Finding Joy

If you have children, grandchildren, know of someone who has children, or even just look around any of the big stores then you probably know about “Elf on the Shelf”. This “magical” elf is adopted and named by the children of the house and gets into all sorts of mischief …. every … single …. day. And of course, no Elf would be complete without at least one other friend or “Elf pet” to participate in its daily activities. ** Side note – the creator of these products is a genius and probably a millionaire! **

All of this continues until the Elf and his friends go back to the North Pole with Santa on Christmas Eve… finally. If you can’t tell by now, our Elf, Singer, and his Elf pets, Sprinkles and Rubble, are big hits in our house and it’s really incredible the number of creative and messy things they get into every night. I say all this tongue-in-cheek, because truthfully the excitement my children exude as they’re looking for their Elf and his pets makes up for the stress of “resetting” the Elf every night.

The same sentiment has been shared by most investors this year as extreme volatility in both bond and stock markets has caused stress. While we do not tout ourselves as perfect predictors of short-term market behavior, data continues to show us that prudent investing during periods of uncertainty does lead to “excitement”, aka reward, in the future. That is not to push the dismal market returns of 2022 under the rug… they have been disappointing! However, with this being my last blog for the year, I wanted to focus on the positive things that have happened this year.

Inflation is Coming Down

Today’s numbers showed that Consumer Price Index numbers while still high are cooling down

Also Housing costs are showing signs of easing

Global Supply Chain Pressures Are Heading Back to Normal

A major factor in upward pressure on inflation is coming back down

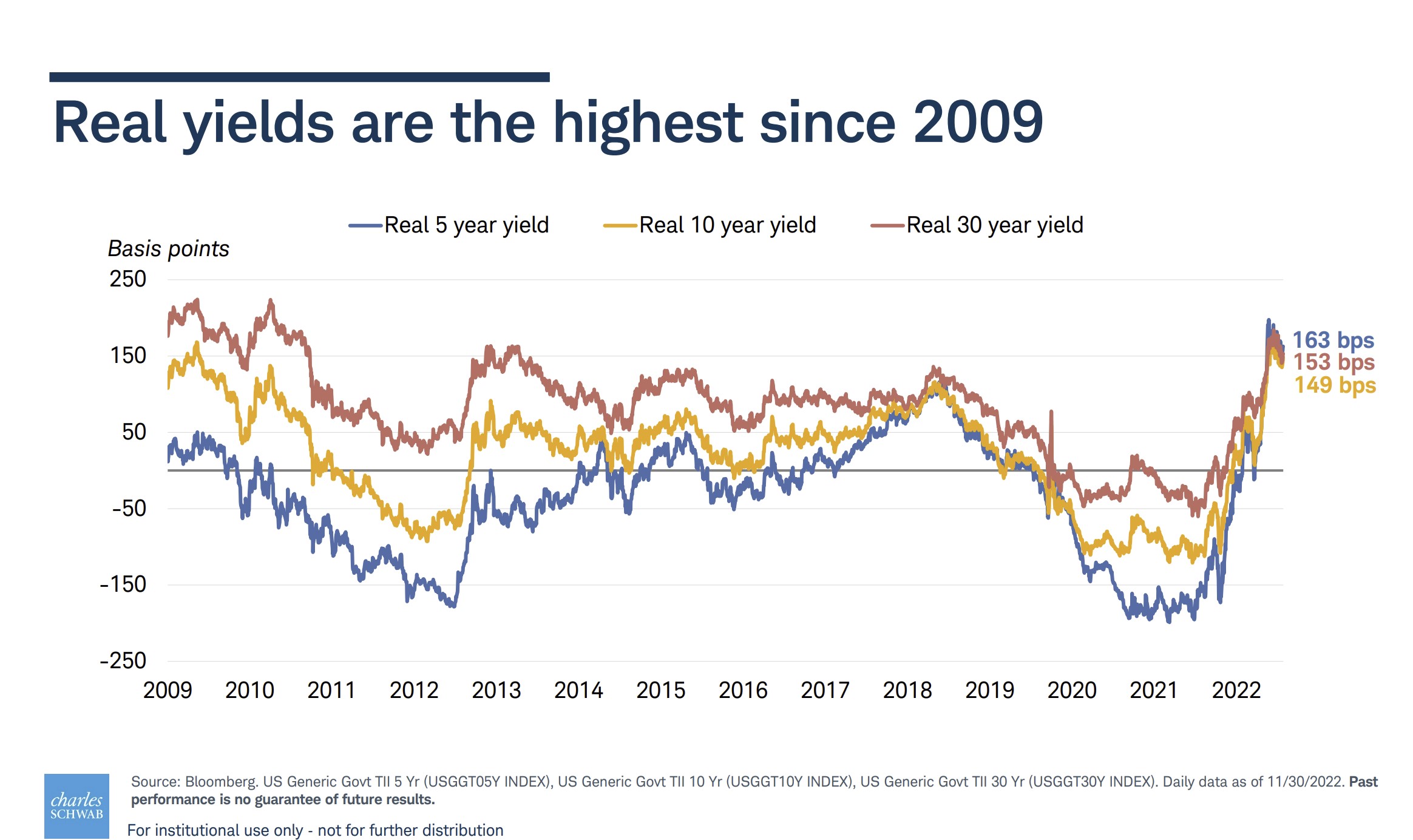

Real Yields are the Highest Since 2009

Back are the days where bonds are starting to pay more which means bond investors will get paid more to hold their bonds and if real yields go down over time, the price (return) of these bonds will go up.

Incentives to Save for Retirement

The SECURE Act 2.0 (SECURE standing for Setting Every Community Up for Retirement Enhancement) is a strong candidate to be passed before end of the year. This will

- Increase RMD age

- Boost catch-up contributions for individuals approaching retirement age

- Include many provisions to bolster 401k plans

Panic is Showing Signs hat it may be Subduing

Where we are now is not euphoric, but the trend is encouraging!

Lucy Valandra Passed Her CERTIFIED FINANCIAL PLANNER™ Exam!

I can’t leave this one out!

The Meridian Family Gained Another Furry Member

The Gilbert’s welcomed their new pup Phoebe to the family.

Meridian Continues To Grow!

Even though the past couple of years have posed many uncertainties Meridian has continued to grow our client base and expand our abilities to serve our clients through our advisor teams.

Every year brings its own set of obstacles and this year has felt particularly challenging in many ways. However, I believe finding the joy is even more important in times like these and once you find a glimmer of joy, it helps make everything worth it.