to you that investing in just one asset class (buying shares in an individual company or only buying investment properties) is risky. “Putting all your (financial) eggs in one basket” isn’t a wise thing to do.

But the Financial Industry Regulatory Authority (FINRA) explains that merely choosing to put your money in conservative products like Certificates of Deposit (CD’s) and high-yield Money Market accounts is also risky as they may not earn enough to keep up with the rate of inflation – currently around 5.4%. If you’re earning 2.1% interest on a CD and the rate of inflation is 4%, your money isn’t growing much. And if your money is sitting in a “safe” savings account at a traditional bank (or worse, under your mattress), it’s earning little to no interest. While a savings account or CD seems like a low-risk money move, losing buying power over time is still risky. You’ll be able to buy less in the future (thanks to inflation), and your money still isn’t making you more money. And that’s the goal of investing.

Preparing To Take More Financial Risk

If you’ve been complacent about your financial future or worry your current saving and investing strategies aren’t going to help you meet your financial goals, there are plenty of things you can do to adjust your course.

But before you decide to put your money at “risk” for a higher return, you need to evaluate a few things:

- Current and Future Available Dollars. Do you currently have $100, $10,000 or $500,000 to invest? How much can you continue to invest each paycheck, per month, or year?

- Current and Future Financial Goals. Are you saving for a car, a house, an investment property, retirement, or your kid’s education?

- Timeframe for Each Goal. 1-year, 3-years, 10-years, or 40?

- Personality/Mindset. Are you by nature a risk-taker? Or are extra-safety precautions more your thing?

Your age, net worth, and ability to earn future income are significant factors in determining your appropriate investment risk level. Now and in the future. A 25-year old you will invest differently than a 40-year old or 65-year old you.

Determining When Risk Is Appropriate and When It’s Not

Before putting money in an investment, you want to consider your ability (financially and emotionally) to recover from a financial loss. In addition to the level of risk and potential return any investment product carries, you’ll also want to consider any upfront or ongoing fees it requires. Plus, you need to know how quickly you can access your money if you need to cash in on your investment.

General recommendations are not to risk emergency funds or savings for shorter-term goals (less than 2-years). Because not only does investing reduce your ability to access your money fast, it also means you could end up with less money than when you started. There, of course, are exceptions.

Managing Risk To Build Wealth

When you decide it’s time to take on more risk, you don’t have to rush to change your total investment strategy. Time is a crucial factor in the magic of compounding. But making investment decisions before you’re ready and understand them, can backfire too. Some people embrace risk by leaving all or most of their safe investments behind. Others will sacrifice higher potential returns for more security. If a conservative approach helps you sleep better at night, investing more money for a lengthier period will build wealth too.

The important thing is you’ll be making decisions about how to invest for your future. Rather than being afraid to take action, by assessing your financial health, you’ll know exactly where you stand with money. You won’t take on risk just because someone tells you it’s important.

Since my horse, Felix, is now living the semi-retired life, I’m back to shopping for my next horse. While it can be a risky endeavor taking on an animal you’ve only ridden a handful of times, I have my vet do a pre-purchase exam which gives us a better baseline and understanding of the risk I am taking on before finalizing the purchase. Fingers crossed that Luke will join the Meridian family at the end of the week!