Following Up

Lucy and Tyler’s blog last week on the financial implications of installing solar panels triggered quite a few follow up questions from our loyal readers! (Thank you to all of you who take the time to read our posts—we appreciate your feedback and questions!!!)

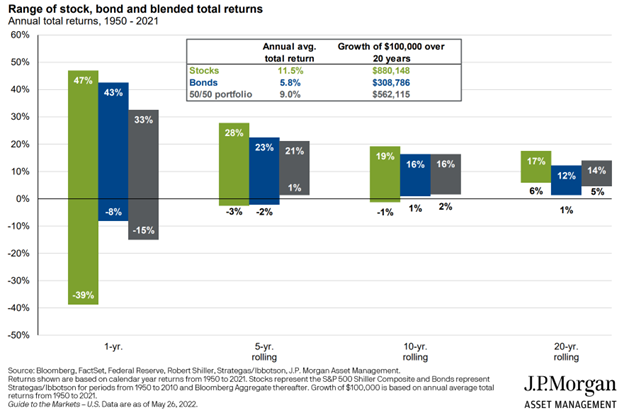

So, we wanted to tackle the general math on home improvements generally. When we ran the internal rate of return for installing solar panels, the annual rate of return was about 1% for the first 15 year period, and then if the panels worked efficiently for the full 25 year life span, then the return on the initial install investment was about 4-5%. Given that a balanced portfolio of 50% stocks and 50% bonds has returned an average annual return of 9% over a 20 year period, solar panels do not appear to be a good “investment”

That said, they can be a great lifestyle choice and bring great satisfaction in utilizing a renewable energy source.

Geothermal heat is much the same calculation. Over a 25 year useful life period, with an initial install cost of $30,000 and estimated annual savings of $1,500, the annual rate of return is about 2%. But again, using a natural energy source is a compelling choice for some.

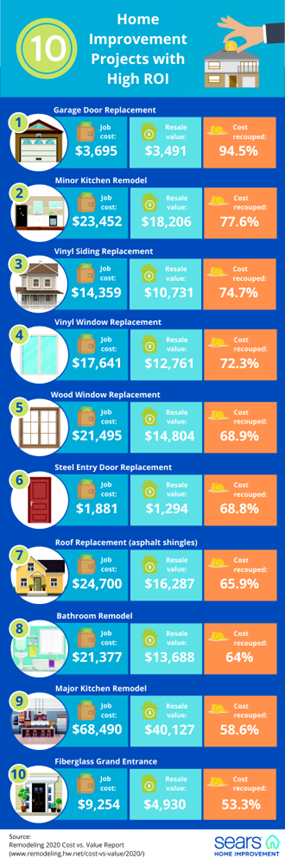

Most home improvements will not bring much of an investment return. Generally recouping the cost is the best financial outcome available:

There are exceptions to each of these—we are certain solar panels make financial sense for some folks based on their roof size, house orientation, and payback period. Likewise, adding useful square footage to a house can actually create additional value. But generally, we view home improvement projects as personal choices to bring enjoyment in your use of a space. So, while crunching the numbers on a big house project is a good idea, looking for a huge investment return is not the object oftentimes!