Testing, testing…

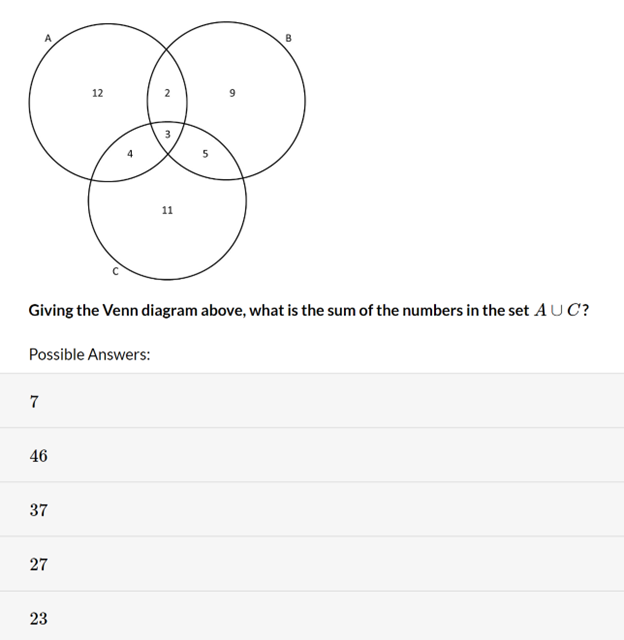

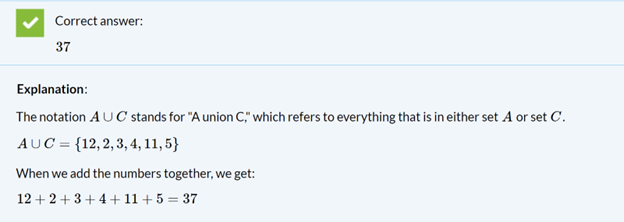

Today the Yakel kids start SAT testing…only Ben is excited—he likes filling in all of the bubbles with his number two pencil. The older kids dread it…probably because they are facing a day full of questions like this:

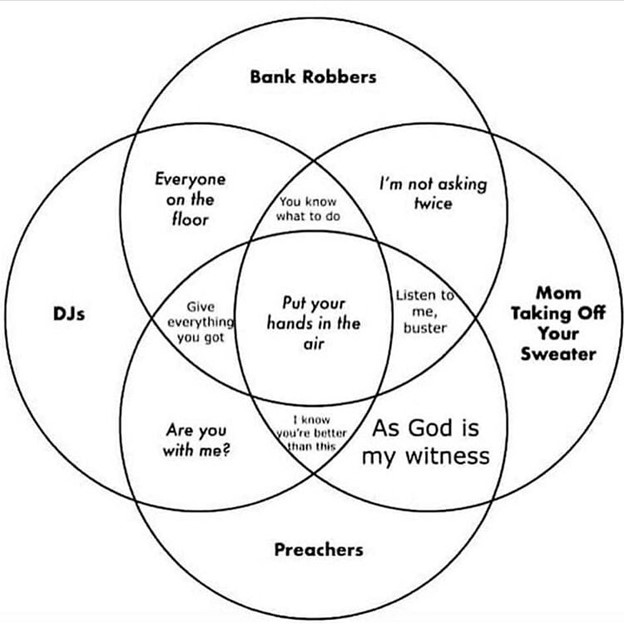

For all you math people, you can check your answer at the end of this post…for the rest of you…here’s a Venn diagram that is way more fun…

https://memeguy.com/photo/357894/venn-diagram-similarities-between-bank-robbers-djs-preachers-and-mom-taking-off-your-sweater

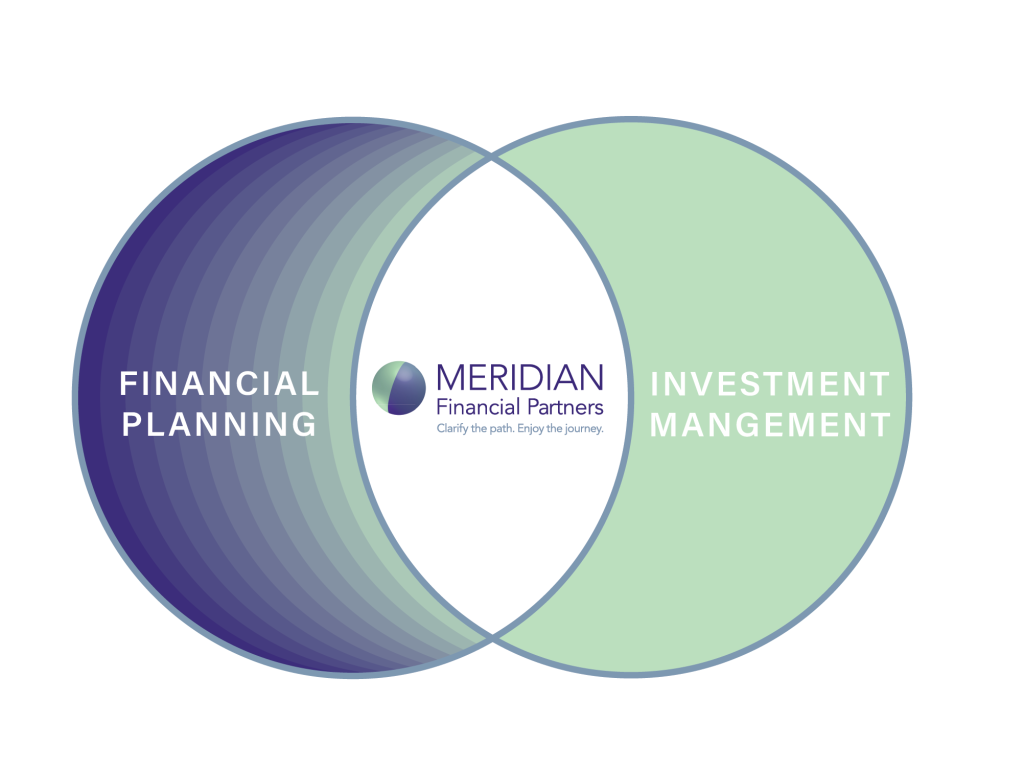

Here are a couple of less complicated Venn diagrams that applies to Meridian:

While some folks are looking for just investment management or just financial planning, we believe that the two things are inextricably linked. Hourly financial planners can build a plan or answer a specific planning question—but the implementation and monitoring of the portfolio are often outsourced and plan revisions become new engagements entirely. Brokers or mutual funds can make portfolio decisions, but often operate outside the context of fuller life goals.

At Meridian, we feel that the financial plan should drive the investment management decisions. Every client’s portfolio is built based on their unique situation, personal risk level and tolerance, and individual objectives. Investment decisions should be made in the context of the total picture of a client.

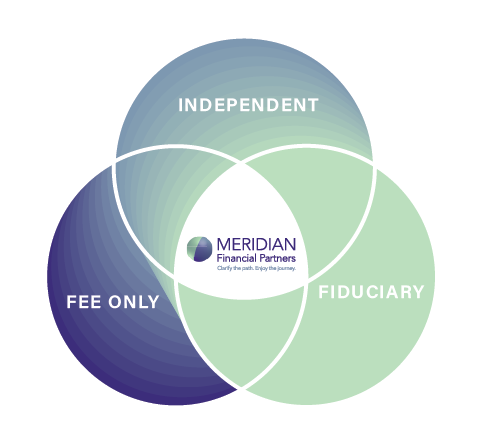

One other Venn diagram that applies to Meridian is this one—which has been part of our DNA since we started in 2015:

We sit in the middle of these three core characteristics:

- Independent. Only the partners own Meridian Financial Partners – no one else. We never have a reason to push one product, fund or strategy over another. We’re not under corporate pressure to raise revenue or steer you toward “in-house” investment research. Our advice is objective and unbiased, intended solely to achieve the best solution for you.

- Fee-only. The cost of our service is completely transparent, and we are paid only by clients. We receive no commissions or mutual fund fees, avoiding potential conflicts of interest. With no commissions or hidden compensation, our clients have no forced lock-up period. If for any reason you no longer need or want our services, you’re free to leave at any time, with no financial penalty. And because there’s no incentive to make a quick sale, fee-only advisors can provide carefully considered financial advice, recognizing that financial decisions mustn’t be made hastily or in a vacuum.

- Fiduciary. This is the highest standard to which your relationship with a financial advisor can be held. In fact, as a fiduciary, it is our legal responsibility to act in clients’ best interest at all times. In addition to the requirement to put clients’ interests ahead of their own, fiduciaries are obligated to perform their duties to clients with loyalty and care.

Advisors who claim all three of these characteristics are rare. We believe it is the best way to serve our clients, and we are grateful to each of our clients who have trusted us to help them make wise financial decisions.

And, in case you were wondering…

https://www.varsitytutors.com/sat_math-help/data-analysis/venn-diagrams?page=2