When Taking a Loss Can Help

As we approach the end of the year, a lot of our clients are asking what they should be doing before 2022 comes to a close. There are plenty of things-to-consider-before-the-end-of-the-year lists out there, but if you have investments in taxable (non-retirement) accounts, you may want to consider tax loss harvesting.

It should come as no surprise to hear that this year has been a rough one for almost all types of investments. As we have said in our blogs previously, even the normally safe-haven bond investments have seen unprecedented losses. And, while the declining numbers are hard to watch, tax loss harvesting might be a good way to offset any gains this year as well as retain unused taxable losses for gains in future years.

While the goal of investing is to buy low and sell high, intentionally selling a holding that has lost money can be good from a tax perspective. This does not mean you need to abandon the holding for good, however.

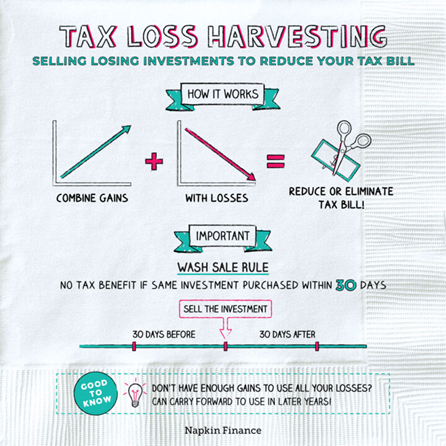

Napkin Finance provides a good graphic overview of how it works:

As is typical with anything having to do with the IRS, there are some rules that you have to follow. The main one is that you need to wait at least 30 days after the sale of your investment to purchase the same holding again. Otherwise, it falls under the wash sale rule which would eliminate the tax benefit.

While you are waiting for the 30 days to elapse, you can either leave the sale proceeds in cash or find a replacement security to own in the meantime. According to the IRS, the replacement security cannot be “substantially identical” to the one that was sold. The IRS is not explicitly clear on what a “substantially identical” security is, but one good solution might be an ETF (Exchange Traded Fund) that approximates the same industry of the sold security. Finding an acceptable replacement can help avoid missing out on a potential recovery during the required 30-day period.

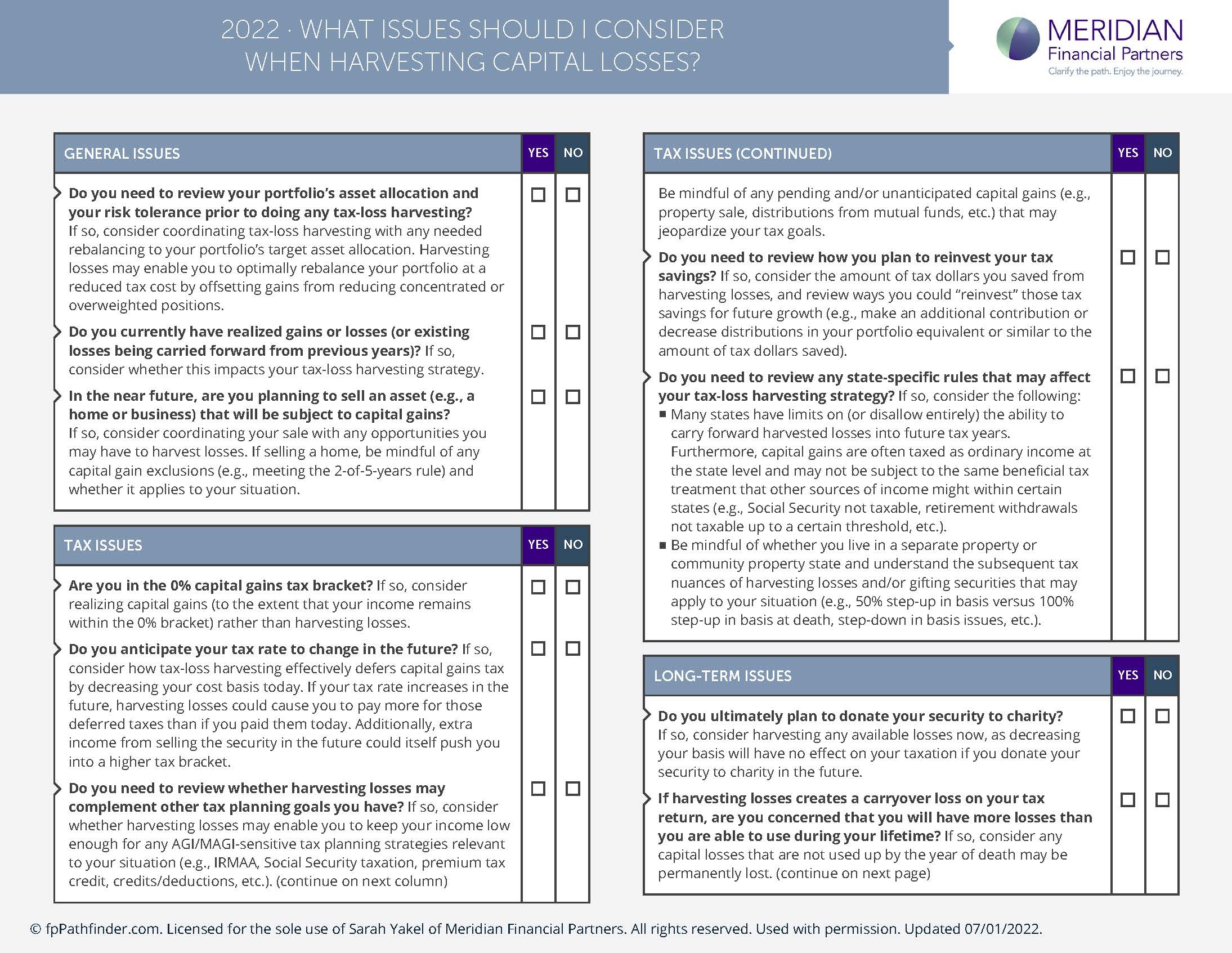

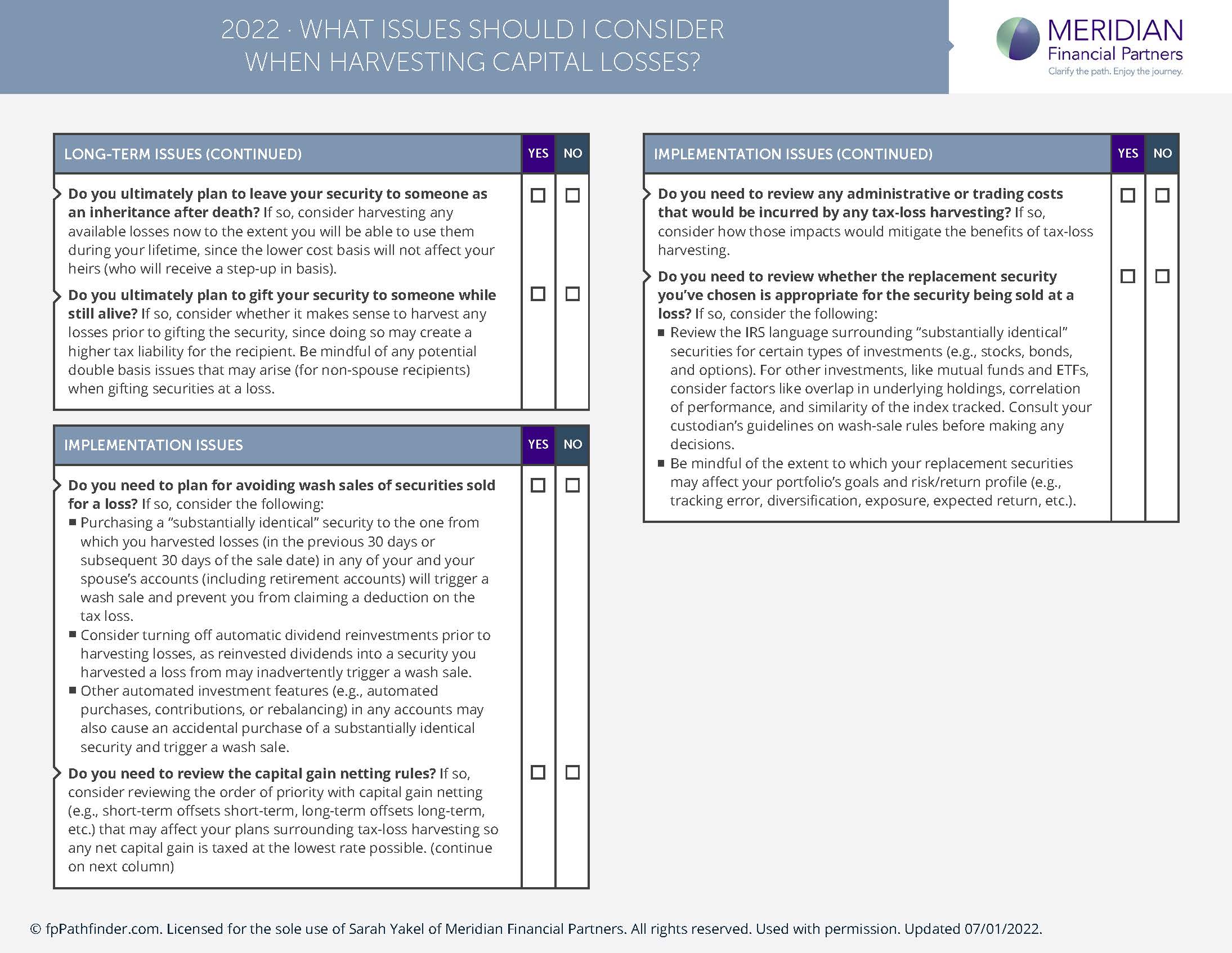

Below is a more comprehensive checklist that may help with the decision-making process.

One interesting thing to note from this checklist is that it might be beneficial (from a tax standpoint) to hold a security with a very low cost basis (a high potential capital gain) if you plan to leave it to your heirs. Recipients of an inherited stock receive a step-up in cost basis, meaning their cost is the price of the security at date of death. This would all but eliminate any capital gain if the security is then sold by the recipient.

I hope to someday be presented with the issue of having a highly-appreciated asset and figuring out what to do with it! I think our youngest might be expecting something down the road, when she seemed all-too willing to climb a ladder to help me with a light bulb replacement.

Working for an inheritance?

As this will be my last post for 2022, I hope you and yours have a wonderful holiday season!

Nathan