Open Enrollment Season is “Falling” Upon Us

October officially kicks off one of the busiest times of years for most as holiday planning, fall breaks, and extracurricular activities fill our schedules. This also seems to be the time bucket lists are drawn and we feel we need to check off every seasonal and holiday themed activity (pumpkin patch/ apple orchard visits, pumpkin carving, fall foliage drives and the list goes on…).

This time of year also kicks off open enrollment season for most employer provided benefits as well as for Medicare benefits and health insurance through the government open marketplace. Yet another thing to check off the proverbial list!

Even if you are already enrolled in benefits through your employer, annually checking the benefits offered to you and determining if they still apply to what you assume will be your situation in the following year can result in not only piece of mind but result in savings as well. Eliminating the benefits that aren’t necessary saves on costs, but more importantly paying for benefits through your employer with pre-tax dollars means lowering your taxable income!

Health Insurance

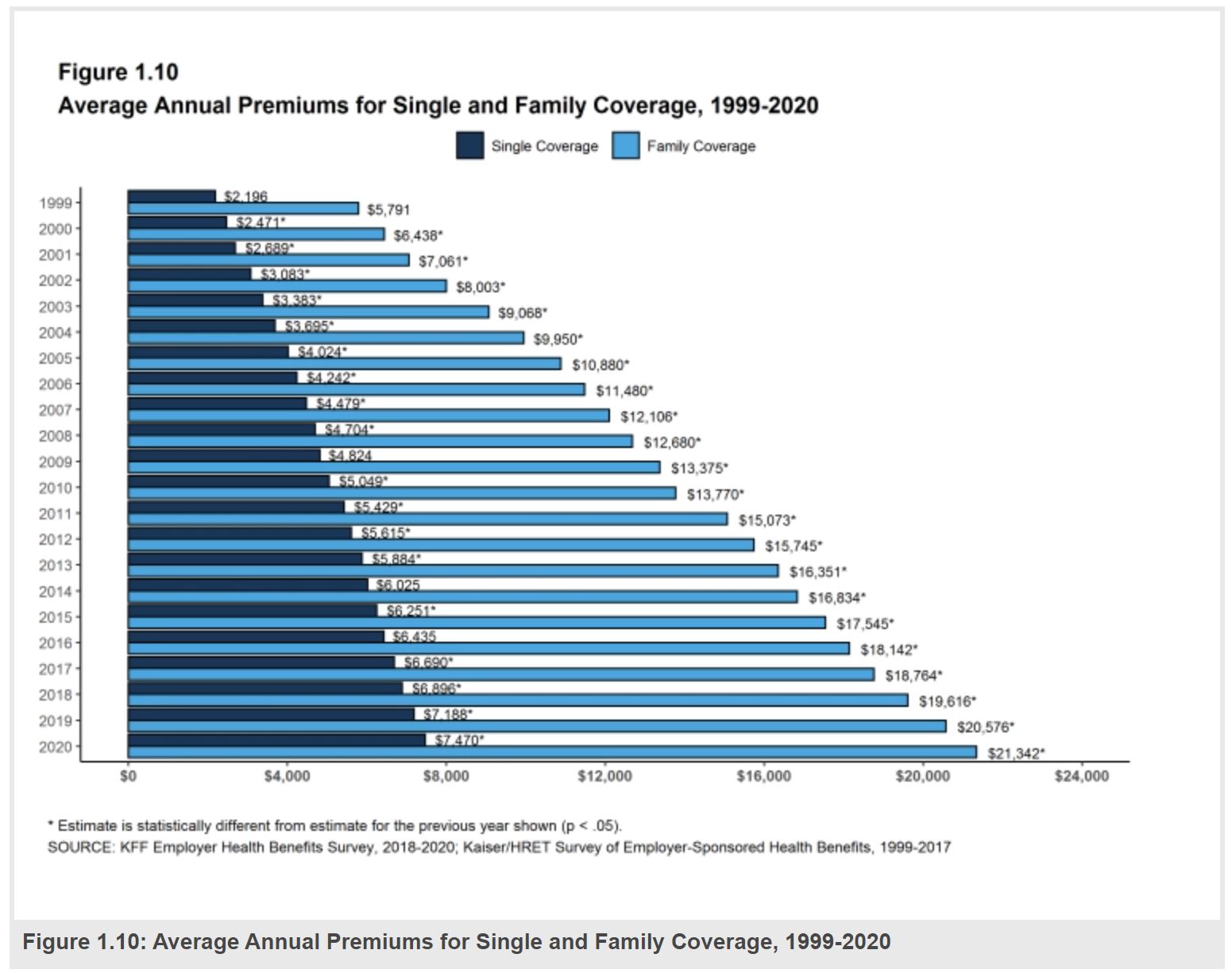

Outside of 401ks and other employer sponsored retirement plans, employer sponsored health insurance tends to be the one benefit most working individuals participate in and in some cases the reason they maintain a job. Which is no surprise — the chart below outlines the growing costs of premiums for insurance.

Health Insurance plans can fall into several main categories:

Usually paid for with PRE-TAX dollars.

- High Deductible Health Plan (HDHP)

- Minimum deductible of $1,400 or an individual or $2,800 for a family. Out of pocket maximums (including deductibles, coinsurance, or copays) must be limited to $7,050 for an individual and $14,100 in network for a family.

- Monthly premiums are usually very low, so perfect if you are not going to the doctor frequently or if you feel you will hit your deductible quickly.

- **BONUS — HDHP’s can be combine with an HSA, which my colleague Lucy covered in her blog post about the many benefits, particularly the triple tax benefit of HSAs.

- PPO – Preferred Provider Organization

- Contracts with several doctors, specialists, and hospitals, which provides broader access to providers

- No requirement to consult with primary care provider before seeing a specialist

- In network means you pay less, out of network you incur an additional cost

- HMO – Health Maintenance Organization

- Group of doctors and hospitals that provide services for a copay.

- Tend to be more affordable

- Only cover in-network services and will not pay for services in out-of -network providers

- Require physician to provide “access” to specialist care

- Flexible Spending Accounts

- Similar to an HSA, you can put save pre-tax dollars into an account to pay for qualified medical expenses.

- Maximum contribution amounts are $2,750 for 2021 (lower than an HSA)

- Unlike an HSA, you may only roll over $500 (2021) each year — i.e “use it or lose it”.

- Usually used with HMOs or PPOs

- If you leave your employer you don’t get to the take the account with you, unlike an HAS

- Dependent Care FSA

- Contribution limits up to $10,500 to cover costs of daycare, after school costs, summer day camps, or taking care of a disabled spouse or older relative.

Paid for with AFTER-TAX dollars

If you are self-employed, are not covered through work, or are bridging the gap between retirement and Medicare eligibility, the open enrollment period for obtaining coverage through the Health Insurance Marketplace is November 1st through January 15th.

While you have to pay the premiums up front and are not receiving any additional employer coverage, it is worth noting that the premiums paid with after-tax dollars still can provide some tax savings. Any medical expenses and premiums over 7.5% of income can be deducted if you itemize. Also remembering that if you are self-employed, you can deduct these health insurance premiums on your 1040.

Medicare

If you are 65 or older and are already enrolled in Medicare open enrollment runs October 15 – December 7 which is the time to review your current plan to ensure it remains the best option. Specifically, the enrollment period applies for Part C aka Advantage Plans and Part D (prescription drug coverage). For example, the plan you were covered under in 2021 may not cover the same prescriptions, costs for medications may have changed, or a provider can opt in or out of a plan.

Disability Insurance

Short Term Disability

Most employers offer short term disability coverage, but this is the perfect time to double check if you are covered.

- Short-term disability policies cover 3 – 6 months of disability and usually come into paly with injuries and pregnancies.

- Salary coverage is usually 70-80% of base salary

- Understand the elimination period, which is the period of time that needs to go by before disability payments are issued (30,60,90 days).

Long Term Disability

If the employer offers this benefit, you will more than likely need to ensure you enroll in it.

- Kicks in once short-term disability ends.

- Salary coverage is usually anywhere from 40-70% of base salary (obviously the higher percentage you could receive the better off you will be if you have to be on long-term disability).

- Elimination periods tend to be much longer (90-180 days).

- Tends to be much more affordable to purchase through employer than independently.

- Keeping in mind that if you pay premiums with pre-tax dollars, the benefit paid out will be taxed and visa versa. Depending on your personal situation, you may want to receive the higher benefit during your disability and therefore pay the premiums with after-tax dollars.

Life Insurance

Most life insurance provided through employers falls under the category of group term insurance, referring to the fact that coverage ends when employment ends. Depending on outside life insurance coverage, this is an excellent benefit to take advantage of, particularly if there is a gap in life insurance coverage, you plan on staying with your employer, and individual life insurance policies may be expensive due to health conditions, age, or other factors.

Employers will usually offer 1x or 2x base salary coverage with the option to increase further. Keeping in mind that coverage over $50,000 is included in income as it is a taxable benefit.

Spousal Life Insurance coverage usually is offered as well at a cost, and may be a good option if your spouse does not have other coverage. But remembering again this does come at a cost.

If you aren’t sure if you have sufficient coverage in life insurance or may be paying (and taxed) on something you might not need, contact your advisor at Meridian. We can help run these numbers for you!

Retirement Accounts

Last, but most certainly not annual review of employer sponsored retirement plans such as 401ks, 403b, 457s, TSPs, SIMPLE IRAs, and any other options offered. Most plans will provide several times in the year when you can update your contribution amounts, but if you aren’t already contributing or are thinking about it, may I direct you to Nathan’s blog post.

This is one of the first places to reduce taxable income while putting away dollars pre-tax allowing them to grow tax deferred, so at some point you don’t have to even worry about employer sponsored benefits 😊.

While this list covers the most basic of the benefits to review during open enrollment season, there are many other perks your employer may offer such as Employee Stock Purchase Plans, Store Discounts, Tuition Reimbursement, Paid Parental Leave, and Pet Insurance.

Using this open enrollment period to get ahead of your benefit to-do list will give you peace of mind going into 2022 as well as freeing up more time for things like …. pumpkin hugging for instance.