Wait, My Bonds Went Down Too??

If you are an investor in the markets, you are probably aware that the stock market can go up and down (news flash!). September lived up to its reputation of being a historically bad month for stocks, but many bond investors may also have been disappointed when they opened their recent statements.

In most cases, the bond portion of a portfolio will provide some level of safety when stocks decline. This is certainly not the case ALL the time, but if there is a decline in stocks over a period, bonds will generally fare better or at least not lose value. There are cases when both will move in the same direction at the same time.

In September of this year, we saw interest rates increase as well as a number of factors that contributed to stocks declining (lingering pandemic fears, inflation concerns, China…take your pick!). An increase in interest rates will cause existing bond prices to decline.

Generally, this occurs because newly issued bonds are now paying a higher rate of interest than existing bonds, so if a bond holder tries to sell his existing bond (paying less interest), he will get a price lower than what he paid for it. Shorter-term bonds will be less sensitive to interest rate movements, and owning a bond fund with a diversified mix of bond types and maturities can also be a good defense against interest rate increases.

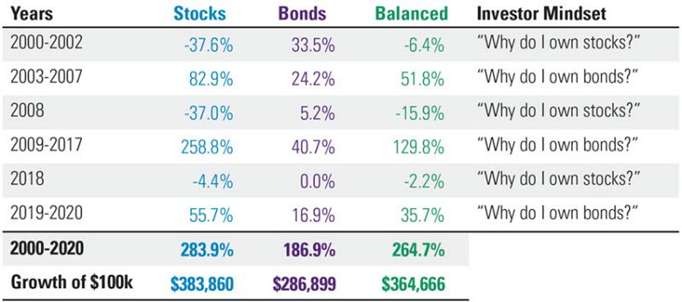

In the end, having a portion of your portfolio invested in highly rated bonds will provide ballast when stocks decline most of the time. Here is a great chart from Hartford Funds showing returns of both asset classes over multiple periods.

Bonds Counterbalance Stocks in a Diversified Portfolio

Cumulative Returns

It’s interesting to note that the hypothetical balanced portfolio returned close to the same amount as the all-stock portfolio, and adding bonds reduced overall volatility.

Like bond prices and interest rates, my son’s energy level can be attributed to the number of hockey games he plays in one weekend. We recently traveled to Charleston, SC for a tournament (95 the whole way, ugh!), and he played four games in one weekend. Suffice it to say that his energy level hit zero the minute we started the trip home.

Energy level = 0%

At least he managed to get some fries in him before passing out!

Here’s hoping we can all find the right balance in our lives,

Nathan