The Big Picture

When thinking about the blog topic for the day, the only thing that seemed appropriate to write about is the ongoing conflict in Ukraine and the economic fallout seen in the market over the past few weeks. Heavy topics to take on in a short blog post, so please excuse the length of this one.

The Ukraine invasion was a heartbreaking humanitarian crisis. The ongoing news coverage is emotionally exhausting, alternating between despair, anxiety, frustration, and anger to amazement and pride at the resiliency of the human spirit and the solidarity in standing against oppression.

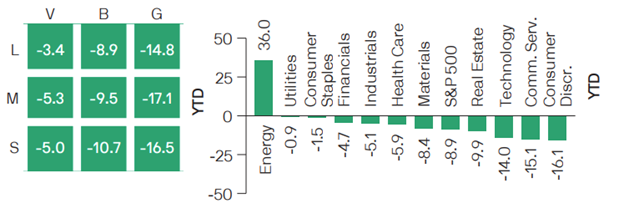

While the battle headlines dominate the front page, the stock market has been swinging wildly, attempting to account for the cost of war and disruption to the global economy. It has been a brutal year across all size stocks (LMS stands for Large, Mid, Small companies) and growth stocks particularly (VBG stands for Value, Blend, Growth stocks). Every sector in the S&P is down this year, except energy:

S&P 500 Returns through March 7, 2022

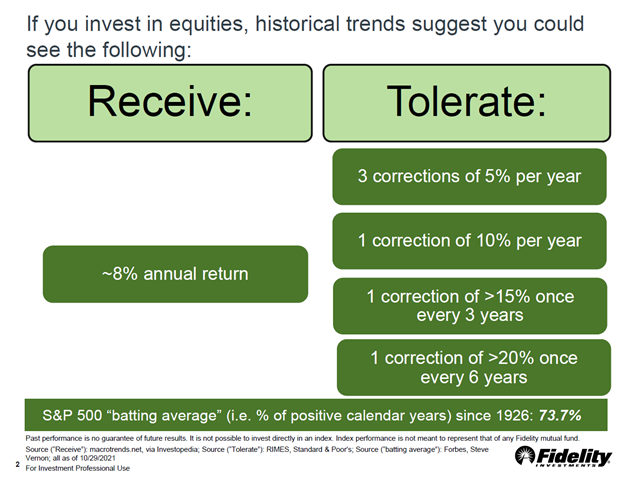

These deep swings in the market are not unusual—in fact, this slide from Fidelity highlights the normal volatility that an equity investor should expect:

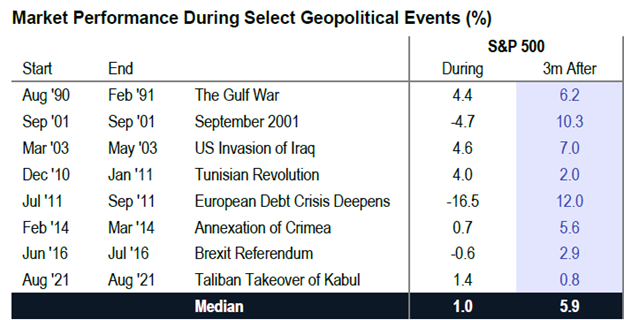

Using history as a guide, geopolitical events have typically caused initial market chaos and disruption, but the stock market has historically recovered to positive territory within three months:

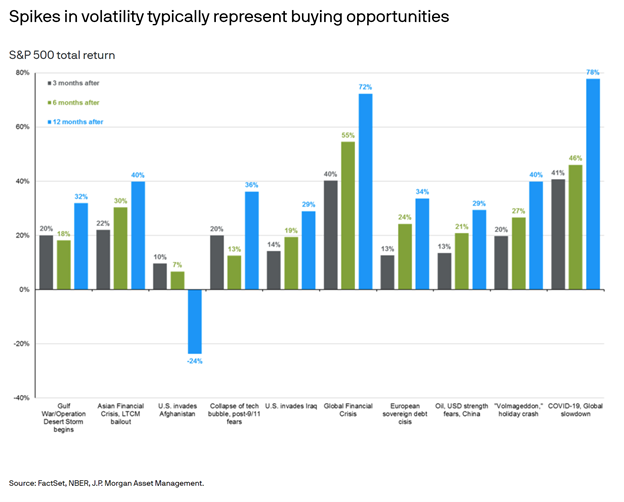

And despite the head spinning swings up and down in the market, times of increased volatility in the market have also historically led to strong returns following the initial shock:

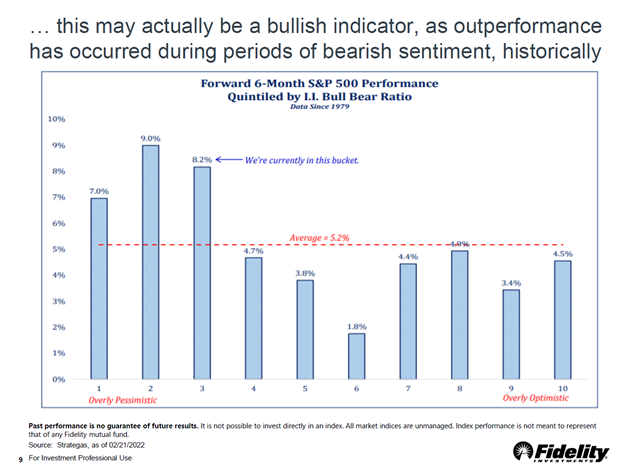

And finally, when the present and future look bleak, and investors become pessimistic on investing in the stock market, it has historically been a contrarian indicator:

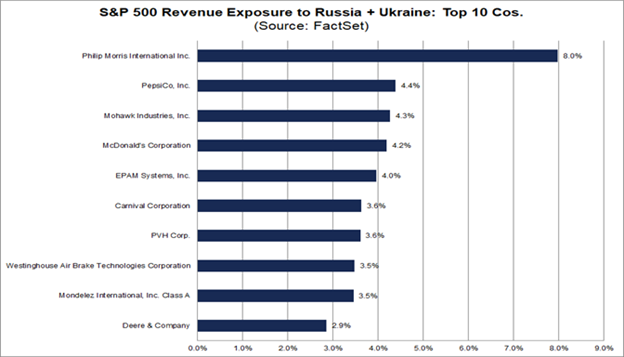

So, given historical trends, is this time different? While the Ukraine-Russia conflict is a tragic humanitarian crisis and a horrible event to see unfolding, the direct economic impact to the US is fairly muted. According to FactSet, the actual revenue derived from Russian and Ukraine combined by S&P 500 companies is about 1%. The companies with the highest direct exposure to Russia and Ukraine markets are Phillip Morris, Pepsi, McDonalds, and a few others…

So, the direct earnings impact to the S&P 500 is muted, but for us, the larger and more concerning impacts of the Ukraine-Russia conflict to the economy are 1) the increased oil and gas prices as well as 2) the risk that the Federal Reserve may back off the interest rate hike cycle that they need to do to curb inflation.

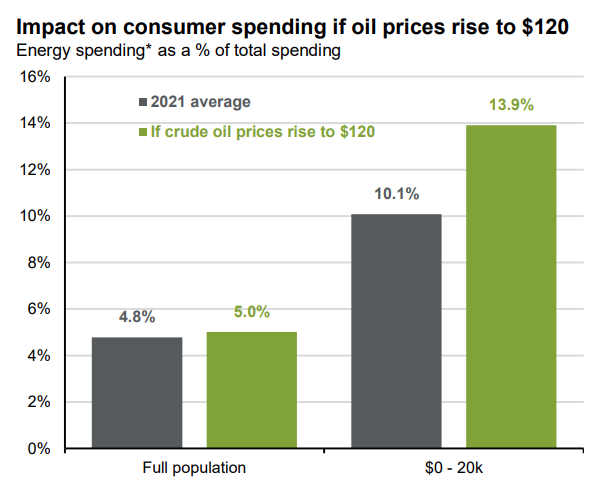

Currently, oil prices are hovering over $120/barrel—and US consumers are feeling the direct impact of this at the gas pump. The challenge with sustained high oil prices is the drag on consumer spending, which makes up 70% of the US economy. With more money required to buy gas to return to offices and school, US consumers have less to spend on goods and services. And this impact is more keenly felt at lower income levels:

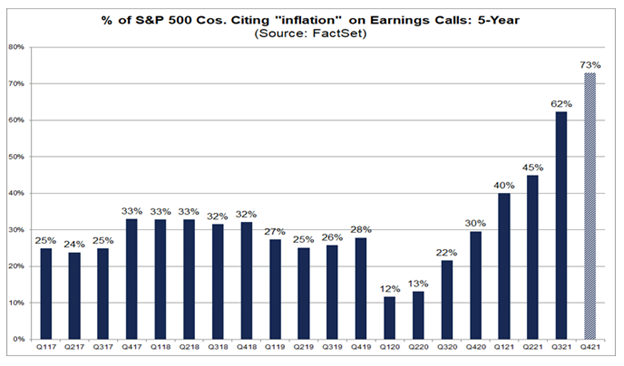

While higher oil prices are a drag on the US consumer, they also add to the general inflationary costs felt by US corporations. For US corporations, all input costs are soaring—energy prices, commodity and raw material costs, labor expenses…in fact, the number of S&P 500 companies that have mentioned the inflationary impact on their businesses is at an all time high, according to Fact Set:

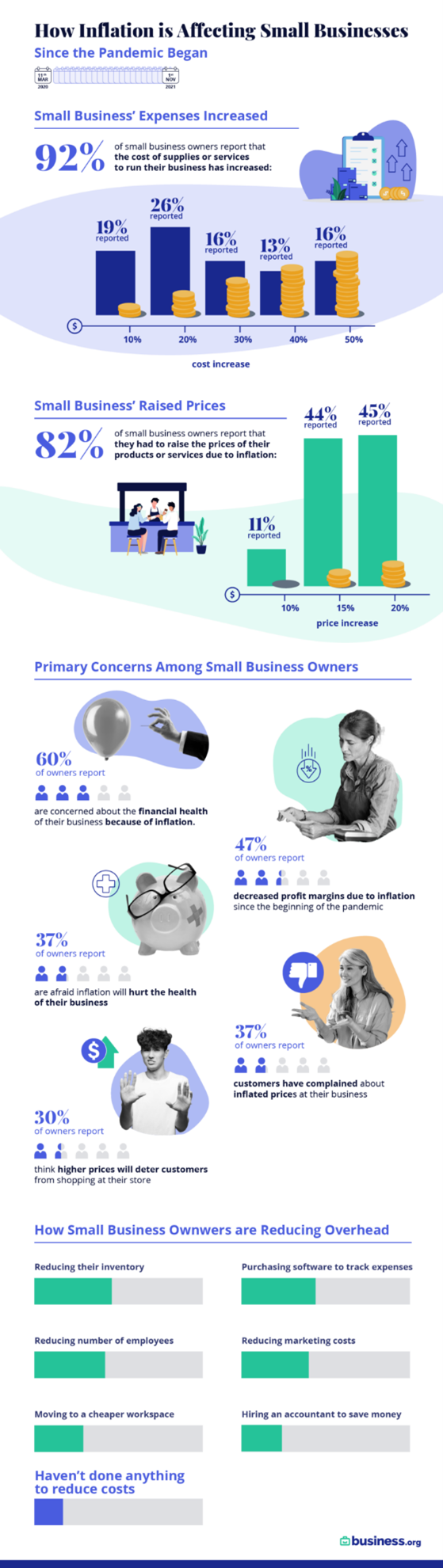

And, inflation hurts small businesses particularly hard:

So, the Federal Reserve needs to take action to address inflation, yet the Ukraine-Russian conflict may give them reason to hold off on any interest rate hikes. At the moment, Fed Chairman Powell has resolved to continue on the rate hike path to tighten the money supply that is fanning inflationary pressure, but he said: “The near-term effects on the U.S. economy of the invasion of Ukraine, the ongoing war, the sanctions, and of events to come, remain highly uncertain. Making appropriate monetary policy in this environment requires a recognition that the economy evolves in unexpected ways. We will need to be nimble in responding to incoming data and the evolving outlook…but the bottom line is that we will proceed but we will proceed carefully as we learn more about the implications of the Ukraine war on the economy.”

We hope the Federal Reserve can act with the necessary resolve to address the inflation issues that could choke US economic growth.

These are troubling times to navigate through, yet we are hopeful that the world will find a path forward together.