Spring Break & The Markets

Spring Break ain’t what it used to be—at this point in my life at least. While spending time with my family is great, there isn’t much of a “break” with three kids under 7 no matter where you are. In fact, I have used the need to write this blog post as an excuse to remove myself from a very noisy living area.

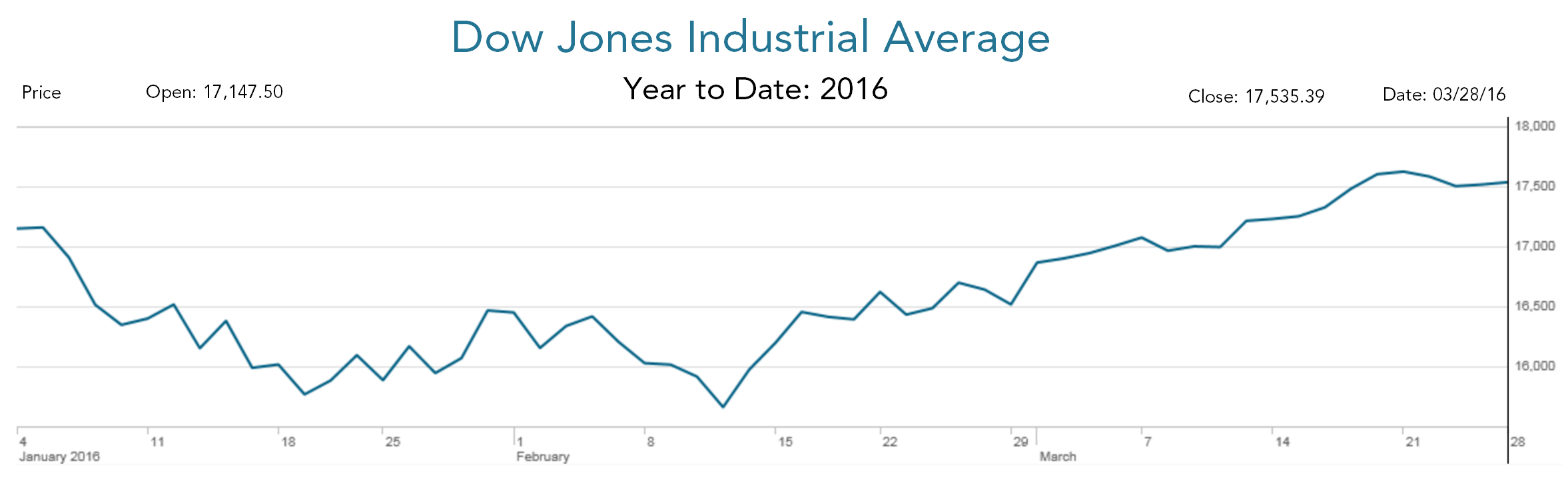

At the beginning of each week (spring break or not), we typically look at all of the levels of the various major indexes to see where things stand with the markets. Obviously, we pay attention to what is going on every day, but looking at things week-to-week helps to keep things a bit more in perspective. And, in a way, the markets have taken a bit of a “spring break” from their early calendar year declines.

If you had to guess (without looking below!), what would you say the US market has returned so far this year? In this example, let’s use the Dow Jones Industrial Average which represents 30 large publicly traded companies in the United States. My suspicion is that most people would answer that the Dow Jones Industrial Average is down for the calendar year.

In fact, as of the close of business on Thursday, March 24th (the market was closed Friday), the Dow was up 1.22% for the year. Now, before you go running to your own portfolio to compare it to this number, keep in mind that you should own many different types of investments other than just the components of the Dow. Just for a little extra context, the S&P 500 is about even for the year, while the MSCI EAFE (Europe, Australasia, and Far East) is still down about 5%.

I think the main takeaway here is that if you were only paying attention to the headlines, you may have come away with all doom and gloom at this point in the year. While, in fact, things have been going a little better recently. We, at Meridian Financial Partners, do expect continued volatility for the remainder of this year, but as always it’s important to keep things in perspective.